Another day filled with weakness, but we managed to close higher (albeit modestly) keeping the bullish case alive for at least another day.

So far weakness has been contained. But as I said yesterday, the last SSBS has not produced a decent rally outside of last Friday, and that wasn't a slam dunk either. This market is keeping both bulls and bears guessing, but I don't think it will be too much longer before we see another big move.

The Seven Sentinels remained on a buy today, but a break to the downside could trigger a sell. A rally on the other hand, could flip them all back to a buy too. Here's today's charts:

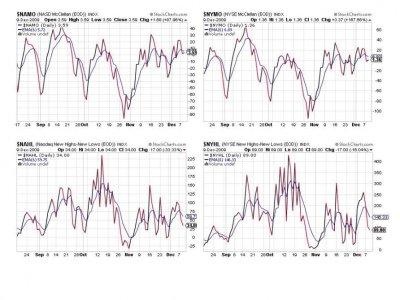

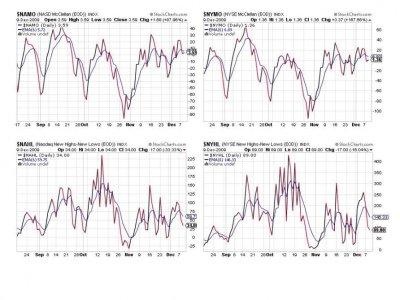

We still have all four of these signals flashing sells, but NAMO and NYMO are not that far from flipping back to a buy with any upside follow-through. However, NAHL and NYHL actually got weaker. But it's not cause for too much concern just yet. The both look poised to bounce back again soon.

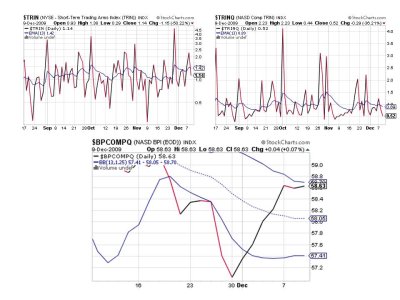

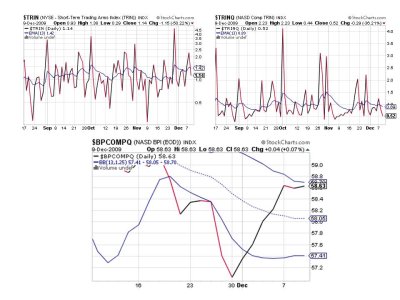

TRIN flipped back to a buy today, while TRINQ remained on a buy. BPCOMPQ also remained on a buy and is close to moving above the upper bollinger band. Note though, that those bollies are tight.

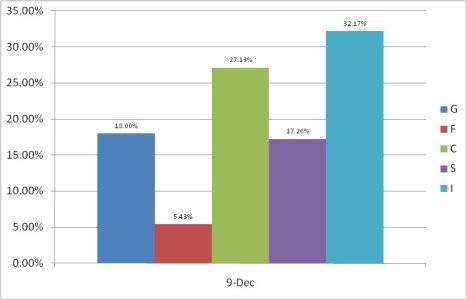

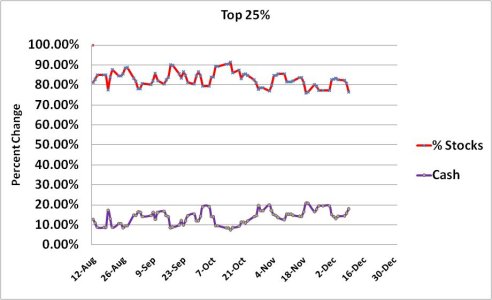

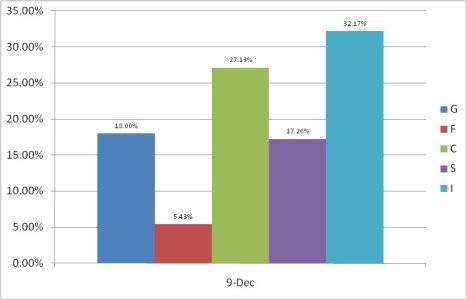

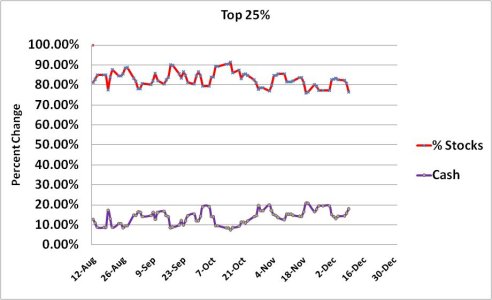

Okay, take note of some interesting, subtle changes among our top 25%. First, cash levels are rising. Second, there's a relatively moderate position in bonds now. Third, total stock holdings are at their 2nd lowest since I began tracking this group in mid-August, and it's not far at all from dropping to a new low. Fourth, the I fund position is dropping, almost certainly due to dollar risk being elevated.

These moves are not large moves, but they reflect some measure of uncertaintly creeping in.

So we remain on a buy with 3 of 7 signals still flashing a buy. This market can go either way, and I'm inclined to think it will be up, but I'm not comfortable with that expectation the way I was a week ago. We need to see bullish levels drop in order to get a good set-up for the next up-leg. It can happen very quickly depending on any given market data release or some other catalyst. Tomorrow we have Initial claims (consensus 465K), Continuing claims (consensus +5435K), and the Trade balance being released, so we do have potential market moving data coming our way. Will one of them trigger a breakout? We'll see soon enough. See you tomorrow.

So far weakness has been contained. But as I said yesterday, the last SSBS has not produced a decent rally outside of last Friday, and that wasn't a slam dunk either. This market is keeping both bulls and bears guessing, but I don't think it will be too much longer before we see another big move.

The Seven Sentinels remained on a buy today, but a break to the downside could trigger a sell. A rally on the other hand, could flip them all back to a buy too. Here's today's charts:

We still have all four of these signals flashing sells, but NAMO and NYMO are not that far from flipping back to a buy with any upside follow-through. However, NAHL and NYHL actually got weaker. But it's not cause for too much concern just yet. The both look poised to bounce back again soon.

TRIN flipped back to a buy today, while TRINQ remained on a buy. BPCOMPQ also remained on a buy and is close to moving above the upper bollinger band. Note though, that those bollies are tight.

Okay, take note of some interesting, subtle changes among our top 25%. First, cash levels are rising. Second, there's a relatively moderate position in bonds now. Third, total stock holdings are at their 2nd lowest since I began tracking this group in mid-August, and it's not far at all from dropping to a new low. Fourth, the I fund position is dropping, almost certainly due to dollar risk being elevated.

These moves are not large moves, but they reflect some measure of uncertaintly creeping in.

So we remain on a buy with 3 of 7 signals still flashing a buy. This market can go either way, and I'm inclined to think it will be up, but I'm not comfortable with that expectation the way I was a week ago. We need to see bullish levels drop in order to get a good set-up for the next up-leg. It can happen very quickly depending on any given market data release or some other catalyst. Tomorrow we have Initial claims (consensus 465K), Continuing claims (consensus +5435K), and the Trade balance being released, so we do have potential market moving data coming our way. Will one of them trigger a breakout? We'll see soon enough. See you tomorrow.