Another gap lower to start the trading day once again saw the stock market turn in the afternoon hours and retrace most of its losses or even post gains as was the case for the DOW and the NAZ. Volume is still quite low in this market, so it's very apparent many traders and investors continue to be avoiding risk. Our own tracker continues to reflect that same sentiment.

This morning saw initial jobless claims reported at 450,000, which was modestly lower than estimates, while continuing claims fell by 84,000 to 4.49 million.

The August Producer Price Index increased 0.4%, which was a tad higher than the anticipated 0.3%. Strip out food and energy and the Core PPI increased 0.1%, which was in-line with estimates.

The September Philadelphia Fed Index posted a much better number than the previous -7.7 and improved to -0.7, but it wasn't enough to cheer the market as some estimates were looking for 2.0.

Charts have still not changed much, but do continue to suggest weakness in the near term.

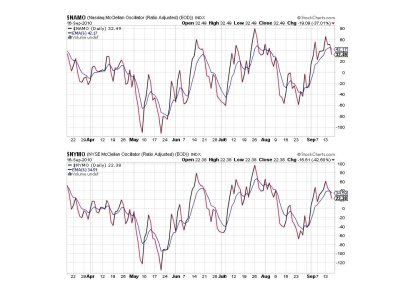

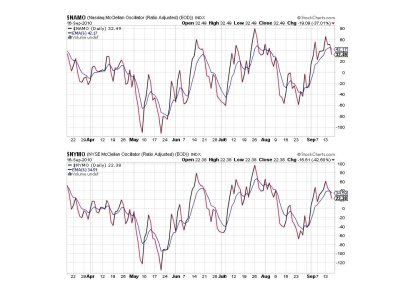

Both NAMO and NYMO flipped to sells, but I'm still expecting another run to the upside before we turn it back down in any meaningful way.

NAHL and NYHL are mixed, although NAHL is just barely holding its buy status.

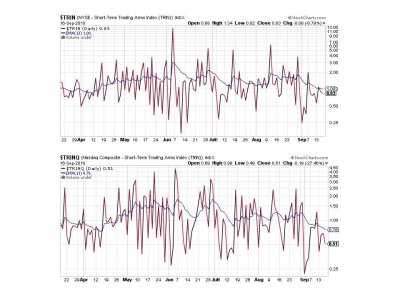

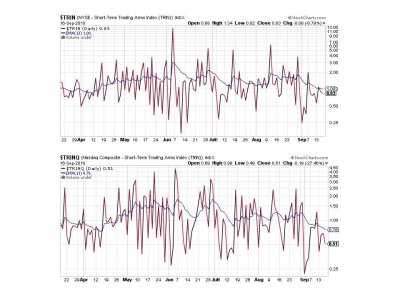

TRIN and TRINQ both continue to remain on buys and their 13 day EMAs continue to drop lower. I see that as problematic and another reason to expect a bout of selling soon.

Up again for BPCOMPQ, but that upper bollinger band is following it up that ladder, so if it does turn we can get flip this to a sell quick.

So we have 4 of 7 signals on a buy, which keeps the system on a buy. I am looking for weakness soon, but it may not come until we break 1130 on the S&P. Tomorrow is OPEX and I doubt any selling starts there. I'm thinking we could see some next week, but of course the market will have the final say.

This morning saw initial jobless claims reported at 450,000, which was modestly lower than estimates, while continuing claims fell by 84,000 to 4.49 million.

The August Producer Price Index increased 0.4%, which was a tad higher than the anticipated 0.3%. Strip out food and energy and the Core PPI increased 0.1%, which was in-line with estimates.

The September Philadelphia Fed Index posted a much better number than the previous -7.7 and improved to -0.7, but it wasn't enough to cheer the market as some estimates were looking for 2.0.

Charts have still not changed much, but do continue to suggest weakness in the near term.

Both NAMO and NYMO flipped to sells, but I'm still expecting another run to the upside before we turn it back down in any meaningful way.

NAHL and NYHL are mixed, although NAHL is just barely holding its buy status.

TRIN and TRINQ both continue to remain on buys and their 13 day EMAs continue to drop lower. I see that as problematic and another reason to expect a bout of selling soon.

Up again for BPCOMPQ, but that upper bollinger band is following it up that ladder, so if it does turn we can get flip this to a sell quick.

So we have 4 of 7 signals on a buy, which keeps the system on a buy. I am looking for weakness soon, but it may not come until we break 1130 on the S&P. Tomorrow is OPEX and I doubt any selling starts there. I'm thinking we could see some next week, but of course the market will have the final say.