Stocks struggled most of the day today, starting off with modest gains and then reversing to sport modest to moderate losses until the final hour when it made it back to positive territory and finishing with modest gains across the TSP stock funds. Volume was average, but still low given the holiday period had expired and we faced the first full trading day for our domestic market since the Dubai story broke.

Word is that Black Friday was "soft" and not as robust as portrayed by the media. All things considered it appears to be a market unsure of where to go from here.

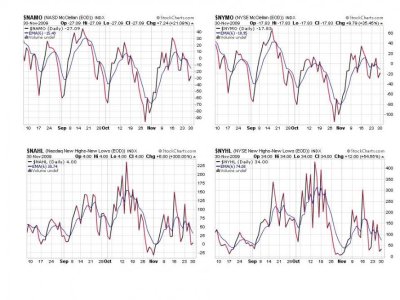

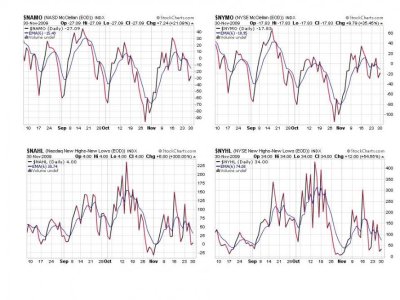

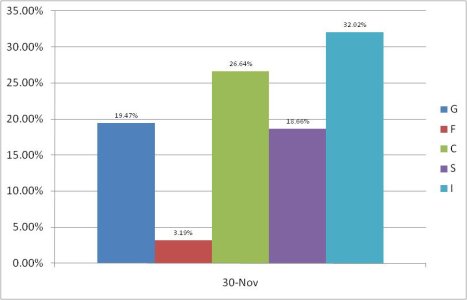

The Seven Sentinels remained on a sell today, with two of the signals flipping to a buy, but the other five remaining on a sell. Here's the charts:

These four remain on a sell. NAMO and NYMO continue to appear weak and look more like a market about to continue a downward leg than begin a new one higher.

TRIN and TRINQ are the two signals that flipped

to a buy. But we can see BPCOMPQ remains in a downtrend. This signal peaked in late September, so it's been over two months now since it had a sustained move to the upside. Remember, this signal is used by traders to ascertain trend, and right now the trend is pointing downward. But with no real damage done to technicals overall, it may still rebound at some point.

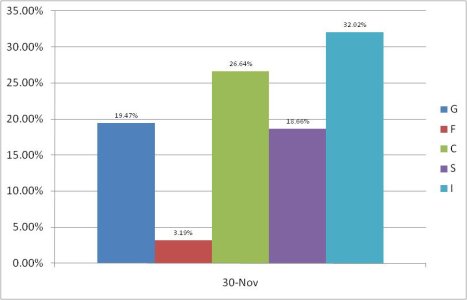

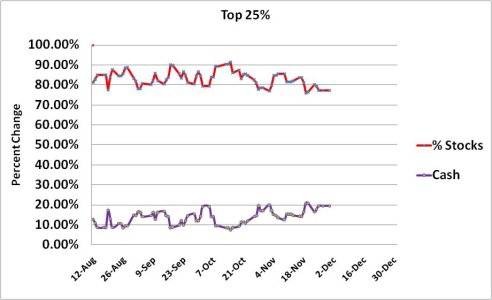

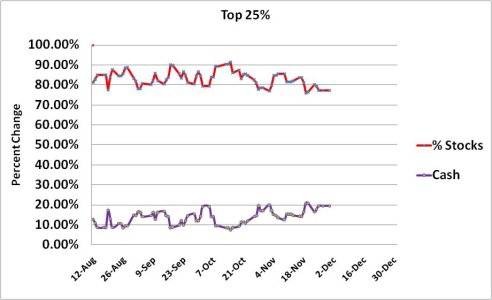

Our Top 25% remain fairly bullish here, with cash levels holding around 20%.

So no major move by the market today. It came Friday instead. But the Seven Sentinels still appear collectively weak. Since sentiment continues to get beared up quickly, taking the market down will not be easy, unless more stories like the Dubai default break, or too much bullish news is forthcoming (not likely).

Tomorrow starts the first day of December and gives us two new IFTs. Hopefully I can make another good trade this month without keeping my portfolio exposed for too long. Of course I'll be watching the Sentinels very closely for that opportunity.

Word is that Black Friday was "soft" and not as robust as portrayed by the media. All things considered it appears to be a market unsure of where to go from here.

The Seven Sentinels remained on a sell today, with two of the signals flipping to a buy, but the other five remaining on a sell. Here's the charts:

These four remain on a sell. NAMO and NYMO continue to appear weak and look more like a market about to continue a downward leg than begin a new one higher.

TRIN and TRINQ are the two signals that flipped

to a buy. But we can see BPCOMPQ remains in a downtrend. This signal peaked in late September, so it's been over two months now since it had a sustained move to the upside. Remember, this signal is used by traders to ascertain trend, and right now the trend is pointing downward. But with no real damage done to technicals overall, it may still rebound at some point.

Our Top 25% remain fairly bullish here, with cash levels holding around 20%.

So no major move by the market today. It came Friday instead. But the Seven Sentinels still appear collectively weak. Since sentiment continues to get beared up quickly, taking the market down will not be easy, unless more stories like the Dubai default break, or too much bullish news is forthcoming (not likely).

Tomorrow starts the first day of December and gives us two new IFTs. Hopefully I can make another good trade this month without keeping my portfolio exposed for too long. Of course I'll be watching the Sentinels very closely for that opportunity.