Another volatile session ended with mixed results for the broader market today. At the close the S&P 500 sported a respectable gain of 0.46%, while the DOW was not far behind with a rise of 0.32%. The Nasdaq was the laggard with a 0.21% loss.

The key event being talked about in trading circles is the debt talks that are scheduled in the eurozone over the coming weekend. Officials have been playing down the talks however, and are being cautious in not raising expectations. There's also rumor that the event may be postponed. That would seem to be a negative for the market should it happen, but it could also spark more shorting interest in bear focused trading. Get enough of that and we could potentially shoot to the upside once again.

On the domestic front, initial jobless claims remained largely the same as 403,000 claims were filed. This was pretty much in-line with estimates.

October's Philadelphia Fed Survey moved higher to 8.7 after a dismal reading of -17.5 the previous month. The current reading was much better than expected.

September existing home sales came in at an annualized rate of 4.91 million units. That total was very close to estimates.

Finally, Leading Indicators were up 0.2%, which just missed estimates calling for a 0.3% increase.

Here's today's charts:

NAMO and NYMO remained on sells today, but are not far from their respective 6 day EMAs.

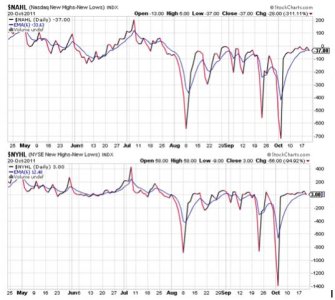

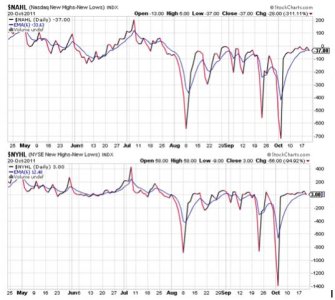

NAHL and NYHL dipped lower today and both flipped to sells (albeit barely) in the process.

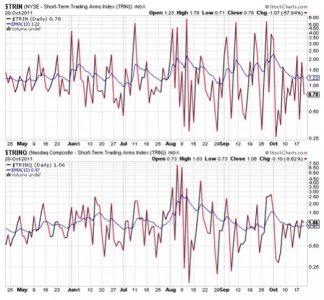

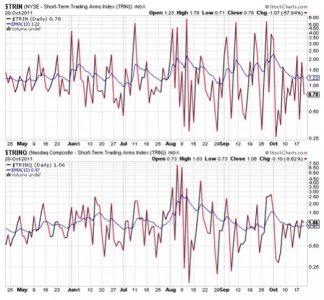

TRIN flipped back to a buy, while TRINQ remained on a sell. Both are largely neutral.

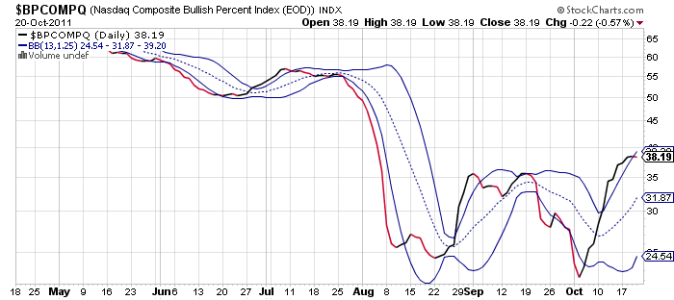

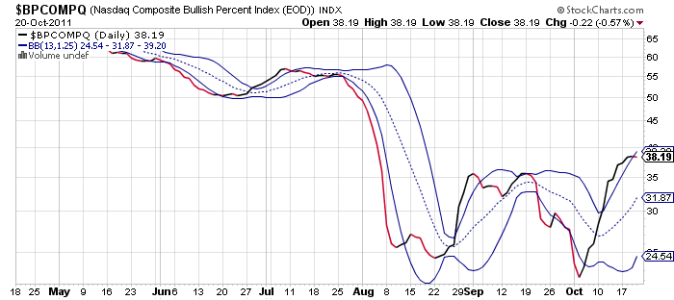

BPCOMPQ crossed the upper bollinger band, which flips it to a sell. However, the signal itself penetrated the upper band with a primarily sideways move. I'm still going to consider this a sell condition, but I'd prefer to see the signal actually move lower first.

So all but one signal (TRIN) are on sells, which keeps the system in a buy condition. But overall the signals don't look overly bearish, although it's entirely possible they get there over the coming days as volatility and news driven spikes in this market are quite prevalent. But there appears to be some measure of support below too and sentiment is still supportive, as is seasonality.

I'm holding my 100% S fund position here and ready to endure some significant draw down in prices should it come, but I'm also fairly certain we'll tag new highs over the coming days or weeks too. The volatility is part of the action now and is almost impossible to avoid unless one is lucky enough to get in front of a multi-day move higher after some severe downside pressure.

The key event being talked about in trading circles is the debt talks that are scheduled in the eurozone over the coming weekend. Officials have been playing down the talks however, and are being cautious in not raising expectations. There's also rumor that the event may be postponed. That would seem to be a negative for the market should it happen, but it could also spark more shorting interest in bear focused trading. Get enough of that and we could potentially shoot to the upside once again.

On the domestic front, initial jobless claims remained largely the same as 403,000 claims were filed. This was pretty much in-line with estimates.

October's Philadelphia Fed Survey moved higher to 8.7 after a dismal reading of -17.5 the previous month. The current reading was much better than expected.

September existing home sales came in at an annualized rate of 4.91 million units. That total was very close to estimates.

Finally, Leading Indicators were up 0.2%, which just missed estimates calling for a 0.3% increase.

Here's today's charts:

NAMO and NYMO remained on sells today, but are not far from their respective 6 day EMAs.

NAHL and NYHL dipped lower today and both flipped to sells (albeit barely) in the process.

TRIN flipped back to a buy, while TRINQ remained on a sell. Both are largely neutral.

BPCOMPQ crossed the upper bollinger band, which flips it to a sell. However, the signal itself penetrated the upper band with a primarily sideways move. I'm still going to consider this a sell condition, but I'd prefer to see the signal actually move lower first.

So all but one signal (TRIN) are on sells, which keeps the system in a buy condition. But overall the signals don't look overly bearish, although it's entirely possible they get there over the coming days as volatility and news driven spikes in this market are quite prevalent. But there appears to be some measure of support below too and sentiment is still supportive, as is seasonality.

I'm holding my 100% S fund position here and ready to endure some significant draw down in prices should it come, but I'm also fairly certain we'll tag new highs over the coming days or weeks too. The volatility is part of the action now and is almost impossible to avoid unless one is lucky enough to get in front of a multi-day move higher after some severe downside pressure.