It's hard to believe that the market would continue to trade in volatile fashion on news that really isn't news anymore, but concern that Greece may default on its debt was blamed for today's sell-off. Media reports that the country may be close to reaching an agreement for more funding seemed to mitigate losses against the major averages however. Still, the S$P 500 closed down just under 1%, while the Nasdaq saw a much more modest 0.36% decline.

The dollar gained 0.7% in large measure due to euro weakness as a result of the Greece drama.

On the other hand, treasuries bounced back again and logged strong gains.

It's tough to figure out where this market wants to go. Bonds certainly aren't buying into any notion of recovery. I am aware that there is lots of shorting in this market, which was probably one of the main reasons for last week's rally. But last week the sentiment started out quite bearish and by the end of the week was beginning to get somewhat bulled up again. The upside would seem to be limited now, but I'd not be surprised by anything this market does at this point.

Here's today's charts:

NAMO and NYMO flipped back to sells today, but remain in positive territory.

NAHL and NYHL also flipped to sells.

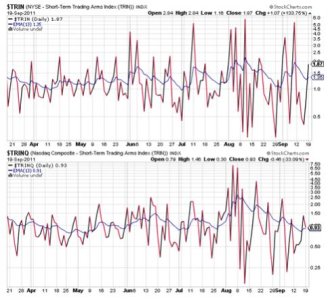

Both TRIN and TRINQ are flashing sells too.

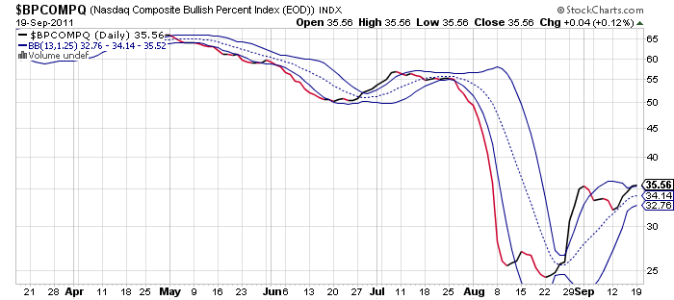

The one buy signal is BPCOMPQ, and that's not by much. Curiously, it only recently flipped back to a buy signal too. And it is at the upper end of the bollinger band right now, so a move lower would not be a surprise.

So all but one signal are in a sell condition, but the Seven Sentinels remain in a buy status for now.

If we continue to see more weakness this week, I noted that NYMO is not really all that far from tagging a 28 day trading low. At least not in this volatility. Anything under -42 should do it if we see significant selling pressure. But that's just a side note for now.

I'd like to be bearish here, but I don't think this market is ready to take a dive. I just don't think we're bullish enough to get back to the lows of the current trading channel and that we may have more upside coming first. I'm not hard over on the scenario, but that's my hunch. That also means I'm not convinced we won't see a decline below the August lows either. And that's why I'm being quite patient with this market as I continue to hold 100% F fund.