-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Geaux4it's Account Talk

- Thread starter Geaux4it

- Start date

Geaux4it

TSP Analyst

- Reaction score

- 5

GrandeBabbo

New Contributor

- Reaction score

- 1

I think you are right on the money. Fed says it might taper to take the air out of the equities but realizes it has no other option but to continue QE.

Geaux4it

TSP Analyst

- Reaction score

- 5

I think you are right on the money. Fed says it might taper to take the air out of the equities but realizes it has no other option but to continue QE.

Follow the money

-Geaux

Geaux4it

TSP Analyst

- Reaction score

- 5

Nice chart, good to see you Geaux4it......been awhile!

Thanks- More of a lurker than a poster

-Geaux

Geaux4it

TSP Analyst

- Reaction score

- 5

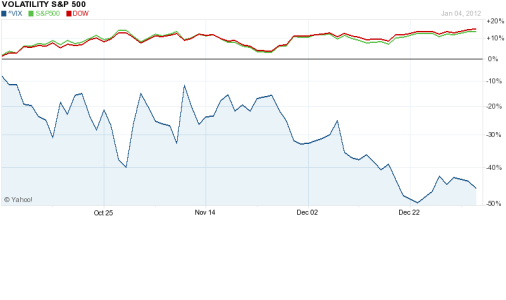

Sitting on the fence today in 25/25 C&S. Before my 0830 meeting I will have to make a decision. If the market is chopping along then its sale central. If we can't rally with CATS good numbers, and taking into consideration last weeks chaos, then I think we could see a more broad move to the downside through the end of the month.

-Geaux

-Geaux

Geaux4it

TSP Analyst

- Reaction score

- 5

Well I decided to hold my 25C/25S/50G position as we have been chopping along here. With the positive GDP report this morning, I am leaning toward increasing my positions in the C&S (1 IFT left for the month) because I feel they are way over sold. But my question is when does the 10 year start to awaken. It's recent opposite direction is puzzleing. The whole house of cards is in flux...

-Geaux

-Geaux

Geaux4it

TSP Analyst

- Reaction score

- 5

Starting to feel like I'm hitting the home stretch of my career. Unless things change dramatically at work, I will indeed pull the ejection handle June 2016 at MRA of 56. In government terms, 22 months is actually like tomorrow. What an awesome feeling to be working on budgets and participating in TEWG's for programs coming after my retirement date which leads to my comments for young TSPer's.

Start now. Yes, retirement seems like many moons from now for you but it's not. Whoever coined the phrase, 'Life is short' actually knew what they're talking about. I remember the old timers who sat me down on my first day of work in 1984 telling me to invest in an IRA or other accounts. The TSP was coming on board and they told me to pile on. Albeit my salary (WG at that time) was peanuts, 10% was still 10% of my salary. I guess the point I'm trying to make here is.... Max out your contributions, invest 100% and get on with your career. If I was still in my first decade of employment I would still do the same thing. Invest 100% and go long. You have the time to ride out a steep valley that all the pundits are predicting, and still recoup any dip that you encounter.

It's better days ahead for Civil Servants come 2016. I truly believe the government will be a boom town again much like we saw in the 90's. There will be a significant pullback in stocks at some point and the young TSPer will be in the catbird seat. There will be some gains to be had soon and the younger demographic at TSP will be adding to their account base for some years to come.

With that said, I'm more conservative these days using just 70% of my balance to invest in the markets. Like the FED, I'm starting to taper.

-Geaux

Start now. Yes, retirement seems like many moons from now for you but it's not. Whoever coined the phrase, 'Life is short' actually knew what they're talking about. I remember the old timers who sat me down on my first day of work in 1984 telling me to invest in an IRA or other accounts. The TSP was coming on board and they told me to pile on. Albeit my salary (WG at that time) was peanuts, 10% was still 10% of my salary. I guess the point I'm trying to make here is.... Max out your contributions, invest 100% and get on with your career. If I was still in my first decade of employment I would still do the same thing. Invest 100% and go long. You have the time to ride out a steep valley that all the pundits are predicting, and still recoup any dip that you encounter.

It's better days ahead for Civil Servants come 2016. I truly believe the government will be a boom town again much like we saw in the 90's. There will be a significant pullback in stocks at some point and the young TSPer will be in the catbird seat. There will be some gains to be had soon and the younger demographic at TSP will be adding to their account base for some years to come.

With that said, I'm more conservative these days using just 70% of my balance to invest in the markets. Like the FED, I'm starting to taper.

-Geaux

Geaux4it

TSP Analyst

- Reaction score

- 5

Just cruising by..

Hard to believe I have been retired 7 years already. Having my best year relative to returns.

I invest 40% in stocks and so far a return of 14.7% YTD. My auto tracker is hosed up but yea, its been a good year so far.

And yes, every day is Saturday :smile:

EDIT- Sorry, I see I should of replied to one of my old threads instead of creating a new title? fAiL

Hard to believe I have been retired 7 years already. Having my best year relative to returns.

I invest 40% in stocks and so far a return of 14.7% YTD. My auto tracker is hosed up but yea, its been a good year so far.

And yes, every day is Saturday :smile:

EDIT- Sorry, I see I should of replied to one of my old threads instead of creating a new title? fAiL

Similar threads

- Replies

- 0

- Views

- 124