Today, I think the market got just about everyone's attention. We are now officially in a correction and took less than 2 trading weeks to get there. Most of that damage was done over 3 of those trading days, with the worst being today.

The Dow dropped 500 points, while the Nasdaq and S&P 500 dove 5.08% and 4.78% respectively. Our S fund, which tracks the Wilshire 4500 was clobbered by an eye popping 6.16%, but the worst performance of the day was the EAFE, which our I fund tracks. That was crushed to the tune of 6.98%. It certainly does feel like 2008 all over again.

It never seems logical to blame the usual suspects such as the ongoing EU debt crisis, or our own high unemployment and depressed housing market when the market sells off like this. Not when those problems never went away to begin with. Earnings have been good overall this reporting period. Of course Quantitative Easing is now behind us.

Or is it? I saw a headline on CNBC shortly after the market closed that indicated the market may be pricing in QE3 right now. That wouldn't surprise me one bit if it turns out to the true.

But it wasn't just stocks that took it on the chin. Gold fell a modest 0.5%, but silver dropped by a hefty 5.6%.

So what can we expect tomorrow when the nonfarm payroll numbers come out? It seems the tone has already been set, regardless of what that report will show.

Of course the charts aren't going to look any better after today, but let's take a look anyway:

I mentioned in last night's blog that while NAMO and NYMO were tagging levels that typically saw reversals in previous months, that the game may have changed and that we could in fact drop lower still. Well, the game has changed and we did indeed drop lower.

I also mentioned that NAHL and NYHL were looking bearish after yesterday's end-of-day rally and today's action didn't do anything to dispel that outlook.

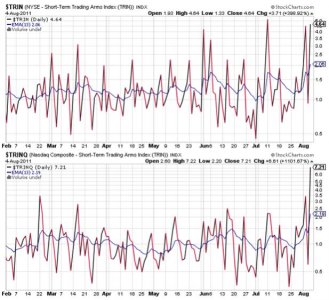

TRIN and TRINQ spiked again to deeply oversold conditions. Two days ago when they were also showing oversold conditions we got a hard fought rally the next day (yesterday). I suppose the question we need to ask is that if tomorrow we get a rally, is it a selling opportunity? I doubt we'll see many bulls jump in expecting another sustained leg higher. Not after this damage. And that leaves open the possibility of more rally than some may be expecting as the market may see increased shorting activity coupled with much more bearish sentiment. That's just a scenario. But it's possible. But I'm also not suggesting a bottom can be declared should we get a few up days either. Things are very dicey right now. But we need to recognize what curve balls may be thrown.

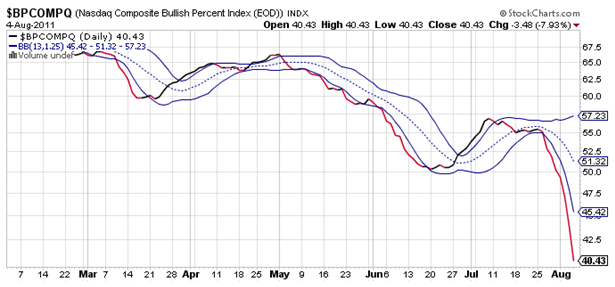

BPCOMPQ has fallen over a cliff. And that's what would make me very cautious about buying any rallies for the next few days. This signal is not going to flip to a buy signal on token buying pressure in the short term, so beware.

So no change in status for the Seven Sentinels. They remain in an Intermediate Term sell condition and I would definitely take that seriously at this point. We can certainly get some rallies somewhere along the way, but as long as the system is on a sell (assuming the game has changed) I would also assume rallies will get sold until the market shows us differently.