We got a rally, but the market really does appear to be fighting headwinds when it finally moves to the upside.

After four negative sessions in a row it appeared that a fifth was in the making, but the market did manage to generate a short covering rally by the afternoon. And it was overseas markets that kept the negativity going early on. There was news that Ireland’s sovereign debt rating was reduced by Standard and Poor's to AA- from AA, which certainly wasn't what the market wanted to hear, although it was probably no surprise. The Shanghai Composite dropped 2.0% and Japan’s Nikkei fell even further into bear market territory. Japan's Ministry of Finance has also been talking about unilateral yen-selling intervention to reduce the strength of the Yen. A lot of moving parts in play and none of them good.

In our own market, the latest durable goods report added to the selling pressure here as orders for July increased just 0.3%, which is a far cry from the 3.0% increase that had been expected. Strip out transportation and durable goods orders dropped 3.8%. Again a far cry from what was expected, which was a 0.5% increase.

I am currently anticipated some follow-through to the upside tomorrow, although I don't know if it will hold till the close, assuming of course that we do rally.

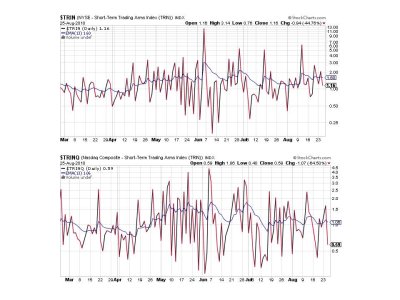

Here's the charts:

Still on sells here, although it's possible they could flip to buys depending on tomorrow's action.

Same with NAHL and NYHL.

TRIN and TRINQ are both flashing buys,

After four negative sessions in a row it appeared that a fifth was in the making, but the market did manage to generate a short covering rally by the afternoon. And it was overseas markets that kept the negativity going early on. There was news that Ireland’s sovereign debt rating was reduced by Standard and Poor's to AA- from AA, which certainly wasn't what the market wanted to hear, although it was probably no surprise. The Shanghai Composite dropped 2.0% and Japan’s Nikkei fell even further into bear market territory. Japan's Ministry of Finance has also been talking about unilateral yen-selling intervention to reduce the strength of the Yen. A lot of moving parts in play and none of them good.

In our own market, the latest durable goods report added to the selling pressure here as orders for July increased just 0.3%, which is a far cry from the 3.0% increase that had been expected. Strip out transportation and durable goods orders dropped 3.8%. Again a far cry from what was expected, which was a 0.5% increase.

I am currently anticipated some follow-through to the upside tomorrow, although I don't know if it will hold till the close, assuming of course that we do rally.

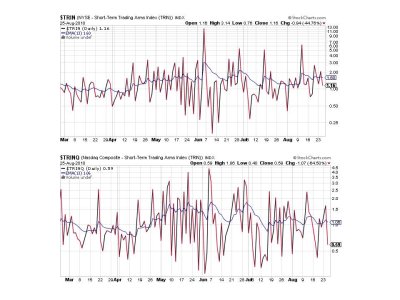

Here's the charts:

Still on sells here, although it's possible they could flip to buys depending on tomorrow's action.

Same with NAHL and NYHL.

TRIN and TRINQ are both flashing buys,