felixthecat

TSP Analyst

- Reaction score

- 41

- AutoTracker

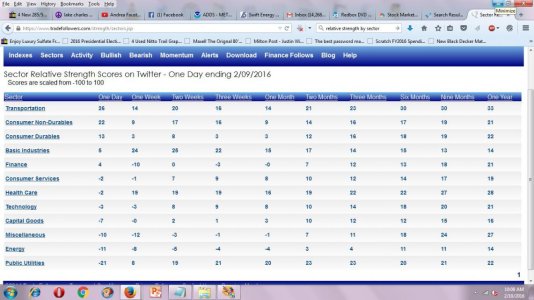

Well, looks like the contrarian move to stay in I Fund is working so far. Even with an up market, the strongest funds today are the I Fund and C Fund. The S Fund is lagging and seems to be hesitant about joining this rally. That is a little concerning since it has been in a down slope since Feb 06. Nevertheless, all funds are up. I'm bothered by the strong dollar which is taking away from the I fund return potential. I have been in long enough in the I fund to see that you must look at both the EFA ( iShares MSCI EAFE ETF - EFA - Stock Quotes ) and the US Dollar Index ( DXY Index Quote - U.S. Dollar Index (DXY) Index Price Today (DXY:NYE) - MarketWatch ) to get a sense of the return of the day ). If I just used these two for today...looks like the I Fund would return about .40%...give or take some fair valuation exchange. Sometimes, I don't see the fair valuation taken off or added until the following day so there is definitely a mystery to the I Fund return. In any case, the C Fund is returning the most, then the I fund, then I think the S Fund.

I'm still waiting on the dang strong dollar to weaken. I fund still good enough to stick with...and will save the one move to get back into the F fund after correction is complete. Looks like two good days of upside possible. Ride it.

I'm still waiting on the dang strong dollar to weaken. I fund still good enough to stick with...and will save the one move to get back into the F fund after correction is complete. Looks like two good days of upside possible. Ride it.