Thanks for all the private messages several of you have sent me. Here is my reply.

I make my own moves based on my years of experience. If you want to be successful, then read the Latest Commentary Page on tsptalk.com (

TSP Talk Market Commentary). You will note important information on Key market Indices and the TSP Funds. This page will tell you when the Funds are due for a rebound or are stretched and ready for a haircut. You will note at the bottom of the page shows TSP Stock Fund Graphics of the C, S, F, I Funds which mirror the stock market of course. This is helpful to see which Fund on a daily basis is doing well in real time so to speak.

TSP Talk Market Commentary

Also not on the same page, you get a snapshot of the TSP Daily returns. on the link below this graphic you will see this link

TSP Share Prices

This link is critical for showing you the Stock Funds past and current prices or Daily, Weekly, Monthly, and Yearly Returns. Excellent!

Read the members Forums here

http://www.tsptalk.com/mb/search.php...e=vBForum_Post

There will be terrific stock analyses and charting. You will get critical market making decision here.

Do not follow the Herd during long runups or downturns....be a contrarian or go against herd mentality. Remember, the market likes to take out the masses when they are leaning one way or another.

Keep an eye on the top returners and their moves:

http://www.tsptalk.com/tracker/tsp_u...all_non_ps.php

Keep an eye on recent moves by the leaders:

TSP Talk AutoTracker

Keep abreast of the world markets...Keep an eye on Europe/Russia/Japan since these world markets feed on each other. You can use any world news you want. Reuters, Bloomberg, CNBC, Yahoo Business, or any other favorite.

Key things to Watch Commodities, US Dollar, Home Sales, Employment Numbers, Retail Numbers, Business Inventories. Don't forget, news from Presidents, Warren Buffet, Big Banks, FED, or anything to do with peoples health or Money.

When you make a informed move, no regrets. Learn from your experience positive or negative. Do not make TSP Moves only based on what the market is doing at the time. I swear to you, the market knows TSP Federal Employees makes moves before 11 AM. Make decision knowing the market can turn on a dime like it did 12/31 from morning positive...then downdraft after noon. I seen it happen so many times it is unreal. Better to make moves on solid information that can have longer lasting effects.

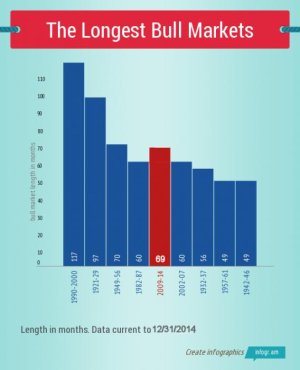

There is a mountain more I use to get the health of the economy including watch the railroads, utilities, car sales, and so on. Too much for any one person to keep up with. Buy and hold strategy can work and has done well. However, the Bull run is on life support, be careful with buy and hold strategy. You can get burned badly. Watch your money! Make moves to save yourself. Remember, buy low and sell high is your motto. If you don't have time to study the market, then use the L Funds and let autopilot make the moves for you. They are appropriate for you and are based on your years to retirement.

Good luck to you all! Have a great 2015 and beyond.