Bullitt

Market Veteran

- Reaction score

- 75

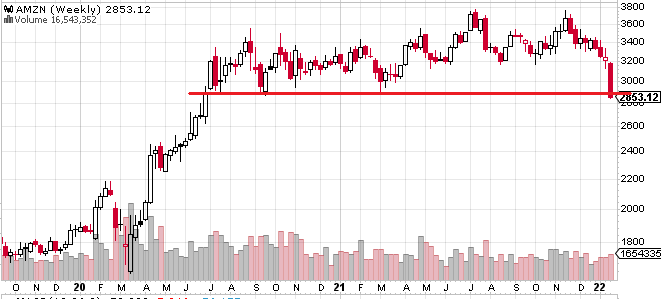

AMZN .... looks primed for that breakout here but nothing says it can't come back down to test the bottom of the channel again first.

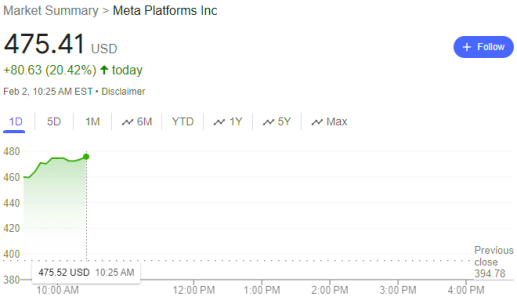

The breakout looks good but a second retest of old resistance in progress has to hold. Looks like general weakness across the board in FAANG stocks despite earnings blowouts.