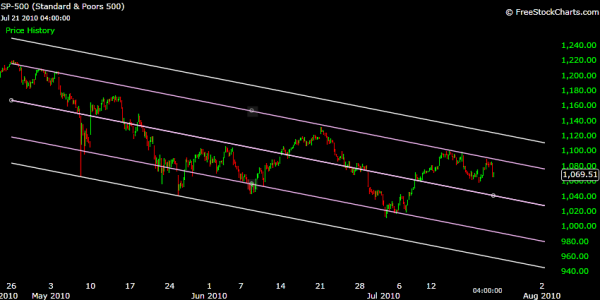

Evaluating entry/exit positions over multiple time frames using regression channels.

The 1st chart below shows the three primary channels I'm watching. What I'm going to do is separate those channels and identify key levels of median-price support and resistance within each time frame. I've also extended these channels to the beginning of August so those of you without IFTs can evaluate price before you reload.

First up is the overall picture showing May's white descending channel, Mid-June's red sideways channel, and July's green ascending channel. In the TSP world, when it comes to judging channels, I'm more inclined to put my faith in the longest trending channel I can find. So in this case I happen to believe May's channel carries the most weight. If this were my ROTH IRA, I'd trade based on a shorter time-frame.

Note: For May's channel, I had to write in and deviate (move) an additional channel to match the peaks of the price waves. Please bear in mind that regression channels evolve everyday as prices fluctuate, these price targets are based on today's prices, not the channels extending out to August. .

May's Channel

Lower 2 lines oversold: 960-992

Upper 2 lines overbought: 1089-1123

Middle line price target: 1041 (current 1069 is slightly overbought)

Mid-July's Channel

Lower line oversold: 1004

Upper line overbought: 1126

Middle line price target: 1065 (current 1069 on target)

July's Channel

Lower line oversold: 1062

Upper line overbought: 1124

Middle line price target: 1093 (current 1069 oversold)

Lastly, in the white circle I want to point out that in the short term we are due for a bounce, based on being on target within Mid-June's channel, and oversold on July's channel.

Take care and trade safe...Jason