Good Bye Prime Minister Papandreou. Hello Prime Minister Berlusconi. It's your turn in the spotlight, and that may be putting it kindly given the mood these days in Italy.

The market came under selling pressure not long after the open as traders and institutions weighed the ramifications of PM Papandreou's impending departure as well as the delicate economic state of affairs in Italy.

And given that Italy's economy is six times larger than Greece's economy, it would appear the stakes are higher now.

But somehow, in spite of the PM shuffle the market found its footing after a rough start, hitting significant lows of the day around 1230 EST and rallying into the close to post modest to moderate gains across the board (for the major averages). Volume was light though, which always begs the question of conviction on the part of buyers.

Here's today's charts:

NAMO and NYMO remained in a sell condition and appear to be losing momentum.

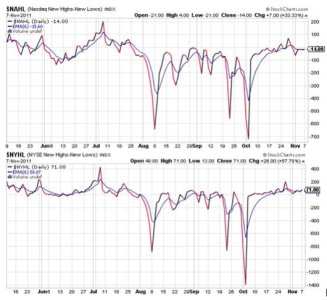

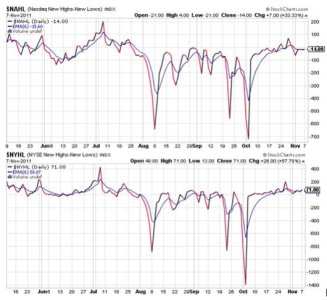

NAHL and is sitting on its 6 day EMA, while NYHL ebbed just above its trigger point, which triggered a buy.

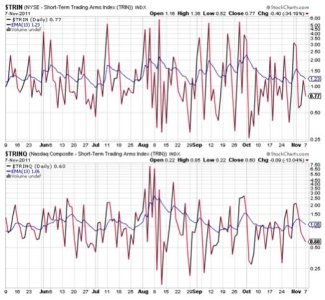

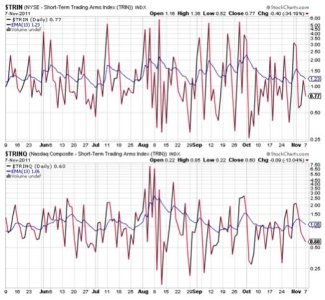

TRIN and TRINQ both remain on buys and are only suggesting modestly overbought conditions.

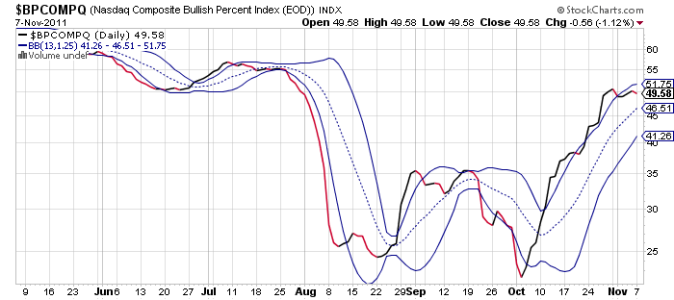

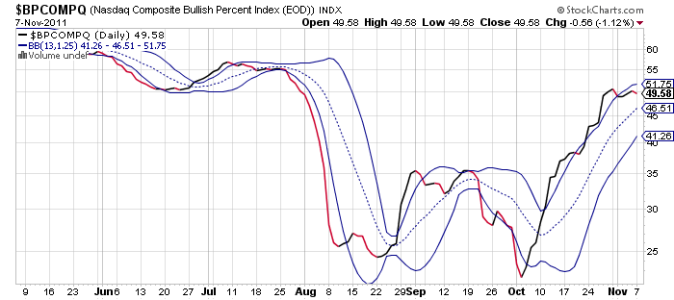

BPCOMPQ dipped a bit today, but is tracking largely sideways at the moment. It remains on a sell.

So the signals are mixed, but the Seven Sentinels remain in a buy condition.

While the charts seem to suggest the upside is limited at the moment, I believe anything is possible in what continues to be a news driven market. Italy is now on the front-burner, but the Super Committee situation is not far from becoming a significant news event itself. The Committee has a deadline of 23 November to agree on cuts, or else draconian measures will go into effect on both sides of the political spectrum. That happens to be the day before Thanksgiving, which is often a time frame for rallies to begin as we head into the holidays.

So I see no clear direction for the market, although I am leaning modestly bearish for the moment. But aside from my personal sentiment, I see no reason to take unnecessary risk in a market that is operating from news event to news event.

The market came under selling pressure not long after the open as traders and institutions weighed the ramifications of PM Papandreou's impending departure as well as the delicate economic state of affairs in Italy.

And given that Italy's economy is six times larger than Greece's economy, it would appear the stakes are higher now.

But somehow, in spite of the PM shuffle the market found its footing after a rough start, hitting significant lows of the day around 1230 EST and rallying into the close to post modest to moderate gains across the board (for the major averages). Volume was light though, which always begs the question of conviction on the part of buyers.

Here's today's charts:

NAMO and NYMO remained in a sell condition and appear to be losing momentum.

NAHL and is sitting on its 6 day EMA, while NYHL ebbed just above its trigger point, which triggered a buy.

TRIN and TRINQ both remain on buys and are only suggesting modestly overbought conditions.

BPCOMPQ dipped a bit today, but is tracking largely sideways at the moment. It remains on a sell.

So the signals are mixed, but the Seven Sentinels remain in a buy condition.

While the charts seem to suggest the upside is limited at the moment, I believe anything is possible in what continues to be a news driven market. Italy is now on the front-burner, but the Super Committee situation is not far from becoming a significant news event itself. The Committee has a deadline of 23 November to agree on cuts, or else draconian measures will go into effect on both sides of the political spectrum. That happens to be the day before Thanksgiving, which is often a time frame for rallies to begin as we head into the holidays.

So I see no clear direction for the market, although I am leaning modestly bearish for the moment. But aside from my personal sentiment, I see no reason to take unnecessary risk in a market that is operating from news event to news event.