esptimer

New Contributor

- Reaction score

- 3

Buy & Hold

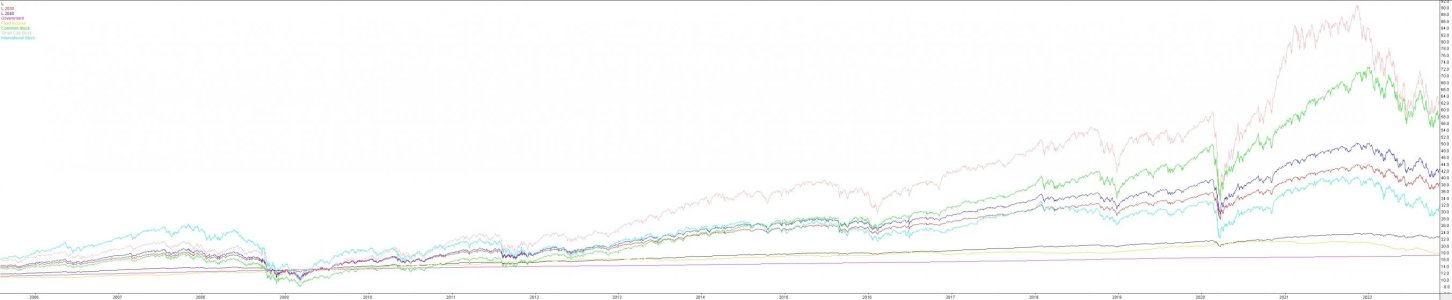

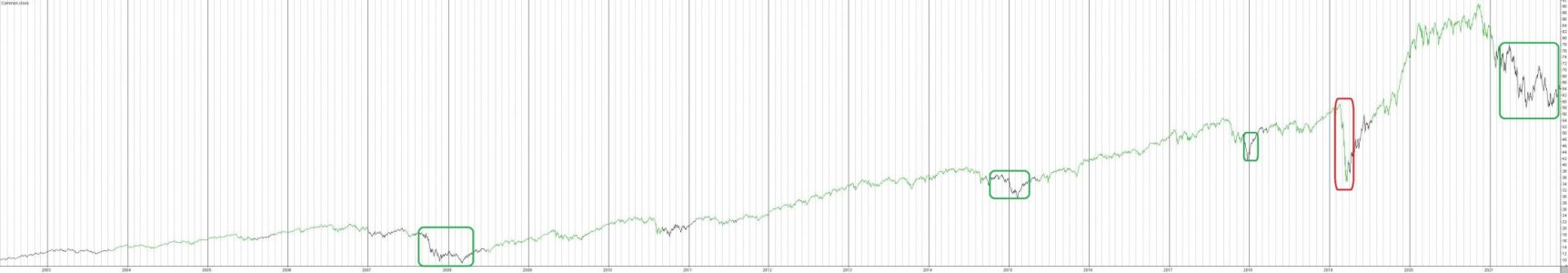

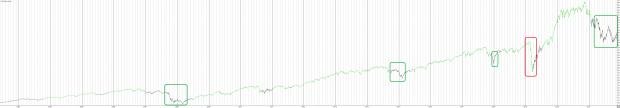

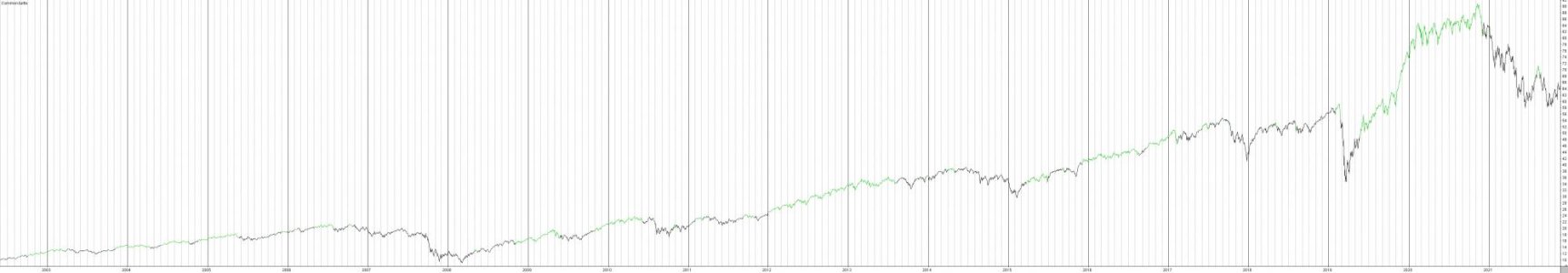

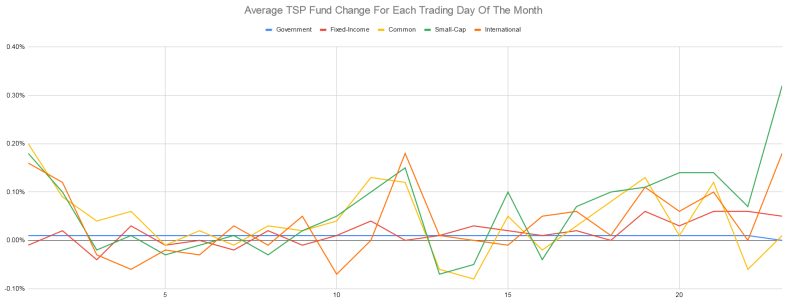

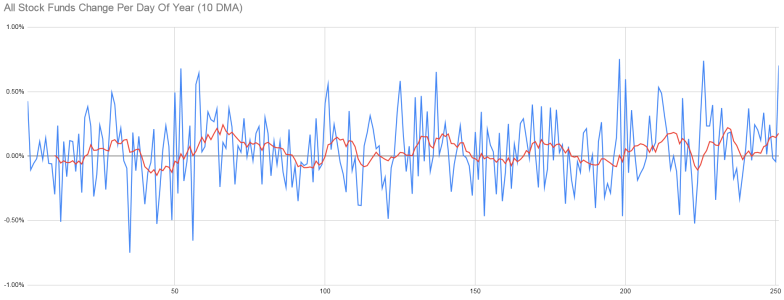

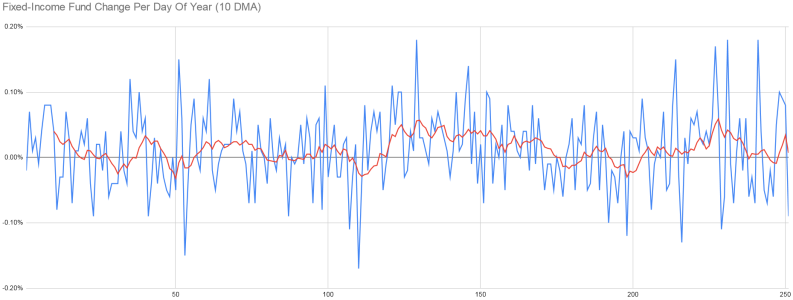

Here is a chart of TSP funds that have existed since 7/29/2005. There have been a lot of ups and downs along the way plus the temptation to try and avoid large drops. Open the image in a new tab to see the entire chart.

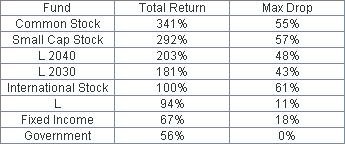

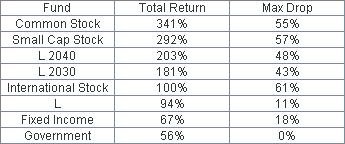

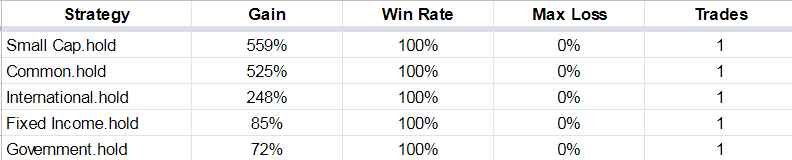

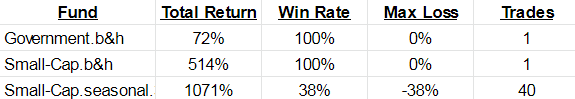

Here are Buy and Hold statistics for the funds sorted by total return and including the largest drops. The Common Stock fund had the highest total return with similar draw-downs to the other stock funds. It is my baseline.My goal is to build a mechanical trading system with better returns and less severe draw-downs. Feel free to check my work and suggest improvements as that is the point of posting this stuff here.

Last edited: