Stocks broke out to the upside in a big way last week. Pundits pointed out that the move was a result of Eurozone officials allowing Spain's banks to be directly recapitalized with bailout funds. This will occur once Europe sets up a single banking supervisor. Spain is also not required to take on more sovereign debt, which was viewed as a positive.

An infusion of 120 billion euros to increase the European Investment Bank’s lending capacity didn't hurt the bullish case either.

Is was also the end of the quarter, which implies that window dressing may have been applied by fund managers looking to cast their portfolios in a better light.

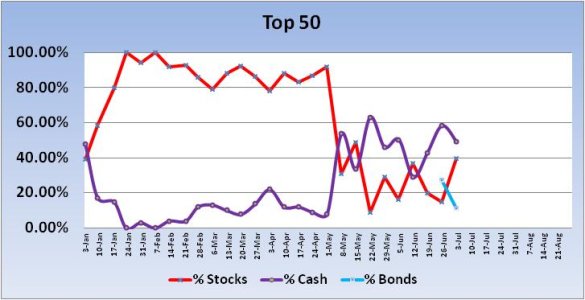

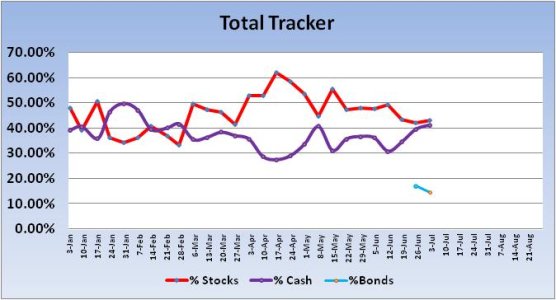

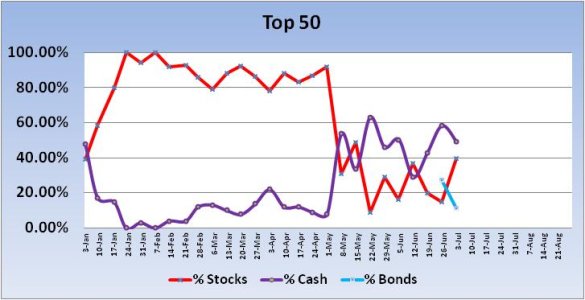

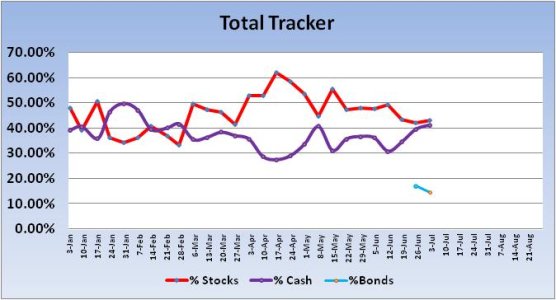

Both the Top 50 and the Total Tracker were decidedly bearish/conservative to begin the week last week. And this was confirmed by our sentiment survey as well. While the week was volatile, the pessimism helped the market resolve to the upside.

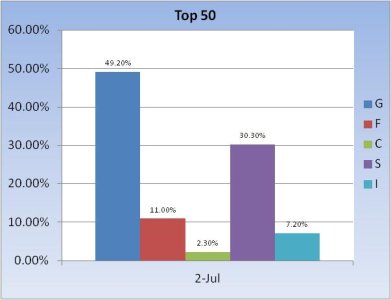

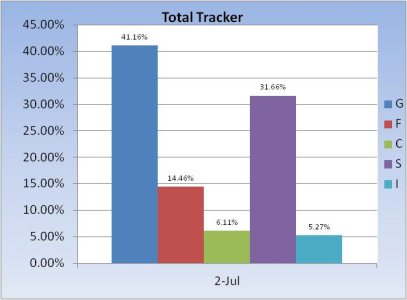

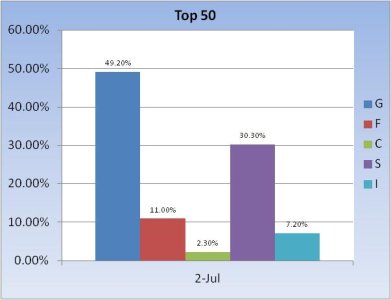

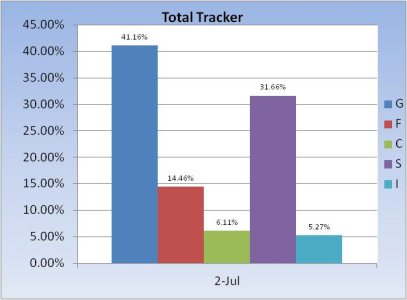

This week, not much has changed for the Total Tracker, although the Top 50 have a few more bulls among them going into the new week.

A drop in cash (G fund) and bonds (F fund) correlates to a rise in stocks (S, C, and I funds) for this group. Still, total stock allocations remain decidedly conservative at 38.8%.

Judging by the very limited movement in allocations for the new week, it would appear we aren't buying this rally just yet. Total stock allocations inched up by only 0.97% to a total stock allocation of only 43.05%. Of course the bulk of the gains came on Friday, which doesn't give us much time to react, but I think it's safe to say we're taking a wait and see approach.

Our sentiment survey remains on a buy for the eleventh straight week.

An infusion of 120 billion euros to increase the European Investment Bank’s lending capacity didn't hurt the bullish case either.

Is was also the end of the quarter, which implies that window dressing may have been applied by fund managers looking to cast their portfolios in a better light.

Both the Top 50 and the Total Tracker were decidedly bearish/conservative to begin the week last week. And this was confirmed by our sentiment survey as well. While the week was volatile, the pessimism helped the market resolve to the upside.

This week, not much has changed for the Total Tracker, although the Top 50 have a few more bulls among them going into the new week.

A drop in cash (G fund) and bonds (F fund) correlates to a rise in stocks (S, C, and I funds) for this group. Still, total stock allocations remain decidedly conservative at 38.8%.

Judging by the very limited movement in allocations for the new week, it would appear we aren't buying this rally just yet. Total stock allocations inched up by only 0.97% to a total stock allocation of only 43.05%. Of course the bulk of the gains came on Friday, which doesn't give us much time to react, but I think it's safe to say we're taking a wait and see approach.

Our sentiment survey remains on a buy for the eleventh straight week.