The broader market tagged new July lows today, while gold hit a record price of almost $1,608 an ounce as economic fears in the EU and here at home continue to plague global markets.

At the open, the major averages gapped significantly lower and never seriously made a run higher the entire trading day. By the close, the S&P 500 had fallen 0.81% to 1305.44, while the DOW and Nasdaq dropped 0.76% and 0.89% respectfully. Those closing prices were well off the lows of the day however, so the market wasn't without some measure of buying activity.

The dollar rose 0.4% by the end of trading, but it was up as much as 1% earlier on. That helped the I fund retrace much of its losses, but it still fell 1.48% on the day.

Here's today's charts:

Lower still for NAMO and NYMO. One more significant drop may push NYMO into a 28 day trading low, which is key for an official Seven Sentinels sell signal. Both signals remain in sell conditions.

Two more sells for NAHL and NYHL.

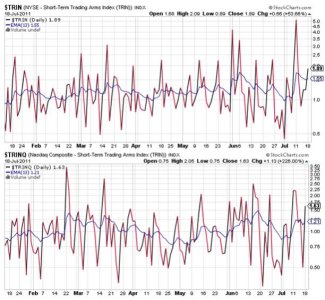

Both TRIN and TRINQ flipped back to sell conditions on today's trading activity. They are only modestly suggesting an oversold market, so I can't anticipate a bounce in the short term based on these two signals, although it's possible nonetheless.

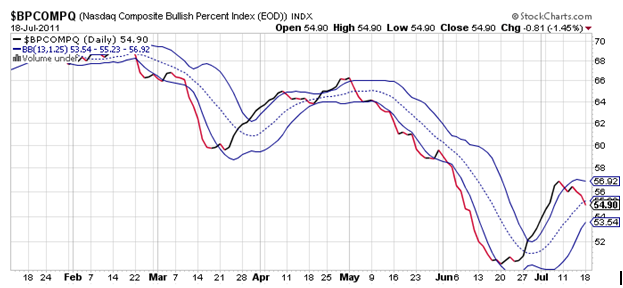

BPCOMPQ has taken a decidedly lower track after today and remains on a sell.

So all Seven Sentinels are now flashing sell conditions, which puts the system in an unconfirmed sell status. Officially, the system remains in a buy condition until NYMO hits a 28 day trading low.

At this point, I am fairly confident that the system will flip to a confirmed sell in the days ahead. That's not a guarantee, only my expectation. But this system has been significantly impacted by the volatile trading action of this market for a long time, which all too often has sent the system into either a buy or sell condition only to see the market reverse its trend sooner than one would expect. As a result, following the signals as they occurred often resulted in whipsaws. And some of those were significant. I myself chose to front run the system several months ago by interpreting the charts rather than trying to trade on signal fulfillment. My personal results have improved dramatically since. Hopefully, you find my analysis more beneficial too.

But the day will come when that strategy will not work as well, although that would probably require the market to settle down into much less volatile trending patterns and there's no telling when that may happen again.

My overall outlook has not changed. I continue to expect lower prices, but I am very aware of how quickly the trend could change. The Seven Sentinels do have some room to move lower and the character of the market has changed to one of selling rallies, but this is probably due in large measure to the economic uncertainty at home and abroad. And it would not surprise me in the least of the Sentinels trigger an official sell signal in the days ahead and a trend reversal occurs before the end of the month. In fact, I'm fairly sure that's how it will play out. But that reversal could happen any time between now and the time these economic headwinds are successfully addressed. And I believe that will happen this month. But the market could begin to move higher ahead of any announcements too, so identifying "the" low is not going to be easy. Then again, it rarely is under any circumstance. That's why we're seeing more buying interest on the tracker over the past few trading days. But not the Top 50. They seem to be a bit more patient.

Will earnings matter in this environment? I'm not betting that they will have a large impact until the aforementioned issues find a resolution, short term relief rallies notwithstanding.

So let's see how it plays out. My expectations are not predictions and I will continue to alter my view as conditions dictate.