2025 STRATEGY: I abandoned prior strategies to SIMPLIFY.

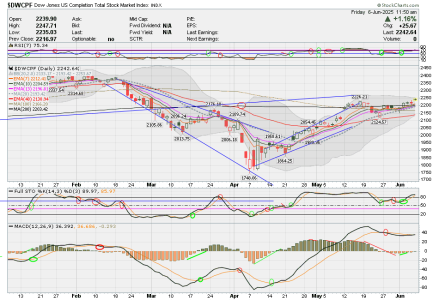

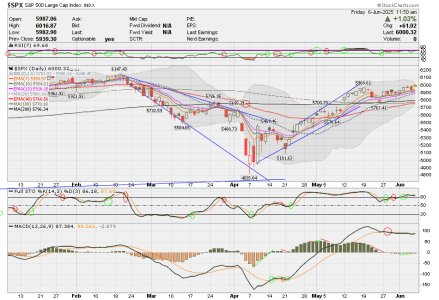

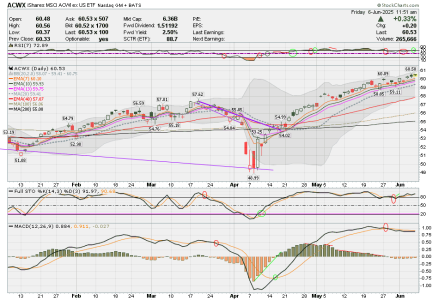

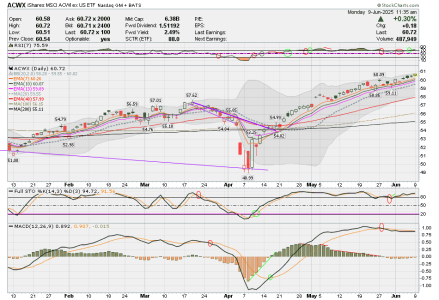

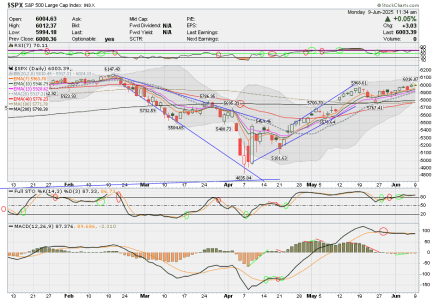

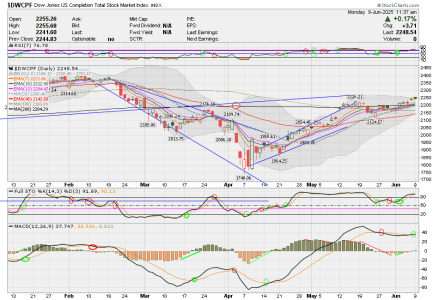

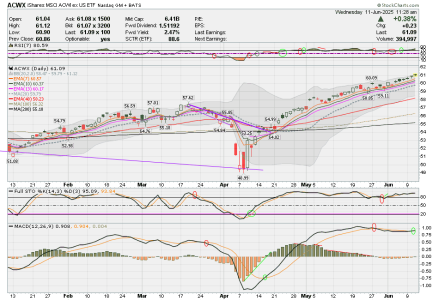

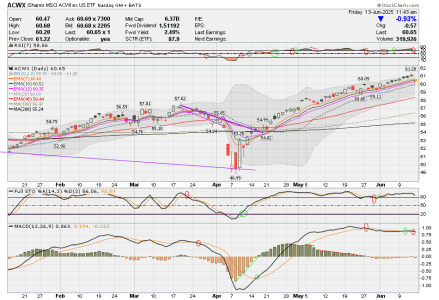

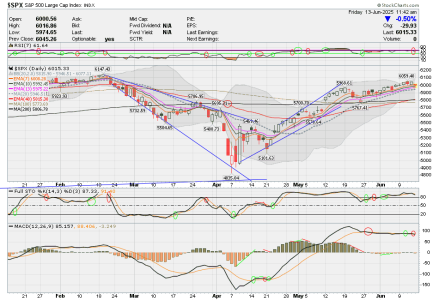

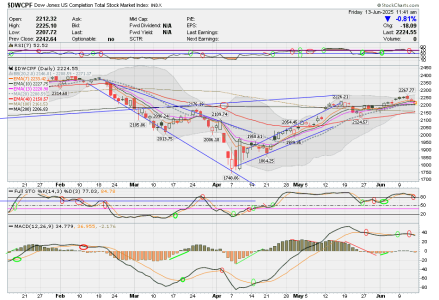

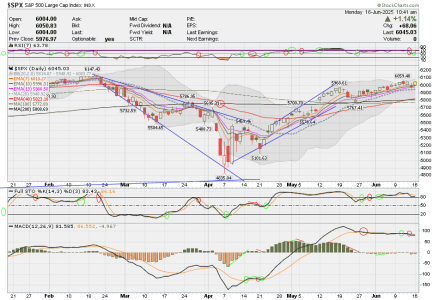

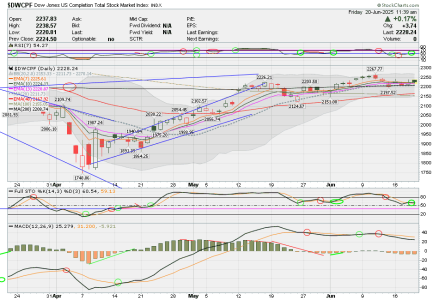

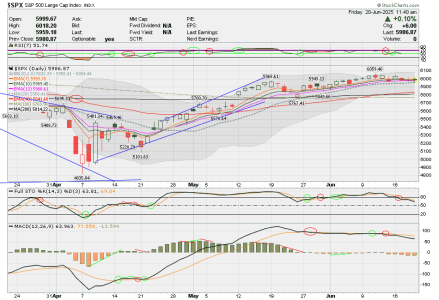

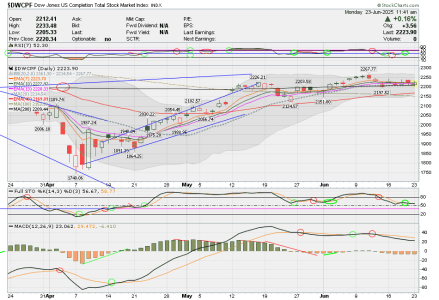

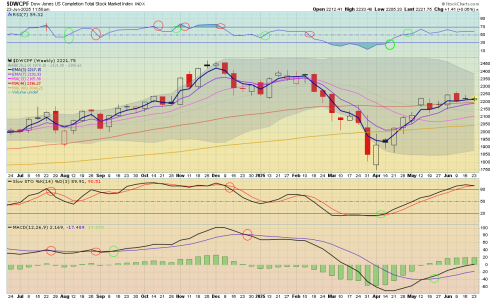

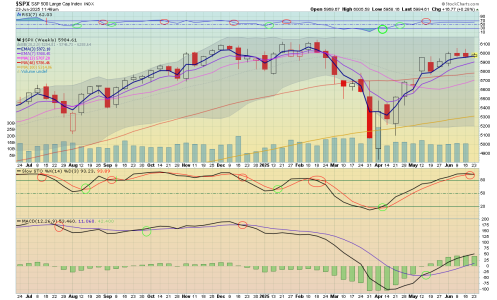

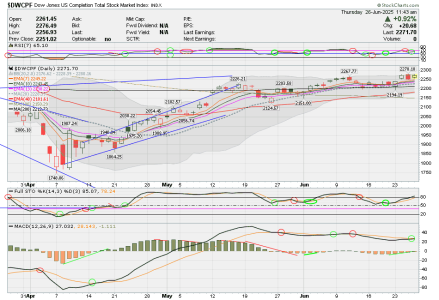

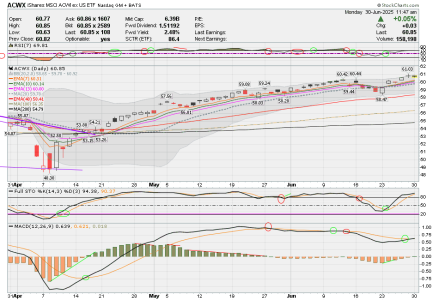

For ENTRY, it is preferred to only enter after Price has caused the Slow Stochastic to drop below 20 and it has started back up to cross back up above 20 and RSI rising above 50, but not yet reached 70. Because MACD is slower than RSI and Stochastic, I will also consider entry as long as the MACD histogram bars are getting closer to turning green and if the MACD line (black) is getting close to crossing above its (red) signal line. Also, do not like entry once price has hit the upper Bollinger Band, or if price is within and moving into a Bollinger Band pipe.

For EXIT, RSI dropping below 70, or Stochastic dropping below its 80 line are strong indicators to get out. The last ditch signal to get out is when MACD (black line) crosses below its (red) signal line (as this is the slowest momentum indicator) in my opinion. Often it seems “bad things” happen after the MACD cross down—but waiting that long could be too late!

On my charts, I try to circle the cross overs with green or red circles when I see them and have time to chart.

Note: Ravensfan and I have been collaborating on entry/exits since start of 2025 and we bounce everything off of each other. So, we try to discuss our individual reading of charts daily, and generally if we both agree, we make a move. Seems to be working good so far but we only invest up to 50% to be conservative as we are both in retirement. While earnings are low, I am very pleased. Doubling our actual earnings shown in the AT tracker will give a more accurate idea of how the strategy would work if we were investing 100% during our moves. Maybe in future, we will consider increasing our exposure for these moves to earn more.