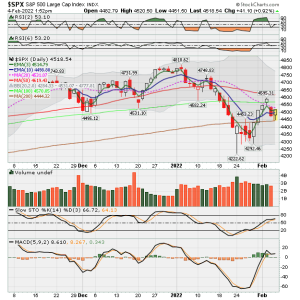

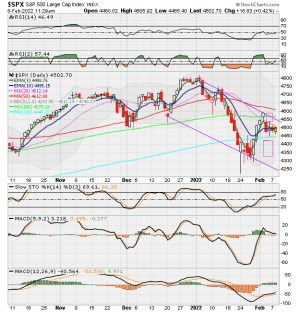

Some compression within the charts. Those BB's look to be coming together a bit more. Perhaps a big move is coming?? I think it very well could be. Of course which direction who knows. To me this move today isn't big, so far but perhaps a start. Maybe get people moving in one direction and then the markets decide ok enough jumped in so the big moves will be to the downside OR today or tomorrow will be the push above those resistance areas in some of the charts and it continues for a few days/week maybe two. VIX still above 20 so anything can happen. Perhaps it moves back down to the 15/16 areas.

I agree that if the markets can hold onto the days gains perhaps some momentum to the upside is in store for a few days. The daily reversals happen which is yet again why I have just sat on the sidelines so far this year. A few wild swings make me gun shy. But the more I just sit here in G and not make anything makes me itching to catch something. Just hoping for a break again, my preference would be for us to test those lows and then get in for that slingshot move back up. But I'm sure others are eyeing that up as well.

Best wishes to those who have some skin in the game over in the C and S funds. Always cheering for you even when I'm not in it. No moves for me yet but I'm nervously watching more closely this week. I do think a big move is coming.