Good morning, Wow... yesterday's down day was a bit surprising and then not. I wondered when European issues would again rock us on this side of the pond. I really thought we would break out soon to the upside since we had started to exceed prior month highs (except for Jan). So not sure if we must hit reset or not.

Oh .. on to another topic. Someone had observed that many folks are not posting any longer. We have lost some folks that were big in posting over the last few years and that is regrettable. But there are still many here to could possibly start posting more regularly and I hope they an be encouraged to do so. I would hope so. I used to post lot but quite honestly with how I am doing this year, I don't want to say a lot so as to not lead someone down a rabbit hole with me.

But you know how sometimes your Phone does not receive messages because you need to maybe restart it (since it is basically a little computer), and then once you reset you get a flood of messages. Well... I am kinda in that boat. Resetting my strategy and hoping to get back in sync. Yesterday read one good article in the afternoon and then two late last night plus two this morning. So getting back in the swing of things.... plus feeling better since I properly times and exited at the top of this last upward move...courtesy of some new Grok Trade information.

What I have loved lately is the GrokTrading videos that Nnutt posts (Thank you so much!!!). I especially like D7 and the weekend analysis he does. I have been trying to figure how he draws his line and after a month or so, I think I am starting to figure out some of how he does that.... though he does mention that he only shows one set of lines... nonetheless helpful. He provides training on the trading the market (mentoring). I am thinking it is probably very costly but what I have been learning from just watching every video and it is pretty good.

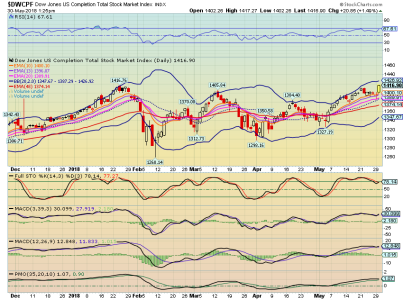

He seems to concentrate the most on support resistance lines of all types, plus some candle reading as well as looking at MACD and volume. He also posts his buy and sell signals so it can clue you in to his view of indexes (SPX, Dow, Russell). He uses the Spyder indexes for his charts and I love his charting software. I like that he can move lines so easily. He uses monthly, weekly and daily charts. This is different from my last strategy since mine was primarily EMAs, Bollinger bands, MACD and Slow Sto. Sol I am hoping that with a different type strategy, my moves could improve.... crossing fingers.

Also, with regard to charting software, I had been thinking to move away from Stockcharts because I have such a hard time drawing lines, and keeping them. Maybe I just haven t yet figured out how to use the drawing tools but Im pretty good with computers and software so I am not sure about this. Seems difficult and I want something easy. So might look at what Grok uses for his charting. He has referred to it once and I think he names it on his site.

Ok.. so I have been a bit chatty today. I have done my damage for the day.

I hope you have a great day and Best Wishes on your Investing!!!!!!!!! :smile: