The headlines came not as a complete surprise, but the focal point of the news release was quite broad. I'm talking about the announcement Standard and Poor's released that put fifteen (yes, 15) EU nations on negative credit watch. I've also heard reports that it's seventeen countries.

That headline took the market well off its highs of the day, but it managed to recoup much of its losses in the final minutes of trade. The question now is, will this news continue to affect tomorrow's action? And we can certainly expect more headlines to hit the market as the week progresses. As a side note, Wednesday is "Weird Wollie Wednesday", which can often see significant downside action or volatility, so we have that in the mix too.

We did have a bit more economic data earlier in the day. The ISM Services Index for November came in a bit lower than estimates at 52.0. Economists were looking for a number closer to 53.4. October factory orders dropped 0.4%, which was in-line with estimates. September orders were revised lower to show a 0.1% decline.

Here's today's charts:

NAMO and NYMO moved higher on today's action and both crossed over into positive territory too. Momentum remains to the upside and both signals retain their buy status.

NAHL and NYHL also remain on buys.

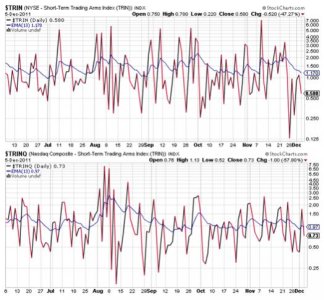

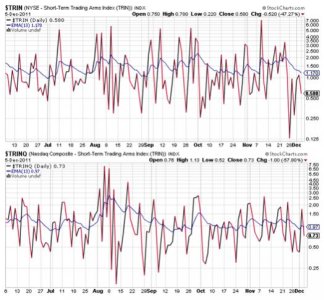

TRIN and TRINQ are both on buys as well.

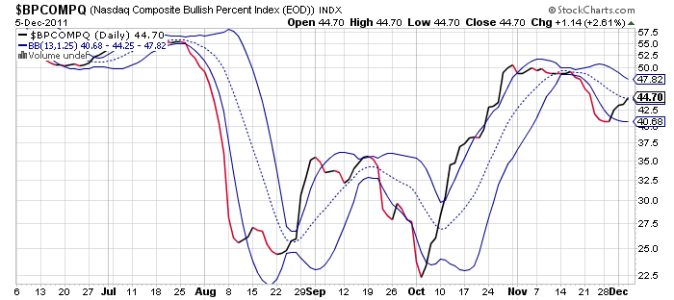

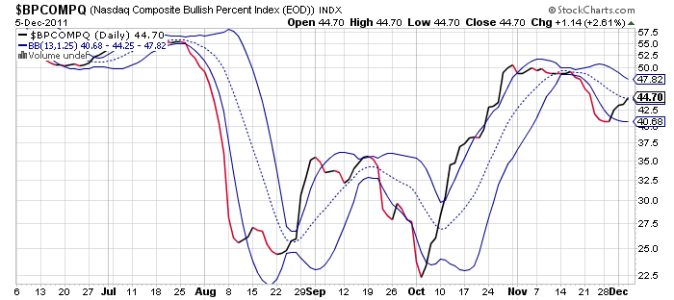

BPCOMPQ moved higher and is looking bullish. It too remains on a buy.

So all seven signals are on buys, which is the third "unconfirmed" buy signal since last week. But NYMO is still well away from a 28 day trading high, so a confirmed buy signal is not imminent. However, in the next three trading days the bar for a 28 day trading high will drop significantly, which would make it easier for the system to trigger an intermediate term buy signal. But for now the system remains in an intermediate term sell condition.

I'm thinking selling pressure will come before an official buy signal, although today's strength was just a bit unexpected. But this market does have a habit of moving further in a given direction than we often expect. And NAMO and NYMO do look bullish, so the downside may turn out to be limited as we move further into the holiday season.

But if that downside does come, I'll be looking to take a position in stocks. Three unconfirmed buy signals are usually bullish in the longer term (1 to 4 weeks).

That headline took the market well off its highs of the day, but it managed to recoup much of its losses in the final minutes of trade. The question now is, will this news continue to affect tomorrow's action? And we can certainly expect more headlines to hit the market as the week progresses. As a side note, Wednesday is "Weird Wollie Wednesday", which can often see significant downside action or volatility, so we have that in the mix too.

We did have a bit more economic data earlier in the day. The ISM Services Index for November came in a bit lower than estimates at 52.0. Economists were looking for a number closer to 53.4. October factory orders dropped 0.4%, which was in-line with estimates. September orders were revised lower to show a 0.1% decline.

Here's today's charts:

NAMO and NYMO moved higher on today's action and both crossed over into positive territory too. Momentum remains to the upside and both signals retain their buy status.

NAHL and NYHL also remain on buys.

TRIN and TRINQ are both on buys as well.

BPCOMPQ moved higher and is looking bullish. It too remains on a buy.

So all seven signals are on buys, which is the third "unconfirmed" buy signal since last week. But NYMO is still well away from a 28 day trading high, so a confirmed buy signal is not imminent. However, in the next three trading days the bar for a 28 day trading high will drop significantly, which would make it easier for the system to trigger an intermediate term buy signal. But for now the system remains in an intermediate term sell condition.

I'm thinking selling pressure will come before an official buy signal, although today's strength was just a bit unexpected. But this market does have a habit of moving further in a given direction than we often expect. And NAMO and NYMO do look bullish, so the downside may turn out to be limited as we move further into the holiday season.

But if that downside does come, I'll be looking to take a position in stocks. Three unconfirmed buy signals are usually bullish in the longer term (1 to 4 weeks).