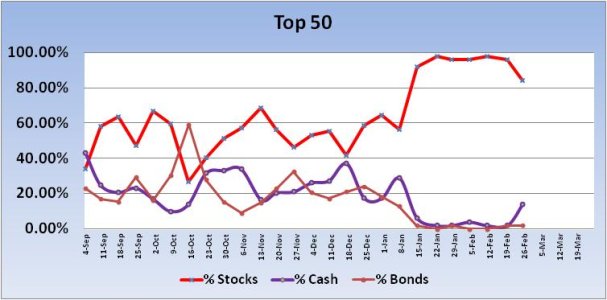

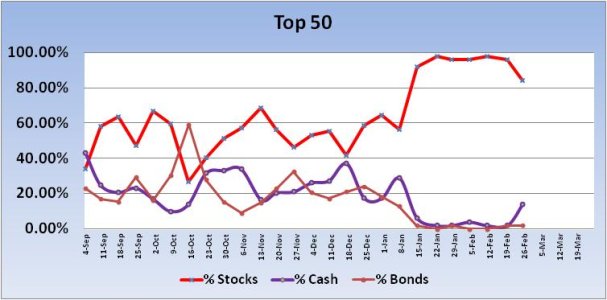

For six straight weeks the Top 50 has maintained a total stock allocation above 91% (and five of those weeks it was over 96%). This week, some of those TSPers are getting more defensive.

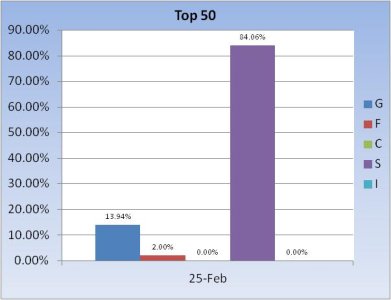

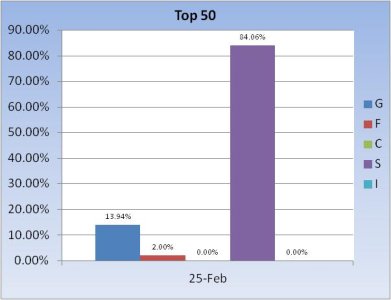

Total Stock allocations fell 11.94% for this group this week to a total stock allocation of 84.06%. Last year, a drop in the stock allocation of more than 10% usually resulted in higher prices the following week. In fact, the Top 50 was wrong 77% of the time last year when they got this defensive in a bull market. I'm thinking we've got at least some upside action next week and given March 1st is next Friday (when sequestration kicks in) we certainly could see a big move. If it's to the upside, we may be in for lower prices earlier in the week first. But I'm just speculating here. The main thing to keep in mind is that we have a catalyst next week that can have a big influence on the stock market regardless.

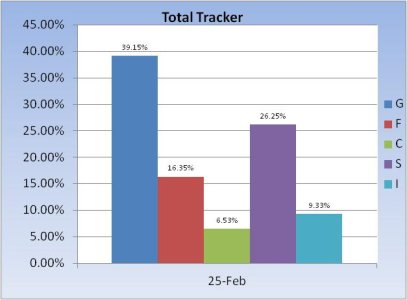

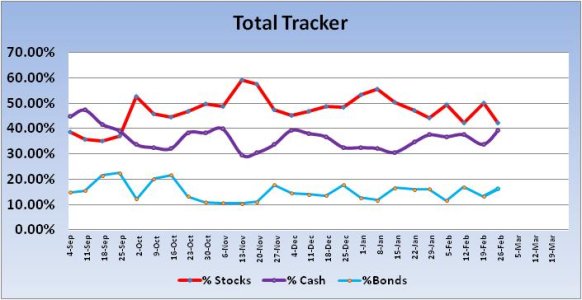

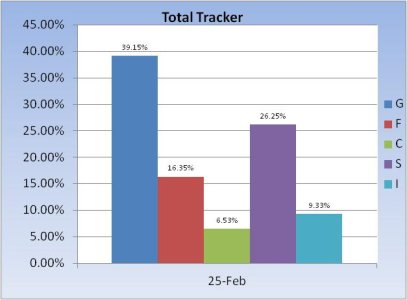

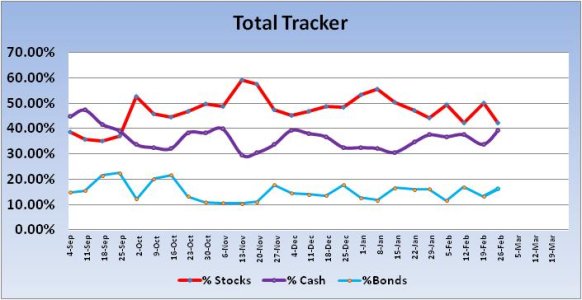

The Total Tracker saw stock allocations drop 7.83% to a total stock allocation of just 42.11% (again, in a bull market). That's fairly defensive.

The S&P 500 saw that shorter term trend line violated last week. The intermediate term trend line is further below. RSI fell last week, but still remains positive. MACD is struggling around the flat line, but has been biased lower.

Our sentiment survey was pretty bearish with 29% bulls vs 63% bears. I'd have to think we're looking higher this week with a reading like this. Not to mention the drop in stock allocations by the Top 50. My thought is that the big money may seek to reload earlier in the week before sending the market higher in the latter part of the week. But that's just a guess. Technically, this market is hurting and does appear poised to fall further. But that's obvious to most technicians. It may not be that easy. Volatility is picking up too and I think that may remain the case for a little while yet. It's a higher risk play, but I'm thinking the dips should be bought in the short term. But volatility will not make that easy for those of us in the TSP. Longer term, I'm looking lower.

Total Stock allocations fell 11.94% for this group this week to a total stock allocation of 84.06%. Last year, a drop in the stock allocation of more than 10% usually resulted in higher prices the following week. In fact, the Top 50 was wrong 77% of the time last year when they got this defensive in a bull market. I'm thinking we've got at least some upside action next week and given March 1st is next Friday (when sequestration kicks in) we certainly could see a big move. If it's to the upside, we may be in for lower prices earlier in the week first. But I'm just speculating here. The main thing to keep in mind is that we have a catalyst next week that can have a big influence on the stock market regardless.

The Total Tracker saw stock allocations drop 7.83% to a total stock allocation of just 42.11% (again, in a bull market). That's fairly defensive.

The S&P 500 saw that shorter term trend line violated last week. The intermediate term trend line is further below. RSI fell last week, but still remains positive. MACD is struggling around the flat line, but has been biased lower.

Our sentiment survey was pretty bearish with 29% bulls vs 63% bears. I'd have to think we're looking higher this week with a reading like this. Not to mention the drop in stock allocations by the Top 50. My thought is that the big money may seek to reload earlier in the week before sending the market higher in the latter part of the week. But that's just a guess. Technically, this market is hurting and does appear poised to fall further. But that's obvious to most technicians. It may not be that easy. Volatility is picking up too and I think that may remain the case for a little while yet. It's a higher risk play, but I'm thinking the dips should be bought in the short term. But volatility will not make that easy for those of us in the TSP. Longer term, I'm looking lower.