Same story, different result. After weathering two days of dollar strength with little technical damage done to the major averages, the dollar staged yet another rally to make it 3 days straight. But this time the results were different. Instead of modest gains or sideways chop, we got a sell-off on decent volume. I had mentioned yesterday how much dollar strength this market would endure before seeing any serious selling pressure, and I got my answer pretty quick. The dollar tacked on another 0.9% gain, which adds up to a 2.8% advance over the past three trading sessions. This after tagging an 11 month low late last week.

And treasuries didn't benefit from the selling either as they saw some stiff selling pressure as well. The Barclays Aggregate Bond fund, which our F fund roughly tracks, posted close to a 0.5% loss. Inflation fears may be driving this action in the bond market, but it's too early to tell if this selling pressure is more than short term action.

Yes, the market likes to throw curve balls and right now dollar strength after a QE2 announcement was not expected. And this action is leading up to what may be a very interesting G20 meeting later this week. But is this a temporary condition, or simply an opportunity to reset the market before driving equity prices higher?

Here's the charts:

NAMO and NYMO are both flashing sells and are also back in negative territory.

NAHL and NYHL are also in sell territory.

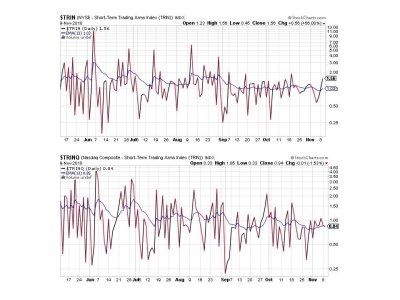

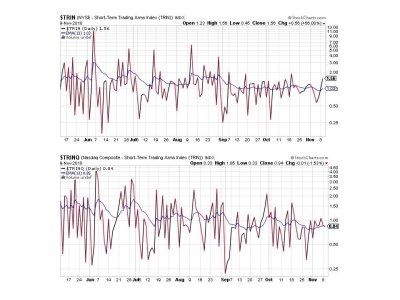

TRIN flipped to a sell today, but TRINQ continued its sideways chop settled on its 13 day EMA. I'd consider that a weak sell.

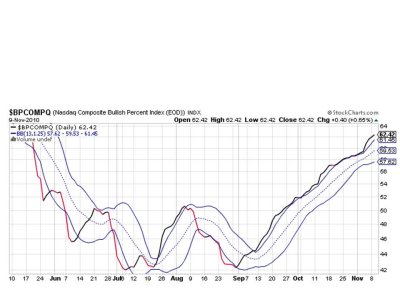

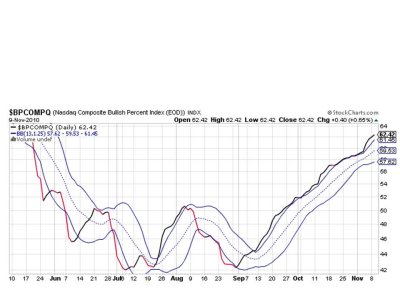

As expected, BPCOMPQ remains on a buy and actually ebbed a bit higher. It remains on a buy.

So we are down to only 1 of 7 signals in a buy condition, but that still keeps the system on a buy as all 7 signals need to be in agreement to flip the system to sell.

The real selling pressure didn't occur until well after our deadline today, so I didn't even consider buying into the market before our noon deadline. I probably wouldn't have pulled the trigger just yet anyway as sentiment has become markedly more bullish in the past couple of days. But that can change quick, so for the moment I see this selling pressure as a potential buying opportunity. But picking an entry point is not going to be an easy decision, because the potential for a Seven Sentinels sell signal may occur depending on how serious any additional selling pressure is. Right now BPCOMPQ is fairly bullish and damage to technicals is light, so it's a wait and see game as we approach the G20 meeting.

And treasuries didn't benefit from the selling either as they saw some stiff selling pressure as well. The Barclays Aggregate Bond fund, which our F fund roughly tracks, posted close to a 0.5% loss. Inflation fears may be driving this action in the bond market, but it's too early to tell if this selling pressure is more than short term action.

Yes, the market likes to throw curve balls and right now dollar strength after a QE2 announcement was not expected. And this action is leading up to what may be a very interesting G20 meeting later this week. But is this a temporary condition, or simply an opportunity to reset the market before driving equity prices higher?

Here's the charts:

NAMO and NYMO are both flashing sells and are also back in negative territory.

NAHL and NYHL are also in sell territory.

TRIN flipped to a sell today, but TRINQ continued its sideways chop settled on its 13 day EMA. I'd consider that a weak sell.

As expected, BPCOMPQ remains on a buy and actually ebbed a bit higher. It remains on a buy.

So we are down to only 1 of 7 signals in a buy condition, but that still keeps the system on a buy as all 7 signals need to be in agreement to flip the system to sell.

The real selling pressure didn't occur until well after our deadline today, so I didn't even consider buying into the market before our noon deadline. I probably wouldn't have pulled the trigger just yet anyway as sentiment has become markedly more bullish in the past couple of days. But that can change quick, so for the moment I see this selling pressure as a potential buying opportunity. But picking an entry point is not going to be an easy decision, because the potential for a Seven Sentinels sell signal may occur depending on how serious any additional selling pressure is. Right now BPCOMPQ is fairly bullish and damage to technicals is light, so it's a wait and see game as we approach the G20 meeting.