At least for the short term.

It didn't take very long for the Goldman Sachs story to lose its ability to strike any fear in this market. Even as civil charges and International investigations are gaining momentum. And GS isn't the only entity under the microscope, but does the market seem to care? Not so far. But that's what fear is noted for in the market; pushing prices higher.

The DOW was the big winner yesterday, but today it was the broader market that tacked on impressive gains as stocks climbed for the eighth time in nine sessions, while the Volatility Index dropped by 9.3% to close just 3% above the multiyear low it hit just last week.

Yesterday I said the market could go either way although the Seven Sentinels were very close to rolling over to a sell condition with one more day of selling pressure. But we rallied instead, which balanced the signals for the time being. Here's today's charts:

NAMO and NYMO have flipped back to buys after today's rally, and are once again neutral.

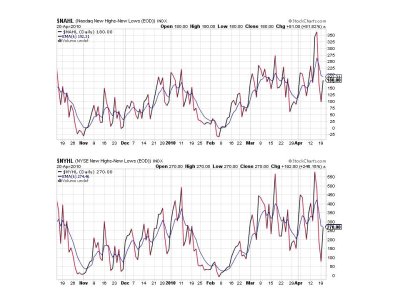

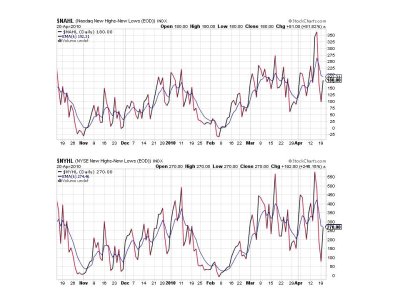

NAHL and NYHL improved their position markedly, but remain on sells.

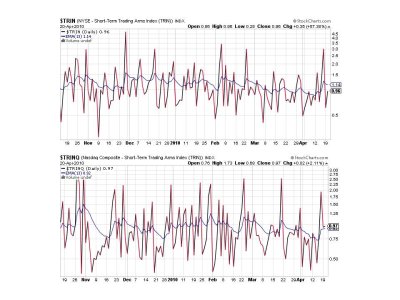

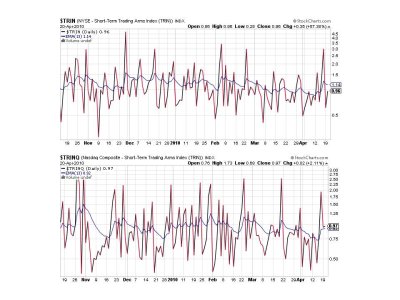

TRIN remained on a buy, while TRINQ remained on a sell.

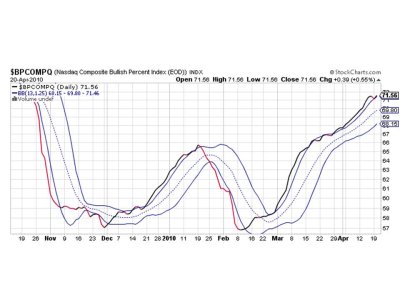

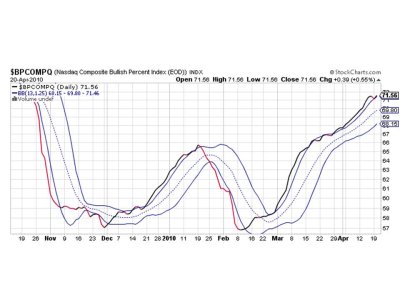

BPCOMPQ turned back up today and is once again riding the upper bollinger band higher.

So we now have 4 of 7 signals on a buy, which pushes us away from a potential sell signal for now. With NAMO and NYMO neutral, BPCOMPQ turning back up and this bull market showing its resilience yet again, I'd have to say the odds favor higher prices from here. There are bearish signs out there, but they have not been able to counter the bullish drive of this market, which has rewarded dip buyers once again.

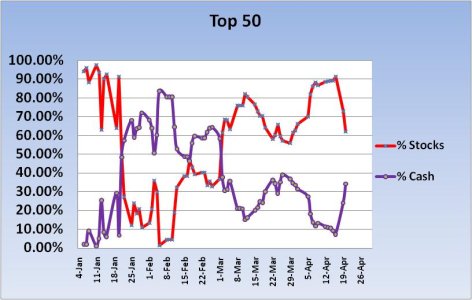

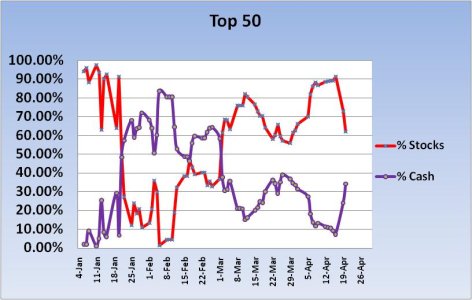

One item of note is that our Top 50 took more chips off the table for Monday's trading.

That's it for today. See you tomorrow.

It didn't take very long for the Goldman Sachs story to lose its ability to strike any fear in this market. Even as civil charges and International investigations are gaining momentum. And GS isn't the only entity under the microscope, but does the market seem to care? Not so far. But that's what fear is noted for in the market; pushing prices higher.

The DOW was the big winner yesterday, but today it was the broader market that tacked on impressive gains as stocks climbed for the eighth time in nine sessions, while the Volatility Index dropped by 9.3% to close just 3% above the multiyear low it hit just last week.

Yesterday I said the market could go either way although the Seven Sentinels were very close to rolling over to a sell condition with one more day of selling pressure. But we rallied instead, which balanced the signals for the time being. Here's today's charts:

NAMO and NYMO have flipped back to buys after today's rally, and are once again neutral.

NAHL and NYHL improved their position markedly, but remain on sells.

TRIN remained on a buy, while TRINQ remained on a sell.

BPCOMPQ turned back up today and is once again riding the upper bollinger band higher.

So we now have 4 of 7 signals on a buy, which pushes us away from a potential sell signal for now. With NAMO and NYMO neutral, BPCOMPQ turning back up and this bull market showing its resilience yet again, I'd have to say the odds favor higher prices from here. There are bearish signs out there, but they have not been able to counter the bullish drive of this market, which has rewarded dip buyers once again.

One item of note is that our Top 50 took more chips off the table for Monday's trading.

That's it for today. See you tomorrow.