It's been a "buy the dip" market for some time now, and this past week was no exception. Friday's market activity saw significant buying interest in the last half hour of trading, which cut the broader market's overall intra-day losses by half. Mondays have been largely positive for months, so that almost certainly played a role in that end-of-day rally too.

But no one really knows how long that formula is going to work. We've seen a lot of volatility of late, which shows there's selling interest out there, but the dip buyers and QE2 could prevent this market from falling too far. Having said that, we are all aware of the geopolitical events playing out overseas, and those events carry the potential to change the game.

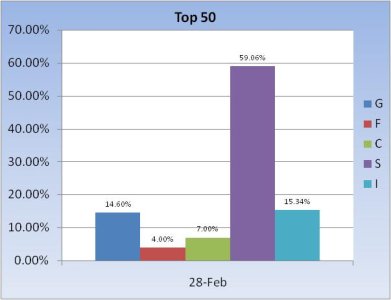

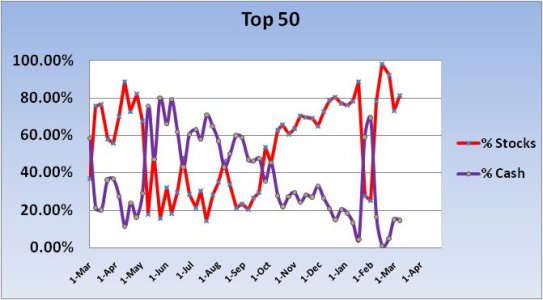

A review of our collective position going into next week's trading shows we did some of our own dip buying this past week. Here's the charts:

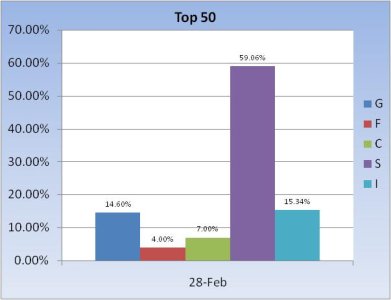

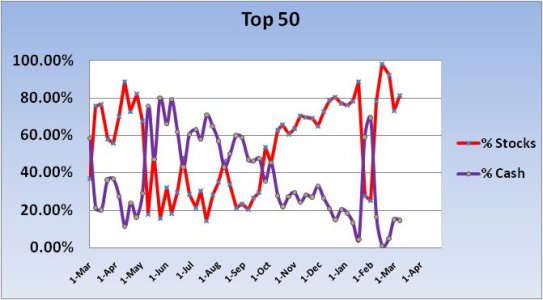

The Top 50 didn't change dramatically, but we can see their stock position did bump higher.

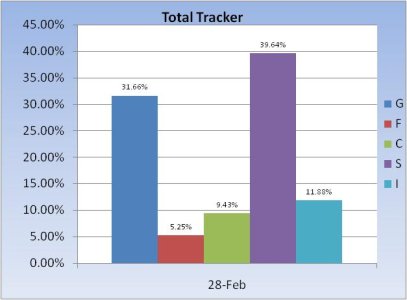

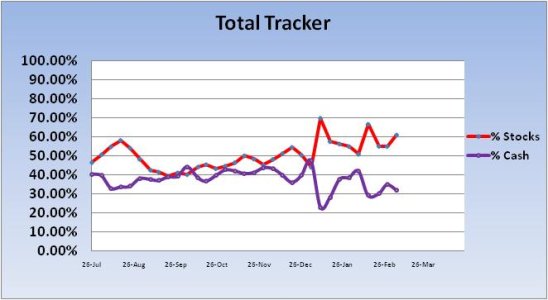

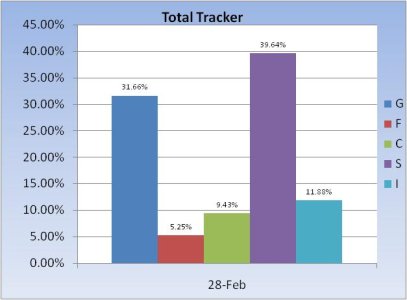

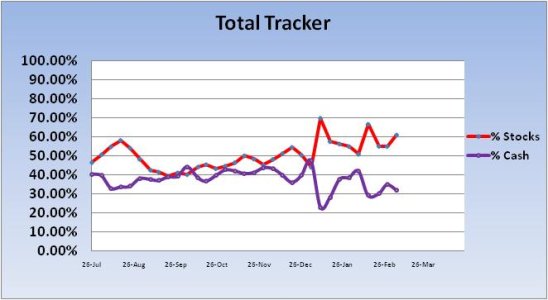

The same is true for the Total Tracker charts. Stock allocations rose, while cash levels dipped.

The Seven Sentinels have been on a buy since 17 Feb, although the market is down overall during that time. Our sentiment survey continues to hold 100% S fund going into the new trading week, although we did have the highest bullish percentage (55%) since the last week of December. But that's been a winning formula too. Hey, it works until it doesn't, right?

But no one really knows how long that formula is going to work. We've seen a lot of volatility of late, which shows there's selling interest out there, but the dip buyers and QE2 could prevent this market from falling too far. Having said that, we are all aware of the geopolitical events playing out overseas, and those events carry the potential to change the game.

A review of our collective position going into next week's trading shows we did some of our own dip buying this past week. Here's the charts:

The Top 50 didn't change dramatically, but we can see their stock position did bump higher.

The same is true for the Total Tracker charts. Stock allocations rose, while cash levels dipped.

The Seven Sentinels have been on a buy since 17 Feb, although the market is down overall during that time. Our sentiment survey continues to hold 100% S fund going into the new trading week, although we did have the highest bullish percentage (55%) since the last week of December. But that's been a winning formula too. Hey, it works until it doesn't, right?