It was another early morning sell-off and just like the last two days stocks staged a comeback to trade around the flat line for a good portion of the trading day. But some last minute selling pressure pushed some of those averages into the red at the close. Still, the Nasdaq close positive so the bulls would appear to have won the battle again as losses were modest in the DOW and S&P 500.

Prior to the open, the December payrolls report was released and it showed that the unemployment rate fell to 8.5% from 8.6% in November. It had been expected to rise to 8.7%, so it was a bit of a surprise to see it edge lower. Nonfarm payrolls were up 200,000, which easily beat estimates calling for 150,000. Private payrolls rose by 212,000, which also beat estimates. Economists were anticipating something closer to 170,000.

Here's today's charts:

Not much happening here. NAMO remains on a buy, while NYMO barely flipped to a sell. Momentum has really tapered off the past three sessions.

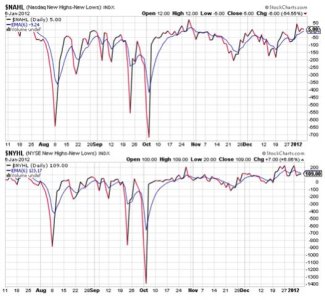

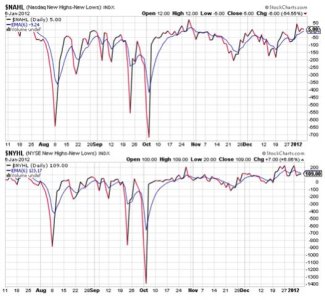

NAHL and NYHL remained on a buy and sell respectively.

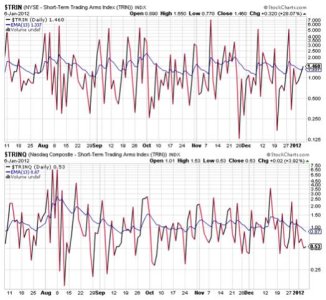

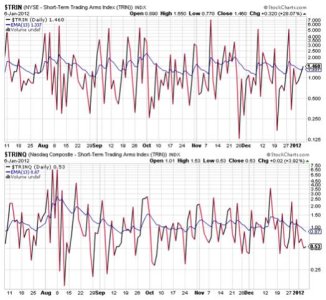

TRIN flipped to a sell today, but TRINQ remained firmly on a buy.

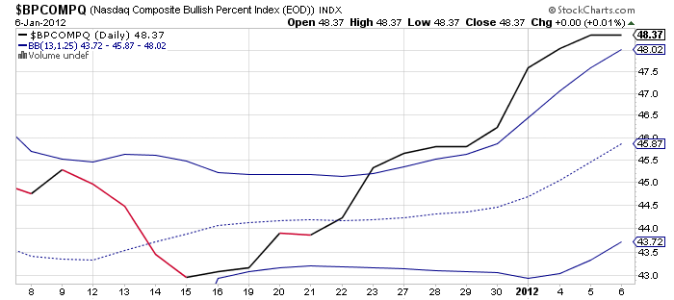

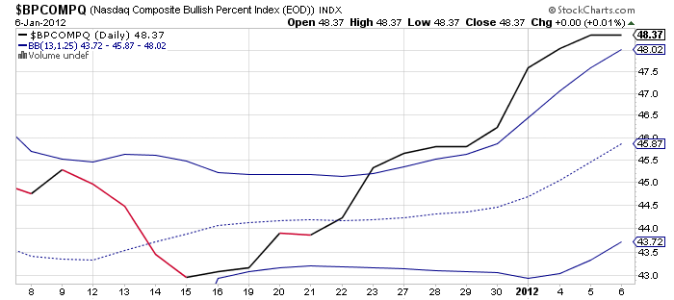

BPCOMPQ tracked sideways and remains in a buy condition. It may be poised to head lower as it has lost its upside momentum.

So the signals are mixed, but the Seven Sentinels remain in a buy condition nonetheless.

My perspective has not changed. I'm still looking lower, but when weakness has presented itself, the bulls have largely stepped back in. It is possible that the downside is very limited right now, but I'm not ready to embrace that notion by taking a position in stocks, so I remain 100% G fund.

Stop by Sunday evening when I'll have the tracker charts posted. See you then.

Prior to the open, the December payrolls report was released and it showed that the unemployment rate fell to 8.5% from 8.6% in November. It had been expected to rise to 8.7%, so it was a bit of a surprise to see it edge lower. Nonfarm payrolls were up 200,000, which easily beat estimates calling for 150,000. Private payrolls rose by 212,000, which also beat estimates. Economists were anticipating something closer to 170,000.

Here's today's charts:

Not much happening here. NAMO remains on a buy, while NYMO barely flipped to a sell. Momentum has really tapered off the past three sessions.

NAHL and NYHL remained on a buy and sell respectively.

TRIN flipped to a sell today, but TRINQ remained firmly on a buy.

BPCOMPQ tracked sideways and remains in a buy condition. It may be poised to head lower as it has lost its upside momentum.

So the signals are mixed, but the Seven Sentinels remain in a buy condition nonetheless.

My perspective has not changed. I'm still looking lower, but when weakness has presented itself, the bulls have largely stepped back in. It is possible that the downside is very limited right now, but I'm not ready to embrace that notion by taking a position in stocks, so I remain 100% G fund.

Stop by Sunday evening when I'll have the tracker charts posted. See you then.