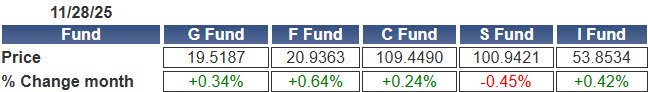

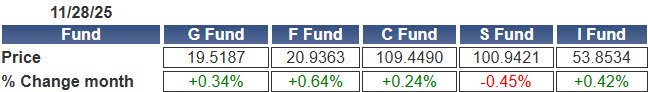

Cash equipped TSP investors turned November’s mediocre returns into big gains. If you didn’t make any moves in November, the best return available came from the F-fund’s 0.6% return. Meanwhile, the Top 5 November performers added gains from 4.6% to 6.4% in November. Their common theme: Tactical patience.

Nine IFTs were used between November’s Top Five Performing Members of the AutoTracker. Eight of the nine came on November 19th or later. Although not identical, their IFT timing can offer a lesson in TSP investing.

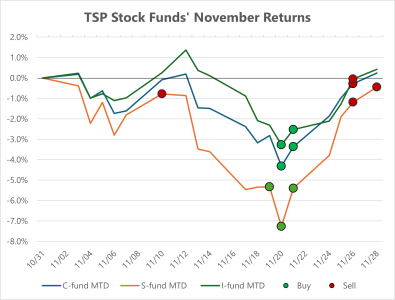

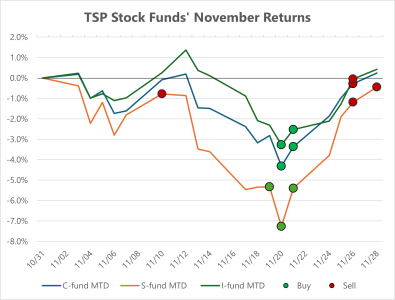

The graph below shows the monthly returns of the C, S, and I-funds through November. The green and red dots mark where members of the Top 5 bought into stock funds (green) or sold out of them (red).

Four of the five began the month with 100% G-fund. talking2jets, the lone exception, started fully invested in the S-fund but moved to the G-fund after an early November bounce off the lows. That shift set them up for success.

All of the buying among the Top 5 came in the three days surrounding the month’s lows, which hit on November 20th. Buyers that day included Top performer talking2jets, who returned to a 100% S-fund allocation.

The remaining four members of the Top 5 all moved out of the G-fund and into 100% stock allocations. This group included three of the Top 4 performers of 2025: MrBowl (2), ColonelFur (3), and Sign_Stealer (4).

Another pattern stood out. Three of the five—talking2jets, MeasureMaster, and ColonelFur—moved back to the G-fund in the final days of the month, locking in their fresh gains and waiting for their next buying opportunity. MrBowl and Sign_Stealer remained fully invested heading into December.

The five members highlighted here didn’t follow identical paths, but they shared something worth noting. Each of them treated cash (the G-fund) as both a shield and a springboard. In their approach, they focused on protecting their balances during stretches of market noise, yet are willing to put that cash to work in stocks when opportunity appears. This month the sharp slide around November 19th through 21st was that moment. All five recognized it, and their returns reflect a willingness to act when the risk-to-reward finally shifted in their favor.

Catch IFTs like these on the day they happen. The Last Look Report gives you a clear lens into the moves and trends developing inside the TSP Talk AutoTracker, a community of TSP investors just like you.

Get Five Free Reports Here

Create Free AutoTracker Account

Nine IFTs were used between November’s Top Five Performing Members of the AutoTracker. Eight of the nine came on November 19th or later. Although not identical, their IFT timing can offer a lesson in TSP investing.

The graph below shows the monthly returns of the C, S, and I-funds through November. The green and red dots mark where members of the Top 5 bought into stock funds (green) or sold out of them (red).

Four of the five began the month with 100% G-fund. talking2jets, the lone exception, started fully invested in the S-fund but moved to the G-fund after an early November bounce off the lows. That shift set them up for success.

All of the buying among the Top 5 came in the three days surrounding the month’s lows, which hit on November 20th. Buyers that day included Top performer talking2jets, who returned to a 100% S-fund allocation.

The remaining four members of the Top 5 all moved out of the G-fund and into 100% stock allocations. This group included three of the Top 4 performers of 2025: MrBowl (2), ColonelFur (3), and Sign_Stealer (4).

Another pattern stood out. Three of the five—talking2jets, MeasureMaster, and ColonelFur—moved back to the G-fund in the final days of the month, locking in their fresh gains and waiting for their next buying opportunity. MrBowl and Sign_Stealer remained fully invested heading into December.

The five members highlighted here didn’t follow identical paths, but they shared something worth noting. Each of them treated cash (the G-fund) as both a shield and a springboard. In their approach, they focused on protecting their balances during stretches of market noise, yet are willing to put that cash to work in stocks when opportunity appears. This month the sharp slide around November 19th through 21st was that moment. All five recognized it, and their returns reflect a willingness to act when the risk-to-reward finally shifted in their favor.

Catch IFTs like these on the day they happen. The Last Look Report gives you a clear lens into the moves and trends developing inside the TSP Talk AutoTracker, a community of TSP investors just like you.

Get Five Free Reports Here

Create Free AutoTracker Account