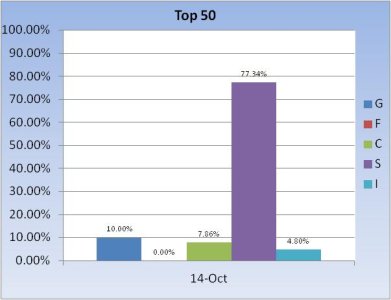

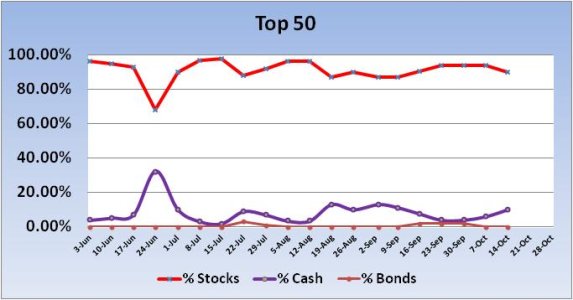

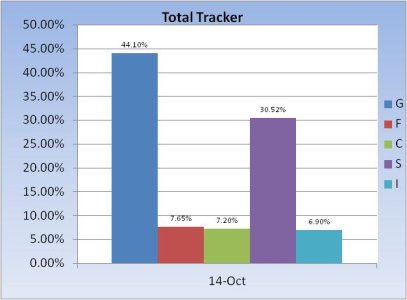

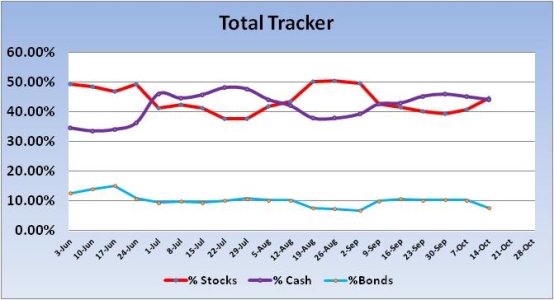

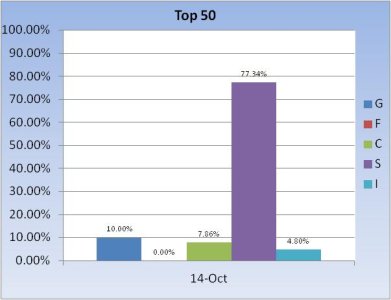

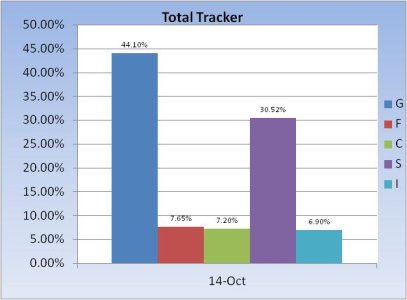

No signal was generated from either the Top 50 or the Total Tracker (Auto-Tracker) for the coming trading week. Last week, our sentiment survey was very bearish with 29% bulls and 66% bears . I showed you some statistical data on bearish levels being over 60% and that data was quite positive for the market. And that’s largely how the market played out as the C fund posted a 0.81% gain and the I fund was up 0.64%. The S fund, which I typically track with this data, was down very marginally with a 0.04% loss. All things being equal, I think it was a good signal. This week, stock allocations rose across the auto-tracker to 44.62%, which remains a conservative allocation and bullish in the longer term. I am a bit wary of the dip buying given the debt ceiling deadline coming next week. I’m not bullish or bearish, just wary.

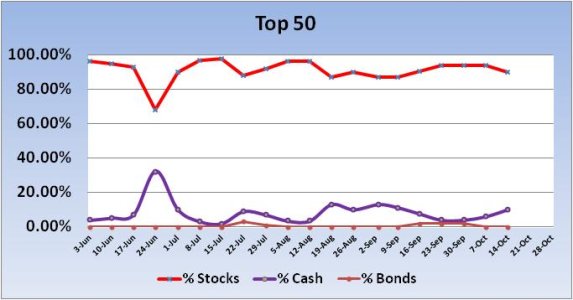

You can see the modest decline in stock allocations from last week. Last Wednesday, total stock allocations were down 20%, but once the rally got started on Thursday allocations spiked higher. By Friday, total stock allocations dipped just 4%. We aren't buying the dip nearly as fast as spikes in price, which have typically been coupled with higher bearish sentiment readings when they occur.

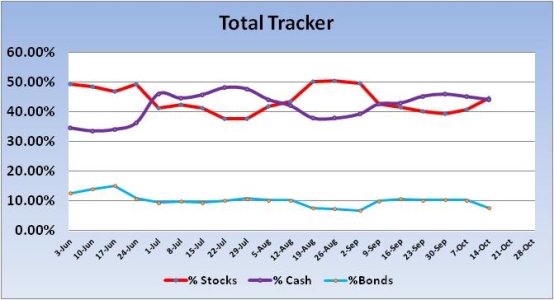

On the chart of the Total Tracker, you can see the gradual dip buying that started about two weeks ago. Total stock allocations are now at 44.62%, which is still conservative and bullish for the longer term.

I had said I expected the 1660 area might find support and aside from the intraday low under 1650 on Wednesday, it proved to be a reasonable target area for a reversal. It’s not as though we could have bought the bottom with TSP, so I'm pretty flexible with target numbers. The S&P 500 ended the week higher than the Wilshire 4500 this week. Price entered the cloud briefly, but shot higher Thursday on rumors that a deal might be made over the debt ceiling (among other things). Technically, the chart looks okay, but news driven moves are suspect. RSI and MACD both moved into positive territory and are pointing higher at the moment.

There is a chance that the current rally turns out to be a sell-the-news event. And that news could range from an agreement prior to the debt ceiling deadline to continued Government paralysis. It's anyone's guess how the market plays out as we move towards Thursday's deadline and beyond, although I'm anticipating more upside for the early part of the week. After that, I'm neutral. Our sentiment survey is bullish for next week, but that's not a lock for higher prices on the indexes by Friday.

To see this week's full analysis, follow this link http://www.tsptalk.com/members/

You can see the modest decline in stock allocations from last week. Last Wednesday, total stock allocations were down 20%, but once the rally got started on Thursday allocations spiked higher. By Friday, total stock allocations dipped just 4%. We aren't buying the dip nearly as fast as spikes in price, which have typically been coupled with higher bearish sentiment readings when they occur.

On the chart of the Total Tracker, you can see the gradual dip buying that started about two weeks ago. Total stock allocations are now at 44.62%, which is still conservative and bullish for the longer term.

I had said I expected the 1660 area might find support and aside from the intraday low under 1650 on Wednesday, it proved to be a reasonable target area for a reversal. It’s not as though we could have bought the bottom with TSP, so I'm pretty flexible with target numbers. The S&P 500 ended the week higher than the Wilshire 4500 this week. Price entered the cloud briefly, but shot higher Thursday on rumors that a deal might be made over the debt ceiling (among other things). Technically, the chart looks okay, but news driven moves are suspect. RSI and MACD both moved into positive territory and are pointing higher at the moment.

There is a chance that the current rally turns out to be a sell-the-news event. And that news could range from an agreement prior to the debt ceiling deadline to continued Government paralysis. It's anyone's guess how the market plays out as we move towards Thursday's deadline and beyond, although I'm anticipating more upside for the early part of the week. After that, I'm neutral. Our sentiment survey is bullish for next week, but that's not a lock for higher prices on the indexes by Friday.

To see this week's full analysis, follow this link http://www.tsptalk.com/members/