The Seven Sentinels were already on a buy, but Friday's action triggered another buy signal.

There wasn't a lot of news to speak of and volume was on the light side the entire day. It may have been a holiday shortened week, but the major averages managed to tack on their best weekly gain so far this year.

Here's the charts:

NAMO and NYMO are looking much more bullish.

NAHL and NYHL are slowing rising again.

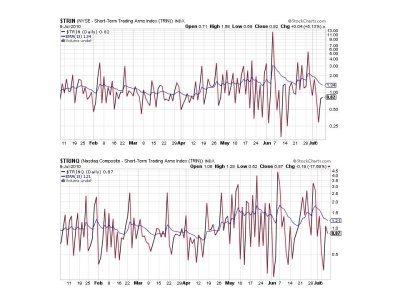

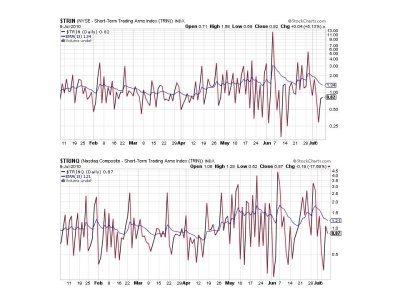

TRIN and TRINQ have held their buy status for 5 straight trading days now.

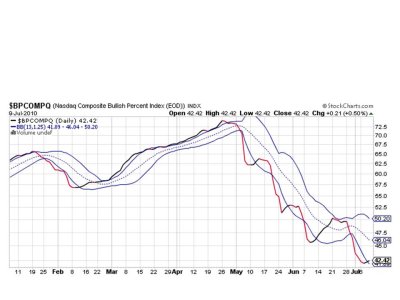

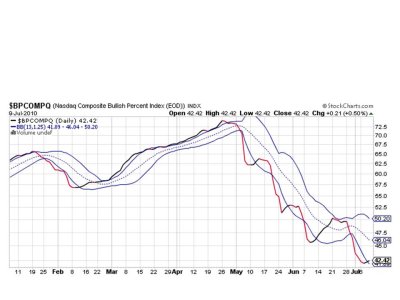

BPCOMPQ needed just a bit more buying pressure to trigger a buy signal and Friday provided just that.

So that makes 7 of 7 signals flashing buys. While the system was already on a buy, I think this buy signal is meaningful and I'm optimistic (that doesn't mean I'm certain) that we've seen the low for now. Sentiment will have to be watched carefully and of course earnings season kicks off in earnest this coming week.

So it should be interesting to see how the market reacts to earnings. I suspect they'll look good overall, but it's what the market thinks that matters.

I'll be posting the Tracker charts tomorrow. See you then.

There wasn't a lot of news to speak of and volume was on the light side the entire day. It may have been a holiday shortened week, but the major averages managed to tack on their best weekly gain so far this year.

Here's the charts:

NAMO and NYMO are looking much more bullish.

NAHL and NYHL are slowing rising again.

TRIN and TRINQ have held their buy status for 5 straight trading days now.

BPCOMPQ needed just a bit more buying pressure to trigger a buy signal and Friday provided just that.

So that makes 7 of 7 signals flashing buys. While the system was already on a buy, I think this buy signal is meaningful and I'm optimistic (that doesn't mean I'm certain) that we've seen the low for now. Sentiment will have to be watched carefully and of course earnings season kicks off in earnest this coming week.

So it should be interesting to see how the market reacts to earnings. I suspect they'll look good overall, but it's what the market thinks that matters.

I'll be posting the Tracker charts tomorrow. See you then.