The Nasdaq led the major averages today, with a gain of 0.66% in choppy trade. The S&P 500 squeaked out a 0.05% gain, while the DOW was off 0.15%.

The mute action was attributed to cautious traders who are awaiting the EFSF vote by Slovakia.

Other than that, it was a quiet, albeit choppy trading day.

Here's today's charts:

NAMO ebbed just a bit higher today, while NYMO dipped. Both remain on buys.

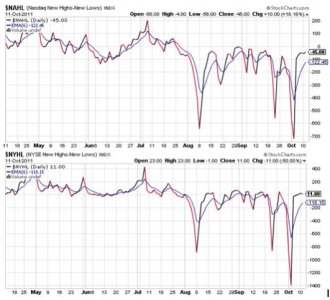

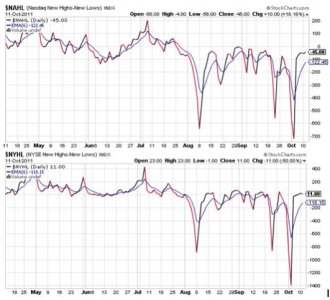

NAHL and NYHL continue to move in a very tight range, but do remain in buy conditions.

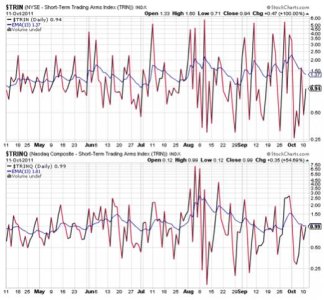

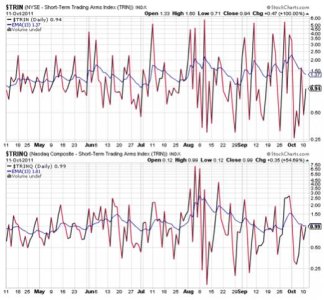

TRIN and TRINQ also remain on buys and are largely neutral after today's trading.

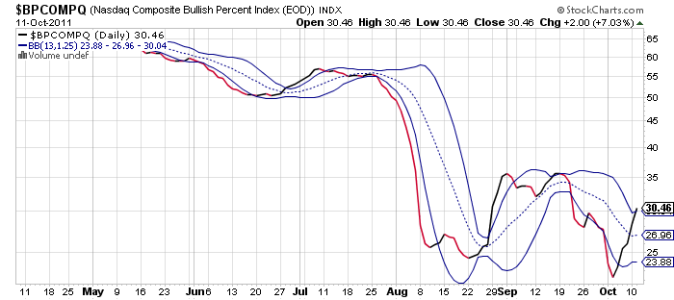

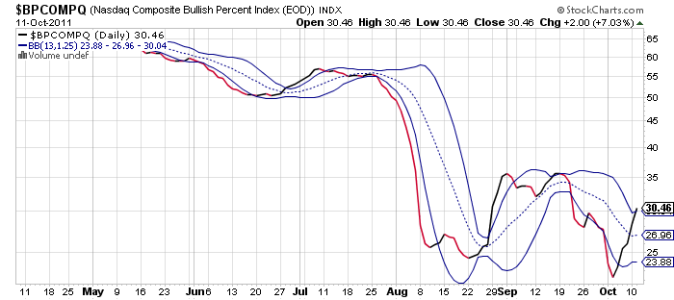

BPCOMPQ poked above that upper bollinger band and is also above 30, which means the market is no longer oversold in the intermediate term. The signal also remains on buy.

So all signals remain on buys, which is the third trading day in the past week that the system has flashed an unconfirmed buy signal. Officially though, the Seven Sentinels remain on a sell.

If this market moves higher tomorrow, there's a chance an official buy signal will be triggered. If that happens, I won't be following that signal. I believe there's a good chance we get some selling pressure soon, although the charts don't really suggest it aside from appearing mildly overbought. Given our sentiment survey is on a sell for this week, I can only assume we'll get some measure of selling pressure during the balance of this week. In any event, I continue to hold 100% F fund for now.

The mute action was attributed to cautious traders who are awaiting the EFSF vote by Slovakia.

Other than that, it was a quiet, albeit choppy trading day.

Here's today's charts:

NAMO ebbed just a bit higher today, while NYMO dipped. Both remain on buys.

NAHL and NYHL continue to move in a very tight range, but do remain in buy conditions.

TRIN and TRINQ also remain on buys and are largely neutral after today's trading.

BPCOMPQ poked above that upper bollinger band and is also above 30, which means the market is no longer oversold in the intermediate term. The signal also remains on buy.

So all signals remain on buys, which is the third trading day in the past week that the system has flashed an unconfirmed buy signal. Officially though, the Seven Sentinels remain on a sell.

If this market moves higher tomorrow, there's a chance an official buy signal will be triggered. If that happens, I won't be following that signal. I believe there's a good chance we get some selling pressure soon, although the charts don't really suggest it aside from appearing mildly overbought. Given our sentiment survey is on a sell for this week, I can only assume we'll get some measure of selling pressure during the balance of this week. In any event, I continue to hold 100% F fund for now.