Market futures were deep in the red in after-hours trading last night, although they moderated a good deal prior to the open. So it looked like the major averages were ready to continue their slide early on, but they only opened modestly lower and managed stay near the neutral line for most of the day. They did rise moderately later in the afternoon when the Fed minutes were released, but those gains slowly faded until the final half hour of trade when some more serious selling pressure hit the market and pushed the major averages moderately in the red where they closed near their lows of the day.

It may not have been ugly, but it couldn't have been an encouraging day for the bulls either.

Concerns about European debt woes are still lingering after yesterday's hard decline and Moody's kept that tone intact when they downgraded Ireland's debt today.

Earlier in the morning, Trade data for May showed that the U.S. trade deficit increased to $50.3 billion, which easily exceeded estimates of 44 billion.

So where's the good news? I'd like to think I'm not that biased, but it's not that easy to find silver linings these days.

Here's today's charts:

NAMO and NYMO both continued their respective slides with NYMO falling into negative territory today. They remain in sell conditions.

NAHL and NYHL moderated today, but still remain on sells.

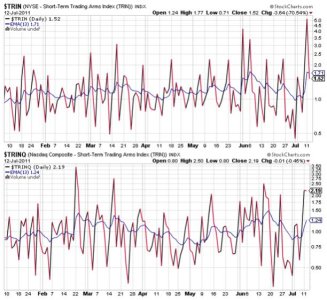

Today's action completely erased the oversold condition as measured by TRIN yesterday and flipped it to a buy condition. TRINQ remained oversold, but only moderately so. It remains on a sell.

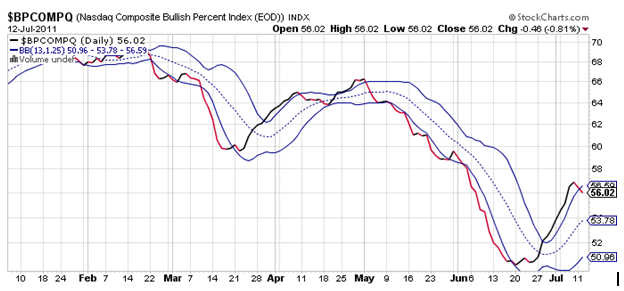

Now things get interesting again. BPCOMPQ fell below that upper bollinger band today, which flips it to a sell condition. This signal is perhaps the most significant of all the sentinels as it tends to do a decent job of discerning the intermediate term trend. But I'm not ready to embrace the idea that this market is ready to roll over completely.

So all but one signal are flashing sells, which still keeps the system in a buy condition.

While I'm of the opinion that the bottom is not in yet, I still think this market will reverse at some point and head back up before triggering another sell signal. But there's a lot at stake with the political theater we are seeing playing out over our debt ceiling. And that's just one issue of many, but I can't help but think it's one that can have significant negative consequences for the market if a compromise can't be reached fairly soon. I can certainly see where prices can be driven lower as this game of chicken continues and then out of the blue a compromise is reached whereby the market rallies for days afterward. It's just a scenario, but I think it's a very plausible one.

I don't like to speculate about fundamental issues, but our current weakness may be due to this particular uncertainty in spite of blame largely being placed on European problems as our media outlets would like us to believe. I just can't entirely buy into that logic. So take it for what's it worth, but I am also mindful of how conservative our overall tracker allocation is right now, and so far they've collectively been on the right side of the trade.