At least while the market's in decline anyway. And decline it did, ignoring good earnings reports again along with "seemingly" good data such as today's 4th QTR advance GDP release.

What it did focus on was, among other things, Standard & Poor's comment that said it no longer classifies the United Kingdom among the most stable and low-risk banking systems.

Now I hadn't seen it come across mainstream media (I probably missed it), but a couple days ago Standard & Poor’s also said that it may downgrade Japan’s sovereign credit ratings if the government fails to rein in its rising public debt and budget deficits.

And it case you missed this post in my account talk thread let me add this revelation from Germany:

http://www.telegraph.co.uk/finance/...s-Germany-warns-of-fatal-eurozone-crisis.html

Yes, the market feeds on fear. Yes, the fear is often overstated. But I'd be very careful about complacency here. Many central banks bought some time this past year and a half or so, but the underlying global financial instability is still with us.

I am not ringing alarm bells, but simply waving the caution flag. Especially while the Seven Sentinels remain in a sell condition. Here's today's charts:

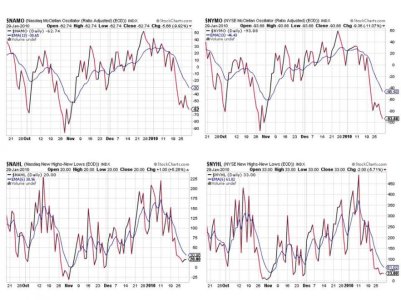

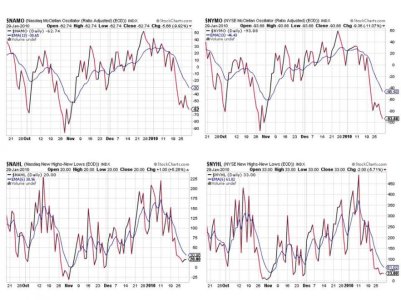

NAMO and NYMO stretched further into negative territory here, and are close to their October lows. For the moment, NAHL and NYHL have leveled off, but both remain on a sell.

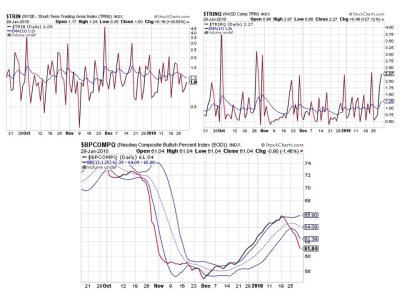

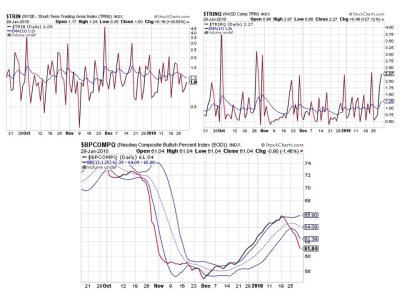

TRIN is still on a buy, but is close to rolling over to a sell while TRINQ continued its push into sell territory. BPCOMPQ is still moving lower and as I'd said last night appears to be signaling a change of trend.

So I remain in cash as the Seven Sentinels system remains in a sell condition. Come Monday we have two new IFTs to play with, but I am not feeling too froggy here as the Seven Sentinels look about as bearish as I've seen them in months. This is no longer 2009 and we have to be ready to acknowledge a potential change in market character. Risk is elevated. I'll post the Top 15 and Top 50 this weekend. See you then.

What it did focus on was, among other things, Standard & Poor's comment that said it no longer classifies the United Kingdom among the most stable and low-risk banking systems.

Now I hadn't seen it come across mainstream media (I probably missed it), but a couple days ago Standard & Poor’s also said that it may downgrade Japan’s sovereign credit ratings if the government fails to rein in its rising public debt and budget deficits.

And it case you missed this post in my account talk thread let me add this revelation from Germany:

http://www.telegraph.co.uk/finance/...s-Germany-warns-of-fatal-eurozone-crisis.html

Yes, the market feeds on fear. Yes, the fear is often overstated. But I'd be very careful about complacency here. Many central banks bought some time this past year and a half or so, but the underlying global financial instability is still with us.

I am not ringing alarm bells, but simply waving the caution flag. Especially while the Seven Sentinels remain in a sell condition. Here's today's charts:

NAMO and NYMO stretched further into negative territory here, and are close to their October lows. For the moment, NAHL and NYHL have leveled off, but both remain on a sell.

TRIN is still on a buy, but is close to rolling over to a sell while TRINQ continued its push into sell territory. BPCOMPQ is still moving lower and as I'd said last night appears to be signaling a change of trend.

So I remain in cash as the Seven Sentinels system remains in a sell condition. Come Monday we have two new IFTs to play with, but I am not feeling too froggy here as the Seven Sentinels look about as bearish as I've seen them in months. This is no longer 2009 and we have to be ready to acknowledge a potential change in market character. Risk is elevated. I'll post the Top 15 and Top 50 this weekend. See you then.