It always amuses me on the tracker whenever the "S-Herd" with its near 100 members, stampedes past me, or vice versa, on the Annual Tracker.

All the funds have some "Herds" where members just "park it, and forget it" for most of the year, or multiple years.

The C Fund "Herd" is only about half the size of the "S-Herd", just a little over 50 members as far as I can see, in the "C" since Jan 1st.

So the assumption by the larger group, is that the S-Fund is a better bet than the C, in the longer run....BUT is this true? Why do so many members feel the S is better than the C long term?

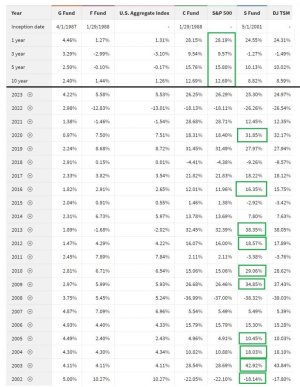

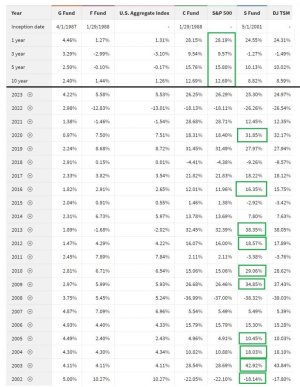

At a recent retirement seminar, the main speaker showed the avg returns of the past 1, 3, 5, 10 years and in ALL of them,

the C beats the pants off the S. So what gives?

A look over the past 22 years, since inception of the S-Fund, gives us a hint I've circled

in green, years the S fund beat the C.

In the first 4 years of the S-Fund inception it strongly outperformed the S&P, by as much as double the return. In the first 12 years, the S Fund outperformed the C 2/3 of the time.

But this trend seems to have ended 10 years ago...where from 2014-2023, the

C outperformed the S in 8 out of 10 years.

This doesn't include this year where the C is crushing the S fund 13.10% vs 2.42%!

What's the reason for this decadal switch?

Is it where Small Caps lead early in a Bull Market, then Large Cap takes over late in a Bull run?

Or have major global technological advances been confined more to larger companies, like NVIDIA, and the FANG stocks?

In any event, I've usually split my "In Stock Allocation" time between the C & S...including now, where I'm now itching to get rid of my S allocation, but don't want to waste an IFT for it this early in the month. But when I jump into G safety sometime soon,

my entrance back into stocks will primarily be in the C-fund.

The data doesn't lie...past returns from 10-20+ years ago have nothing to do with current expectations.