JTH

TSP Legend

- Reaction score

- 1,158

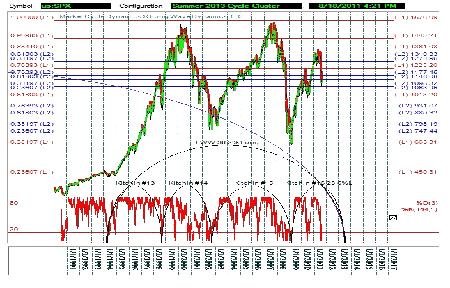

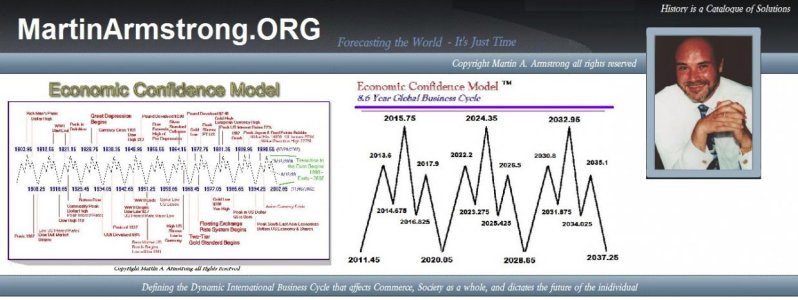

Well, looking at the two plots above, we get the following:

The Juglar and Kitchen cycles are predicting a down wave in the monthly stocks until May 2012; and Armstrong's wave count was off by a year for the secondary up wave in March 2008 (it really started in March 2009), but if it's just a registration error in the date, then his down wave will take us into May 2012.

There are too many similarities between the business cycle and the stock market for me to discount it right now. Back testing of the Biz_Cyc B&H method (100% F in bear markets and 100% I in bull markets as determined by the business cycle) shows a VERY good correlation with a 1200% return since Sept 1991. This compares to a B&H in stocks (40% C, 30% S, 30% I) of 400% since Sept 1991. Avoiding the Bear hits to your portfolio is the key to good long term returns. Amazingly, the LMBF method has returned 500% since Sept 1991 which is better than a straight B&H of stocks mainly because it does avoid losses in an extended bear market.

Time will tell. Still playing it cautious for now and if Armstrong's cycle proves to be off by a year, I will not be going into equities on June 2011, but will wait until June 2012.

I may try to trade, but every time I do, I lose, so maybe not.:notrust:

Thank you for this update, I did enjoy it and do appreciate the amount of back-testing you had to do.