A couple of blogs ago I talked about the fact that window dressing may be at play as we are at the end of the quarter and that liquidity is still pouring into this market. We've certainly seen enough upside in the past few trading days to make the case that stocks may have been front running those obvious facts. I figured the upside could be much higher than current levels, but I also expected some downside action in the midst of this rally. After the extreme readings on TRIN and TRINQ Thursday, I would have expected to see some selling Friday. But that didn't happen and now those two signals are largely neutral.

So we still have four trading days left in March, but can we expect this rally to run unimpeded?

Well, our sentiment survey for this week is neutral with bulls at 52% and bears at 34%. This implies at least some volatility this week.

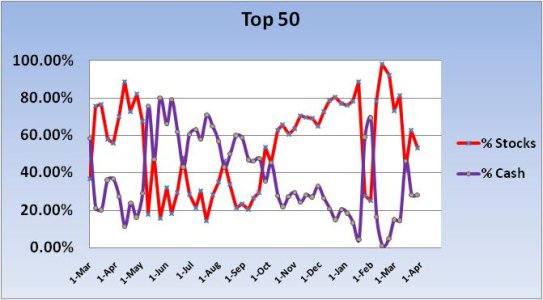

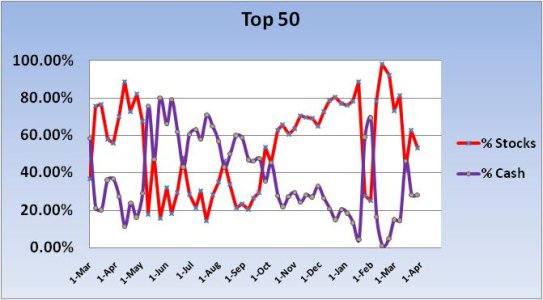

And given the percentage of bulls jumped from 39% to 52% one would think our allocations would follow this sentiment. But that wasn't the case as you'll see this in this weeks charts. Let's take a look:

The Top 50 reduced their overall stock exposure by more than 9%. Most of that money found its way into the F fund, which jumped from 9% to 18.50%. This is the same group that collectively dodged some significant selling pressure a couple weeks ago. For this reason, this shift supports the notion that we'll see some measure of weakness this week. But since it wasn't a huge change, I don't think it will be a significant event.

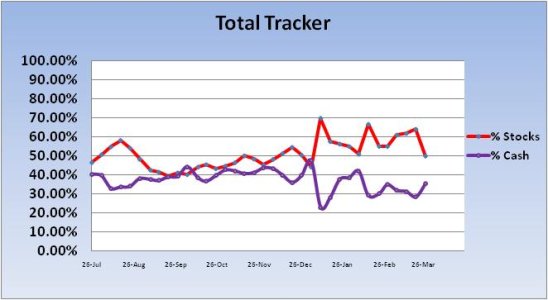

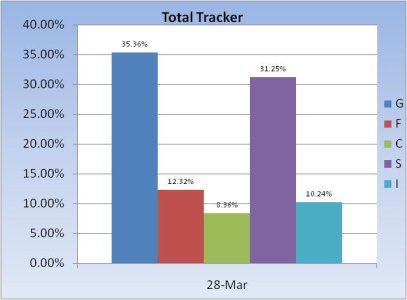

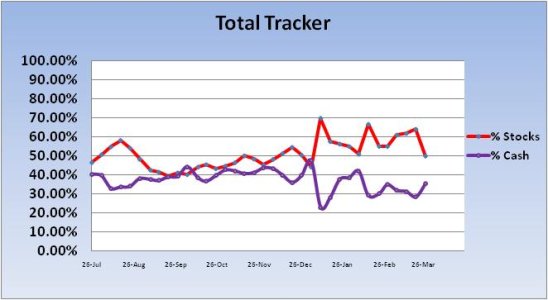

Just like the Top 50, the Total Tracker also shows that we have collectively reduced our stock exposure. But in this case it's by a larger margin (14%). That money found its way to both the G and F funds.

It could be that the reason we're more bullish this week, but have chosen to reduce stock exposure is because many of us may be out of IFTs this late in the month. Overall though, I see this as a sign that we are due for some volatility, but should remain on an upward tack.

Also, as a result of the significant upside we've seen recently, many trading systems are now flipping to buy conditions, while others are close to flipping. The Seven Sentinels have had three unconfirmed buy signals in as many days and I have to think that means higher prices down the road. But that doesn't mean we can't see some selling pressure along the way. In fact, I would bet on it. It's possible we sell off some before the end of this week in order to discourage recently minted bulls (this fits in nicely with what I've surmised on the Tracker charts), but after that I'd expect another leg higher.

So we still have four trading days left in March, but can we expect this rally to run unimpeded?

Well, our sentiment survey for this week is neutral with bulls at 52% and bears at 34%. This implies at least some volatility this week.

And given the percentage of bulls jumped from 39% to 52% one would think our allocations would follow this sentiment. But that wasn't the case as you'll see this in this weeks charts. Let's take a look:

The Top 50 reduced their overall stock exposure by more than 9%. Most of that money found its way into the F fund, which jumped from 9% to 18.50%. This is the same group that collectively dodged some significant selling pressure a couple weeks ago. For this reason, this shift supports the notion that we'll see some measure of weakness this week. But since it wasn't a huge change, I don't think it will be a significant event.

Just like the Top 50, the Total Tracker also shows that we have collectively reduced our stock exposure. But in this case it's by a larger margin (14%). That money found its way to both the G and F funds.

It could be that the reason we're more bullish this week, but have chosen to reduce stock exposure is because many of us may be out of IFTs this late in the month. Overall though, I see this as a sign that we are due for some volatility, but should remain on an upward tack.

Also, as a result of the significant upside we've seen recently, many trading systems are now flipping to buy conditions, while others are close to flipping. The Seven Sentinels have had three unconfirmed buy signals in as many days and I have to think that means higher prices down the road. But that doesn't mean we can't see some selling pressure along the way. In fact, I would bet on it. It's possible we sell off some before the end of this week in order to discourage recently minted bulls (this fits in nicely with what I've surmised on the Tracker charts), but after that I'd expect another leg higher.