The market managed to shake off what began as listless trading for almost the entire morning session. But just before noon EST, the market began to rally, and with no headlines to account for the buying spree it should be noted that the dollar began to weaken around the same time.

And with a weakening dollar came a sharp rise in commodities, which saw the CRB Commodity Index tack on about 2% today, with oil leading the way with a 5.4% advance to $102.55 per barrel.

By the end of the day the dollar settled with a 0.4% loss.

Aside from the typical Eurozone debt concerns that have been filling media headlines, there was little else to drive the market today. Overall volume on the NYSE was anemic with less than 800 million shares traded, although some of the drop off in volume was attributed to the Citigroup 1:10 reverse split, and rightly so.

Here's today's charts:

Back to the neutral line for NAMO and NYMO. Both are in a buy condition. They do suggest we could go up a bit more in the very short term.

NAHL and NYHL remain in sell conditions, but are not far off a buy signal.

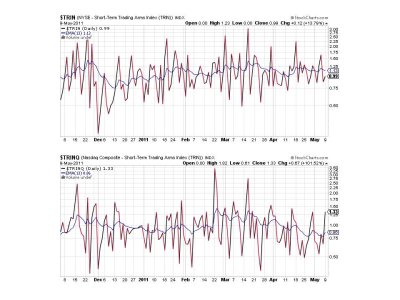

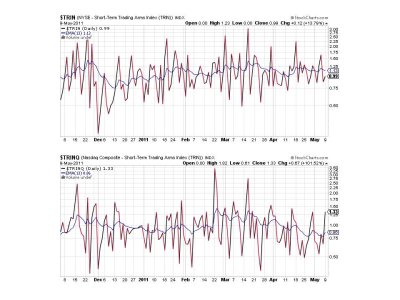

TRIN is on a buy, but TRINQ is flashing a sell. In fact, TRINQ suggests an overbought condition, which could bring some weakness in the very short term, but I doubt it would be anything dramatic if we do get some selling pressure.

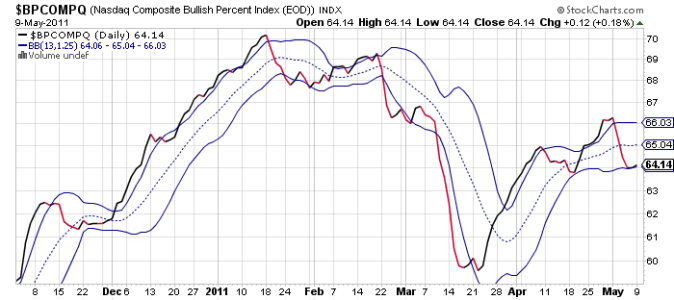

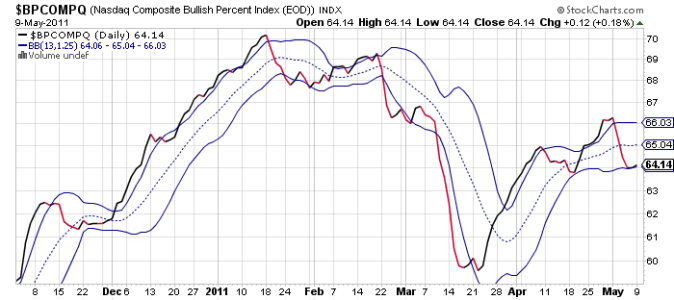

BPCOMPQ appears to be trying to turn back up, and it did in fact ebb a bit higher today, but it's too soon to get too bulled up here.

So the system remains in a buy condition, and the signals appear to be net neutral. I think the market is still being cautious, but the fed continues to provide support so a positive bias is not unusual on a slow news day. I'm not seeing anything particularly noteworthy at the moment other than implied volatility, which the NAMO and NYMO charts have been reflecting for a few weeks now.

And with a weakening dollar came a sharp rise in commodities, which saw the CRB Commodity Index tack on about 2% today, with oil leading the way with a 5.4% advance to $102.55 per barrel.

By the end of the day the dollar settled with a 0.4% loss.

Aside from the typical Eurozone debt concerns that have been filling media headlines, there was little else to drive the market today. Overall volume on the NYSE was anemic with less than 800 million shares traded, although some of the drop off in volume was attributed to the Citigroup 1:10 reverse split, and rightly so.

Here's today's charts:

Back to the neutral line for NAMO and NYMO. Both are in a buy condition. They do suggest we could go up a bit more in the very short term.

NAHL and NYHL remain in sell conditions, but are not far off a buy signal.

TRIN is on a buy, but TRINQ is flashing a sell. In fact, TRINQ suggests an overbought condition, which could bring some weakness in the very short term, but I doubt it would be anything dramatic if we do get some selling pressure.

BPCOMPQ appears to be trying to turn back up, and it did in fact ebb a bit higher today, but it's too soon to get too bulled up here.

So the system remains in a buy condition, and the signals appear to be net neutral. I think the market is still being cautious, but the fed continues to provide support so a positive bias is not unusual on a slow news day. I'm not seeing anything particularly noteworthy at the moment other than implied volatility, which the NAMO and NYMO charts have been reflecting for a few weeks now.