I know I'm one. And apparently there resides a whole hen house full of them within the TSP tracker. You may know who or what I'm talking about. Maybe you're one too. I'm talking about bullish chickens. :nuts:

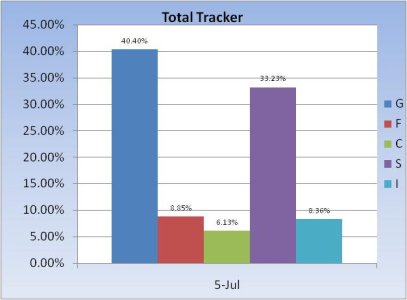

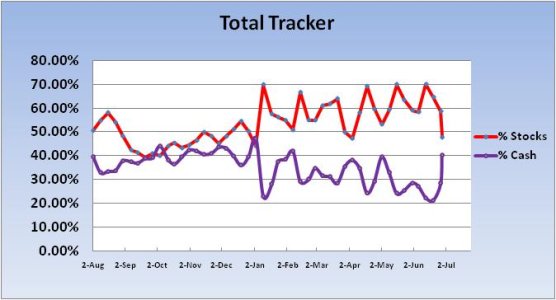

They're everywhere this week. What else could possibly explain an 18% upside shift in bullish sentiment in our TSP sentiment survey for this week, while at the same time an almost 11% drop in stock allocations across the entire tracker? :cheesy:

Yeah, locking in profits. I did that to the tune of 80% myself.

I just had to have some fun with that. When I voted in the sentiment survey this week, I voted neutral. But that was Thursday. On Friday the market took off again and I became bullish for this coming week. I'm still thinking we'll retrace a good deal of those gains, but I'm not so sure now that it'll happen next week.

Here's the charts:

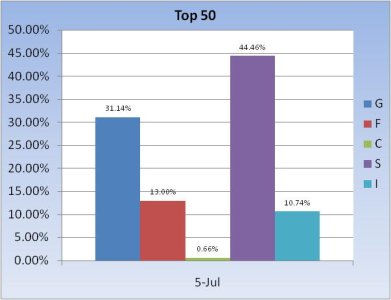

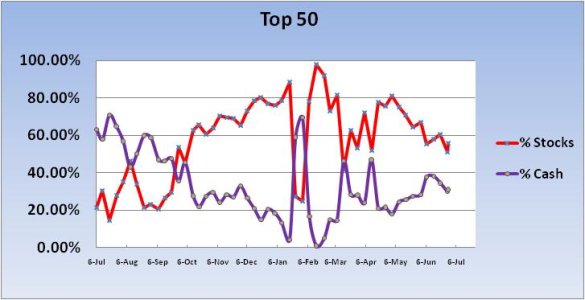

The Top 50 actually increased their stock allocations by almost 5%. But I know there was probably some G fund holders that fell out, while some stock holders advanced, so I'm not sure how many of these folks actually changed allocation.

Look at that drop off on stock allocations, not to mention that ramp up in G fund holdings! We're loaded for bear now, huh? :laugh:

We're now under 50% for stock allocations. Guess the S&P 500 will hit 1400 by week's end now.

Hope you're all having a great 4th of July! See you Tuesday.