userque

TSP Legend

- Reaction score

- 36

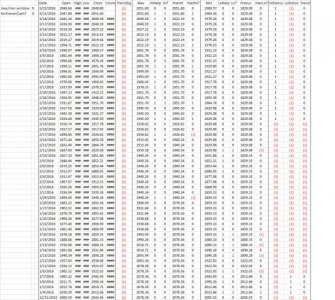

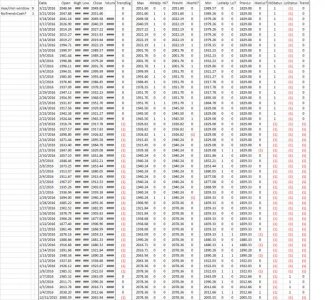

A place to toss around ideas regarding building trading systems (mainly in an excel spreadsheet) that might include machine learning capabilities.

JTH posed the question in our discussions about how to determine the trend.

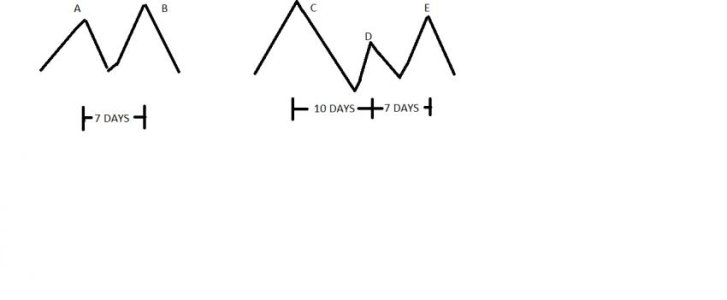

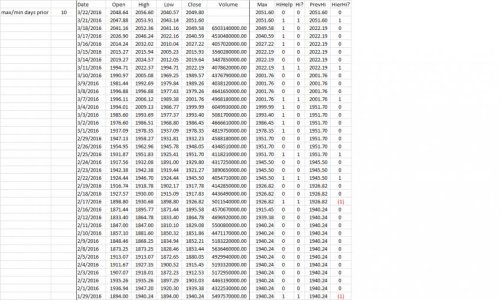

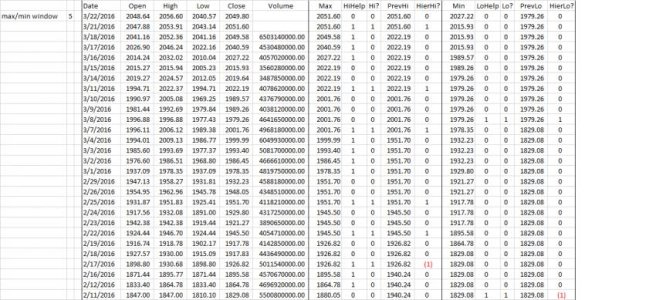

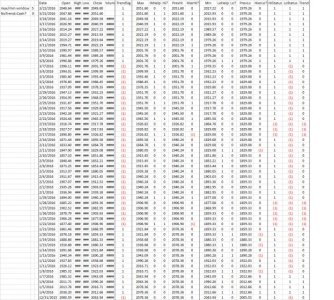

One way would be for the code to recognize higher highs/lows=an uptrend; lower highs/lows=downtrend; mixed=no trend. (I believe JTH also mentioned a transitioning trend, or something like that ) Isn't this part of Dow Theory??

) Isn't this part of Dow Theory??

Well, before coding anything, we'll have to first clarify how we, ourselves, (or JTH, really ) can personally look at a chart an determine what trend we are in. Then I'll try to reduce it to code/formulas.

) can personally look at a chart an determine what trend we are in. Then I'll try to reduce it to code/formulas.

I'm assisting JTH with this, so it's his final determination; but any ideas are welcome I'm sure. We are doing this publicly as it may help another or another may help us.

Any other general questions are welcome too.

JTH posed the question in our discussions about how to determine the trend.

One way would be for the code to recognize higher highs/lows=an uptrend; lower highs/lows=downtrend; mixed=no trend. (I believe JTH also mentioned a transitioning trend, or something like that

Well, before coding anything, we'll have to first clarify how we, ourselves, (or JTH, really

I'm assisting JTH with this, so it's his final determination; but any ideas are welcome I'm sure. We are doing this publicly as it may help another or another may help us.

Any other general questions are welcome too.