In spite of a two-day rally during the week, the broader market still closed with significant losses overall. For the week, the C fund fell 2.46%, the S fund was down 1.51%, and the I fund dropped a whopping 6.20%. Our sentiment survey was on a sell for the week, so it was a good call for that system.

The Greek debt crisis didn't see any major headlines today, but there's word that the G-20 meeting currently in session is seeing some of its own volatility. And that situation will continue to play out over the weekend in Cannes. So Monday could be interesting depending on what may or may not happen between now and then.

On the domestic front, Nonfarm Payrolls came in at 80,000, which was under estimates of 90,000. Nonfarm Private Payrolls came in at 104,000, which was below estimates of 120,000. The Unemployment Rate dipped from 9.1% to 9.0%, which was a bit better than expected, but hardly a reason to cheer.

Here's the charts:

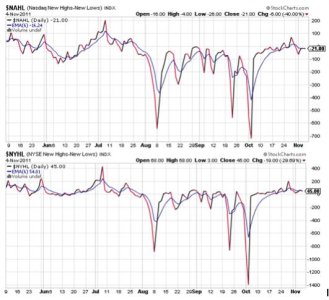

NAMO and NYMO both dipped, flipped back to sells in the process.

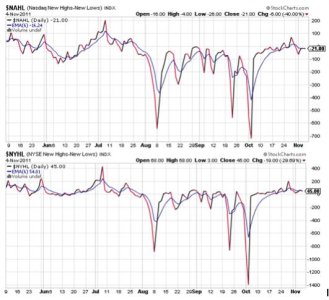

NAHL and NYHL are skirting their 6 day EMA, but are also now on sells.

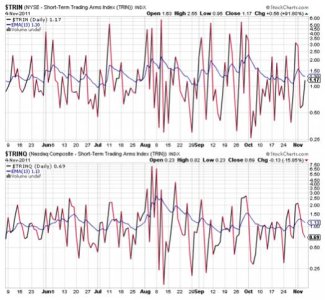

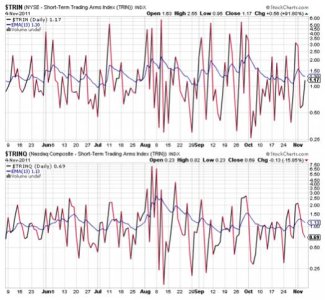

TRIN moved higher and remains in a buy condition, while TRINQ moved a bit lower, but also remained on a buy.

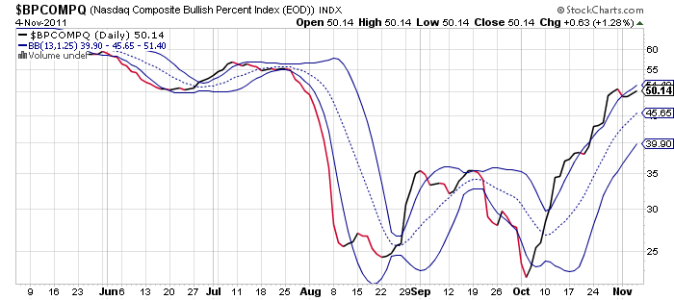

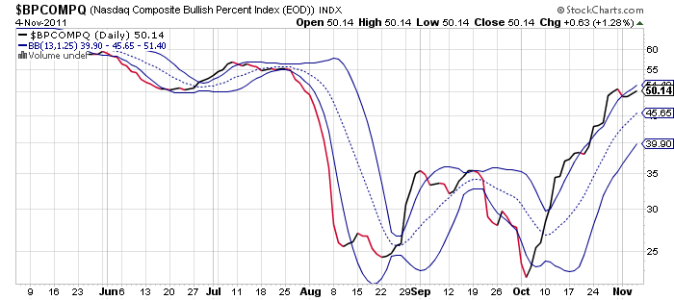

BPCOMPQ remained on a sell, but is following that upper bollinger band higher. My take on this is that the system is probably moving towards a sell, but that there is still a lot of support in this market. But headline risk remains and can drive this market in either direction regardless of what the charts are suggesting.

So the Seven Sentinels remain mixed, but officially retains a buy status. This past Tuesday saw the system flash an unconfirmed sell signal, which I believe is still in play. It may just take this market a bit more time to either confirm that sell or rally through resistance, in which case it would invalidate the signal. I suspect we'll get confirmation one way or another sometime next week.

Stop my Sunday evening, which is when I'll have the weekly tracker charts posted. See you then.

The Greek debt crisis didn't see any major headlines today, but there's word that the G-20 meeting currently in session is seeing some of its own volatility. And that situation will continue to play out over the weekend in Cannes. So Monday could be interesting depending on what may or may not happen between now and then.

On the domestic front, Nonfarm Payrolls came in at 80,000, which was under estimates of 90,000. Nonfarm Private Payrolls came in at 104,000, which was below estimates of 120,000. The Unemployment Rate dipped from 9.1% to 9.0%, which was a bit better than expected, but hardly a reason to cheer.

Here's the charts:

NAMO and NYMO both dipped, flipped back to sells in the process.

NAHL and NYHL are skirting their 6 day EMA, but are also now on sells.

TRIN moved higher and remains in a buy condition, while TRINQ moved a bit lower, but also remained on a buy.

BPCOMPQ remained on a sell, but is following that upper bollinger band higher. My take on this is that the system is probably moving towards a sell, but that there is still a lot of support in this market. But headline risk remains and can drive this market in either direction regardless of what the charts are suggesting.

So the Seven Sentinels remain mixed, but officially retains a buy status. This past Tuesday saw the system flash an unconfirmed sell signal, which I believe is still in play. It may just take this market a bit more time to either confirm that sell or rally through resistance, in which case it would invalidate the signal. I suspect we'll get confirmation one way or another sometime next week.

Stop my Sunday evening, which is when I'll have the weekly tracker charts posted. See you then.