-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bquat's Account Talk

- Thread starter Bquat

- Start date

Bquat

TSP Talk Royalty

- Reaction score

- 717

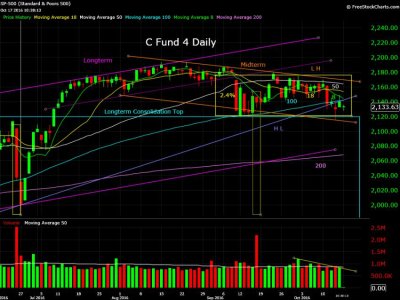

Test:Noticed that on my phone the price labels on the right are truncated off. I will try a smaller chart later.

Bquat

TSP Talk Royalty

- Reaction score

- 717

Look at the two red volume peaks. In the latest one look how the dip was bought. Price moved a lot less with this peak in volume even if you proportion for the less volume. Also look at the volume as price goes down and see that volume isn't increasing:Looks like the markets are following your charts!

If you feel like it, and want to, putz with overlays on the VIX, SnP and Volume. I did a couple of sets of 10days spread out over the past several months and I saw some divergences which have me happy to be out of the markets. Of course, that is probably me making myself see things to conform with my market position but, if you get a chance, I wouldn't mind a response from the chart master!

Attachments

Mcqlives

Market Veteran

- Reaction score

- 24

Look at the two red volume peaks. In the latest one look how the dip was bought. Price moved a lot less with this peak in volume even if you proportion for the less volume. Also look at the volume as price goes down and see that volume isn't increasing:

That is what I see as well. I have not tested it further but the frequency of this volume/dip buy observation seems to be increasing. I am not sure on market direction but imo this does not bode well for strength in the bulls.

Mcqlives

Market Veteran

- Reaction score

- 24

Does fear look relatively low? VIX-CBOE:

I think so...but going back to your "Computers rule the trading systems" theory...this could easily be a controlled stat. If buyers and sellers systems move fast enough the volatility won't climb unless the majority of systems pick a direction.

It also looks like the SnP is headed into another decision point going into the close today. I wish volatility would get back up there so I could try to make money on some daily trades!

Bquat

TSP Talk Royalty

- Reaction score

- 717

I'mok willdochartlater.spacebarnotworkingIs everything OK my friend? I got up this morning with my coffee in hand and am missing your Charts! I hope all is well!

Bquat

TSP Talk Royalty

- Reaction score

- 717

Ok maybe I had a little more coffee.I will be back home in 20 minutes . :smile:

Bquat

TSP Talk Royalty

- Reaction score

- 717

Bquat

TSP Talk Royalty

- Reaction score

- 717

Similar threads

- Replies

- 2

- Views

- 537

- Replies

- 2

- Views

- 532

- Replies

- 2

- Views

- 825