Whipsaw

Market Veteran

- Reaction score

- 239

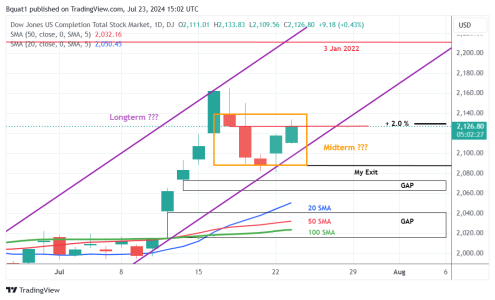

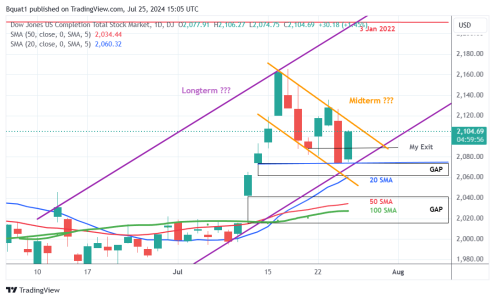

I had to open my mouth!That's where I was at, held in the C fund though. Don't think it's a blow off top, it should keep going - I just can't see the S-Train continuing to run at this rate. Gimme a dip! :cheesy: