-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bquat's Account Talk

- Thread starter Bquat

- Start date

Bquat

TSP Talk Royalty

- Reaction score

- 716

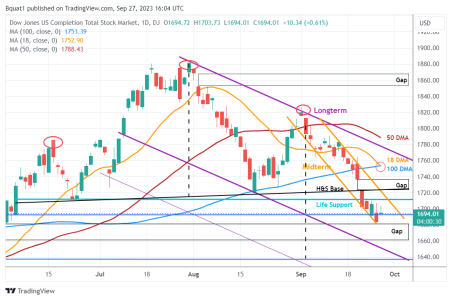

Fighting to get back above life support level:Breakout is confirmed. Looking for life support here and now:

Attachments

felixthecat

TSP Analyst

- Reaction score

- 41

- AutoTracker

I’m looking to bail on a sucker bounce. Maco economics weakening on oil surge, weakening consumer, debited student loans, high interest rates braking the economy, manufacturer continuing to weaken, high levels of US debt, impending government shutdown,, and china/taiwan conflict on the horizon. There is more crap ongoing like ovrblown housing and rapidly expanding of credit card debt. I wish that was all but I have not mentioned other problems. We got problems going forward that the FED just cannot control. Banks are stressed so boo hoo. Oh and thatrecession, well we are likely to see us inching closer in the last quarter. Maybe we get a one last gasp rally…I will hopely be there to get some gains for 2023.

Last edited:

tom4jean

TSP Strategist

- Reaction score

- 6

What do you think about seasonality going into October? I'm thinking of buying this dip and carrying it through until after a Christmas.Chart:

Sent from my Pixel 7 Pro using Tapatalk

Bquat

TSP Talk Royalty

- Reaction score

- 716

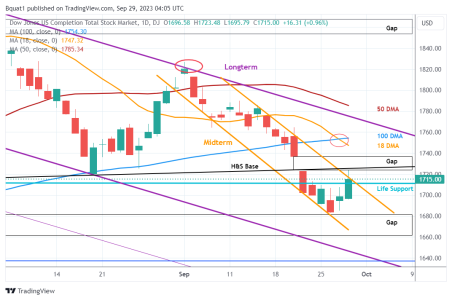

I will look at longer-term for you but we may be seeing a bigger post head and shoulders drop. JMGWhat do you think about seasonality going into October? I'm thinking of buying this dip and carrying it through until after a Christmas.

Sent from my Pixel 7 Pro using Tapatalk

This may be a good time for patterns not working in a news based market :cheesy:

Bquat

TSP Talk Royalty

- Reaction score

- 716

Longer Term:I will look at longer-term for you but we may be seeing a bigger post head and shoulders drop. JMG

This may be a good time for patterns not working in a news based market :cheesy:

Attachments

Bquat

TSP Talk Royalty

- Reaction score

- 716

I may be out of pocket tomorrow eating Menudo. Above Life Support:Just my guesses so let's get above Life Support. OK

Attachments

felixthecat

TSP Analyst

- Reaction score

- 41

- AutoTracker

I just hope we can still call it a bull market after this week.

Scott Harrison

Senatobia, MS

Wait…what…bull market? That is news to me. I know we rebounded from 2022…but in the longer stretch…I was expecting a early crash in 2023 (which we did not get). The FED delayed the crash. Rising 10 year yield is actually a precusor to the stock market crash in the beginning of a recession. We have a ways to go before the stock market bull returns with rising 10 yr yields. Its more like the 7th inning of a train derailment. For sure though…we will get rebounds from overselling but the FED pivot will bring on max pain before the hanging black clouds clear. If we can get really ugly here in this 4 quarter then I believe we will have our bull market renewed for 2024. In the meantime…keep the powder dry for a big opportunity. I need to bail but cannot get a big gain to exit. For crying out loud…the slow step down is accelerating.

Bquat

TSP Talk Royalty

- Reaction score

- 716

Just grasping for straws here as maybe the Head and shoulder's drop is happening. Hoping Gap fill is enough:Midterm more negative than expected. Bad news I guess:

Attachments

Similar threads

- Replies

- 2

- Views

- 534

- Replies

- 2

- Views

- 532

- Replies

- 2

- Views

- 825