-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bquat's Account Talk

- Thread starter Bquat

- Start date

Bquat

TSP Talk Royalty

- Reaction score

- 717

Well since my charting isn't working, I will do some Cooperate Economics:

ECON 101 C

Cooperations were given write-offs against taxes for reinvesting, modernization, and expansion to remain in the USA. The main purpose was to make it economical to hire Americans at the higher labor rate and still provide a good profit margin. This also was an effort to stop the migration of US cooperations from moving their headquarters overseas. So, if they have to pay the 15% tax anyway why not move to a country with a cheaper labor base.

ECON 102 M& CA

So this will help Mexico and Central America, right? In the past it would have done exactly like in the 70's but now not at all. Paying for workers protection and company property protection to gangs and corrupt local officials has taken away the profit margin. So, off to Asian Pasific and South America or just get China to produce your product for you.

Well, there you go. Companies will exit United States and you will see unemployment increase like when car manufacturers left Detroit. Enough for now. Do you agree? :nuts:

ECON 101 C

Cooperations were given write-offs against taxes for reinvesting, modernization, and expansion to remain in the USA. The main purpose was to make it economical to hire Americans at the higher labor rate and still provide a good profit margin. This also was an effort to stop the migration of US cooperations from moving their headquarters overseas. So, if they have to pay the 15% tax anyway why not move to a country with a cheaper labor base.

ECON 102 M& CA

So this will help Mexico and Central America, right? In the past it would have done exactly like in the 70's but now not at all. Paying for workers protection and company property protection to gangs and corrupt local officials has taken away the profit margin. So, off to Asian Pasific and South America or just get China to produce your product for you.

Well, there you go. Companies will exit United States and you will see unemployment increase like when car manufacturers left Detroit. Enough for now. Do you agree? :nuts:

Epic

TSP Pro

- Reaction score

- 365

Well since my charting isn't working, I will do some Cooperate Economics:

ECON 101 C

Cooperations were given write-offs against taxes for reinvesting, modernization, and expansion to remain in the USA. The main purpose was to make it economical to hire Americans at the higher labor rate and still provide a good profit margin. This also was an effort to stop the migration of US cooperations from moving their headquarters overseas. So, if they have to pay the 15% tax anyway why not move to a country with a cheaper labor base.

ECON 102 M& CA

So this will help Mexico and Central America, right? In the past it would have done exactly like in the 70's but now not at all. Paying for workers protection and company property protection to gangs and corrupt local officials has taken away the profit margin. So, off to Asian Pasific and South America or just get China to produce your product for you.

Well, there you go. Companies will exit United States and you will see unemployment increase like when car manufacturers left Detroit. Enough for now. Do you agree? :nuts:

Nice write-up. Cooperate Economics not my strong point by a looooong shot....LOL

This probably isn't even relevant because I have no idea what I'm talking about concerning this subject.....but:

We're already having massive layoffs (Tesla, Walmart, etc), so that already will contribute to unemployment on top of what it already is.

If you produce it here (in the United States), then you can sell it here and avoid supply chain nightmares. If you produce it overseas, then you have that to deal with. Why make it elsewhere only to have your product stuck in port for months on end?

Sorry.... I wish I had a more thought provoking, educated response. At least I tried. Need more coffee .....:boggled:

Epic

TSP Pro

- Reaction score

- 365

No one cares who's going to pay.Chart:

We're all going to pay. The legal American Citizen who works hard and pays their Taxes as required, THATS who's going to pay. And the ones steering the ship and implementing this know full well who's going to pay and they don't give a dam about it. They do not care about you. Never did. Very sad indeed.

Bquat

TSP Talk Royalty

- Reaction score

- 717

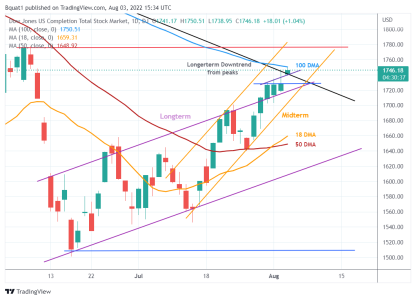

3.0% already and may be peaking. Will we double top or what? As always we'll see after deadline: :blink:Going to be a big pop this morning because consumer price remains 8.5 %

Attachments

Bquat

TSP Talk Royalty

- Reaction score

- 717

Yes: :blink:Is gap going to backfill? Chart: :suspicious:

Attachments

Similar threads

- Replies

- 2

- Views

- 537

- Replies

- 2

- Views

- 532

- Replies

- 2

- Views

- 825