A soft week, with a low ATR but decent volume.

The Candlestick body was .03% of the ATR a level this low is not common.

Both the upper and lower wicks of the candlestick showed slight symmetry, thus most folks would call this a Doji.

We had a near identical match 20-May-2024 which happens to be (on the far left) the 2nd to last candlestick on the regression channel.

In this instance or context (as with many doji) it was a continuation pattern, as would appear Week-19's Doji.

This might hint at Week-20 being a low-energy week with a small gain or loss +/- 1%

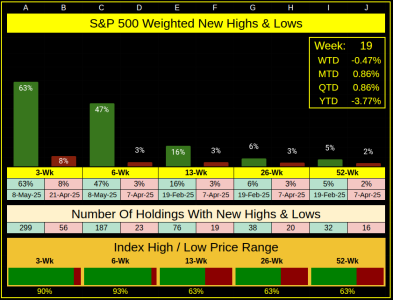

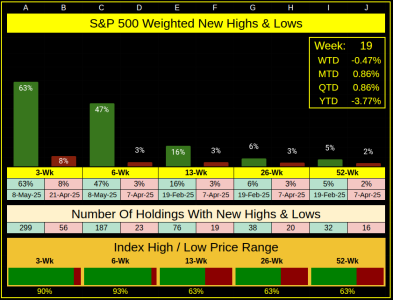

I'll keep it short here, the next 3 charts, haven't shifted much from last week.

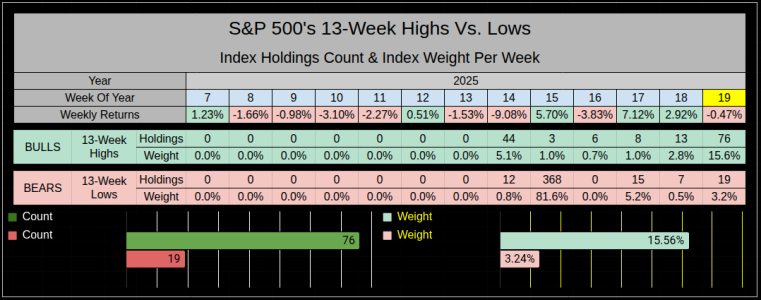

It's the 3 & 6 week time/price scale which has all the movement, we are trying to creep into the 13-Wk but haven't made significant progress.

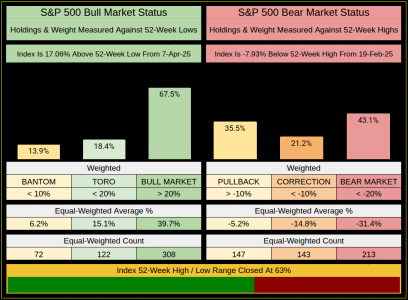

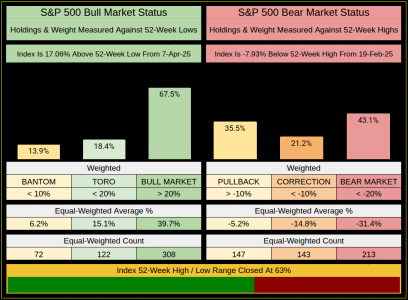

Once again, on the 52-Week High/Low scale, not much has changed, I give the edge to the Bulls, but not with much conviction.

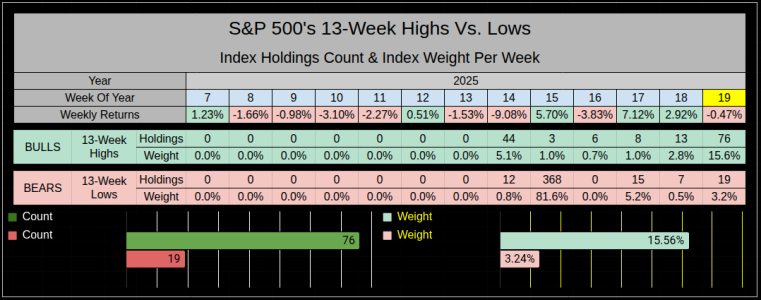

The 13-Wk scale flounders around, of the last 13 weeks 8 have closed down. The bulls did outpace the bears with new highs, but it didn't materialize in this week's -.47% return.

The bigger question.... Have we already made the yearly low?

From the previous 63 years, the yearly low fell within the first 4 months 60% of the time. In May the yearly low has happened only 1 time, in 1970 with a .10% yearly return. If I were to make a call I would tell you that yes the yearly low is in, but don't be surprised if we get another scare (but not a lower close).

The current theme is "Nobody knows" with earnings, Tariffs & the Fed. If I were to guess, then I'd guess that indecision is more likely to trickle up as we "climb the wall of worry".

Have a great week...Jason

The Candlestick body was .03% of the ATR a level this low is not common.

Both the upper and lower wicks of the candlestick showed slight symmetry, thus most folks would call this a Doji.

We had a near identical match 20-May-2024 which happens to be (on the far left) the 2nd to last candlestick on the regression channel.

In this instance or context (as with many doji) it was a continuation pattern, as would appear Week-19's Doji.

This might hint at Week-20 being a low-energy week with a small gain or loss +/- 1%

I'll keep it short here, the next 3 charts, haven't shifted much from last week.

It's the 3 & 6 week time/price scale which has all the movement, we are trying to creep into the 13-Wk but haven't made significant progress.

Once again, on the 52-Week High/Low scale, not much has changed, I give the edge to the Bulls, but not with much conviction.

The 13-Wk scale flounders around, of the last 13 weeks 8 have closed down. The bulls did outpace the bears with new highs, but it didn't materialize in this week's -.47% return.

The bigger question.... Have we already made the yearly low?

From the previous 63 years, the yearly low fell within the first 4 months 60% of the time. In May the yearly low has happened only 1 time, in 1970 with a .10% yearly return. If I were to make a call I would tell you that yes the yearly low is in, but don't be surprised if we get another scare (but not a lower close).

The current theme is "Nobody knows" with earnings, Tariffs & the Fed. If I were to guess, then I'd guess that indecision is more likely to trickle up as we "climb the wall of worry".

Have a great week...Jason