With many of these stats I've shown this week, I would conclude now would be a good time to either buy, wait or run.

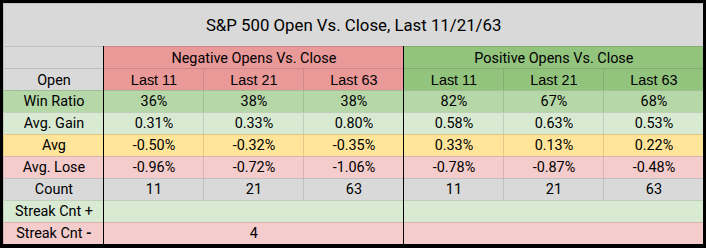

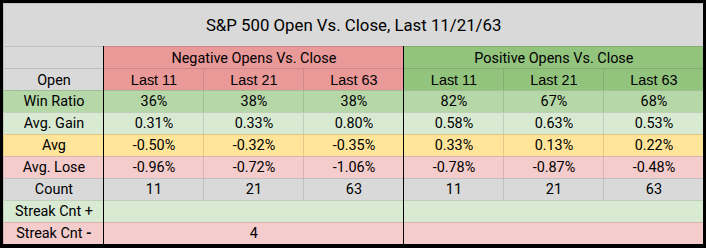

Typically, a Negative/Positive open is highly correlated to a Negative/Positive close, which wasn't the case for Thursday's reversal.

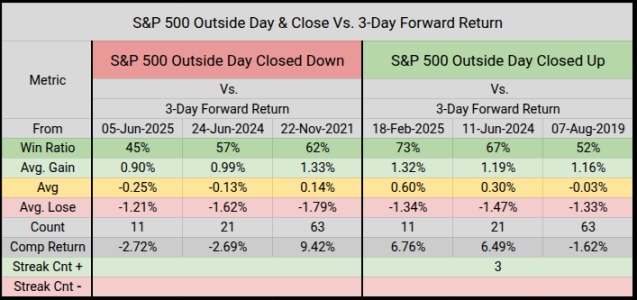

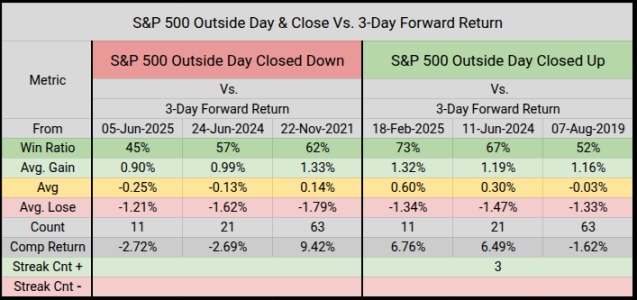

The past 11 times an outside day closed down the 3-Day Forward Returns had a 45% Win ratio

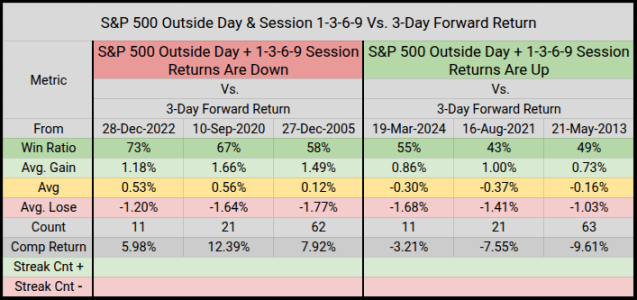

Digging deeper, at present, our 1-3-6-9-Day Returns are down, so here's the 3-Day Forward Returns after an outside day.

Happy Friday.... Jason

- 70% of me says to buy on the -5% pullback, 25% says to wait for a deeper cut, while 5% says to run and hide.

- We are missing some key features here, they just aren't present at the levels I'd like to see for a Flushed out bottom.

- Volume has been average, nothing special, nothing exhaustive, just normal.

- Breadth has been low, but not at the Pre-Tariff-Crash levels I'd like to see.

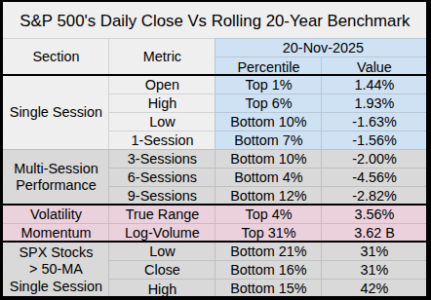

- That 1.44% open was a Top 1% event, the 30th best of 20 years and it closed the session down.

- For context, prior to Thursday, the 100 best 20 year opens have closed their session down only 10 times.

- 7 of those fit our current context where the 1-3-6-9-Day Returns were down.

- 3-6-9-Day Forward Returns later, 5 of 7 where positive

- The average gain of those five, 9-Day Forward Returns were 6.53%

- The loss of those two, 9-Day Forward Returns were -.96 & -10.83%

- The True Range was 3.56% a Top 4% 20-Year Ranking

- Many of these stats (7 of 12) are in their extremes

- For context, prior to Thursday, the 100 best 20 year opens have closed their session down only 10 times.

Typically, a Negative/Positive open is highly correlated to a Negative/Positive close, which wasn't the case for Thursday's reversal.

- We have a Streak Count of 4, on Negative openings, leading to a negative close.

The past 11 times an outside day closed down the 3-Day Forward Returns had a 45% Win ratio

- For context 11-21-63-Day stats are provided for both sides of the tape.

Digging deeper, at present, our 1-3-6-9-Day Returns are down, so here's the 3-Day Forward Returns after an outside day.

- The left column shows us a respectable 73% Win Ratio, likely these event are what is defined as an oversold short-term condition in a Primary Medium/Long Term Uptrending Market.

Happy Friday.... Jason