It could've been worse. The market latched on to today's jobs report and opted to set a very positive tone in what was an oversold market. But today's reversal is going to have many traders second guessing their market expectations moving forward as the market closed well off its highs of the day.

So nonfarm payrolls for April jumped 244,000, while private payrolls were up 268,000. Both were much higher than economists expected. But the unemployment rate rose to 9.0%, which was not expected.

Oil continued to dive as a barrel of oil closed at $97.55, which translates to a weekly loss of about 14%. Silver also continued its descent, dropping to $35.52 per ounce.

And the dollar advanced another 1.0% today, which follows on the heels of the a 1.4% gain yesterday. Rumors that Greece was considering leaving the euro was blamed for today's move.

Here's today's charts:

Downside momentum has been turned for today anyway, but NAMO and NYMO still remain on sells.

NAHL and NYHL also improved and they too remain in a sell condition.

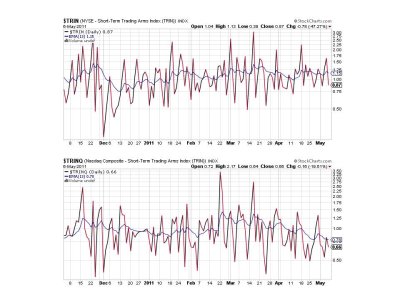

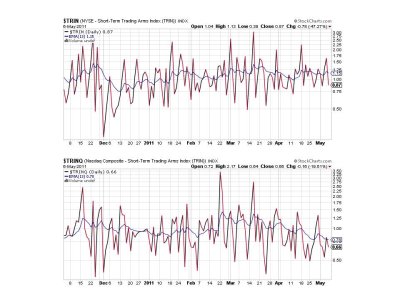

Both TRIN and TRINQ flipped back to buys today.

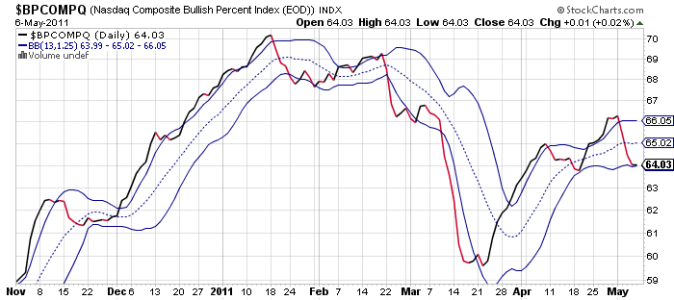

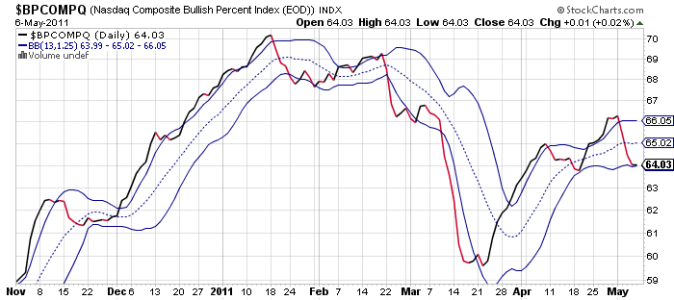

BPCOMPQ remains in a sell condition, but did manage to track sideways just a bit.

So what happens next? My market expectations haven't changed, at least not for the very short term. I'm expecting more volatility next week and chances are it will be biased to the downside. We may eventually resume the uptrend, but there is a lot of uncertainty given the big moves in commodities and the dollar. Anything can happen, but I'm still looking for those gaps to get filled on the S&P and Nasdaq. Unless that happens, I think downside risk remains uncomfortably high in the short term.

So nonfarm payrolls for April jumped 244,000, while private payrolls were up 268,000. Both were much higher than economists expected. But the unemployment rate rose to 9.0%, which was not expected.

Oil continued to dive as a barrel of oil closed at $97.55, which translates to a weekly loss of about 14%. Silver also continued its descent, dropping to $35.52 per ounce.

And the dollar advanced another 1.0% today, which follows on the heels of the a 1.4% gain yesterday. Rumors that Greece was considering leaving the euro was blamed for today's move.

Here's today's charts:

Downside momentum has been turned for today anyway, but NAMO and NYMO still remain on sells.

NAHL and NYHL also improved and they too remain in a sell condition.

Both TRIN and TRINQ flipped back to buys today.

BPCOMPQ remains in a sell condition, but did manage to track sideways just a bit.

So what happens next? My market expectations haven't changed, at least not for the very short term. I'm expecting more volatility next week and chances are it will be biased to the downside. We may eventually resume the uptrend, but there is a lot of uncertainty given the big moves in commodities and the dollar. Anything can happen, but I'm still looking for those gaps to get filled on the S&P and Nasdaq. Unless that happens, I think downside risk remains uncomfortably high in the short term.