The initial jobless claims data for the previous week totaled 451,000, which was less than the 470,000 claims that had been expected.

Continuing claims were pegged at 4.48 million, a little above the anticipated 4.45 million.

And of course the market took its cues from those numbers and drove the indexes higher. But interestingly, those numbers have been revised lower quite often after the initial reports are given, but the market doesn't seem to care about that.

So the job picture is still bad, but it's better than expected, assuming you put any stock in those numbers at all.

Part of the reason for the selling pressure earlier in the trading day was news from Deutsche Bank that it may issue stock to raise capital. Sounds like a familiar story, but for the moment the big money isn't reacting to that kind of news the way it did a few months ago.

But while we did get a rally today, volume picked up right at the close amid selling pressure and indexes closed well off their highs of the day.

Here's the charts:

Still flashing buys here, but NYMO has still not hit its 28 day trading high.

Two more buys here.

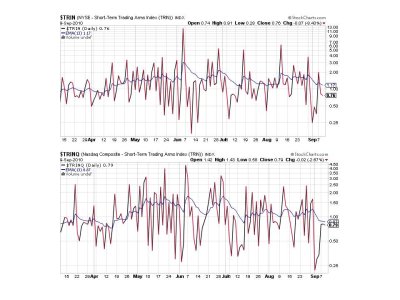

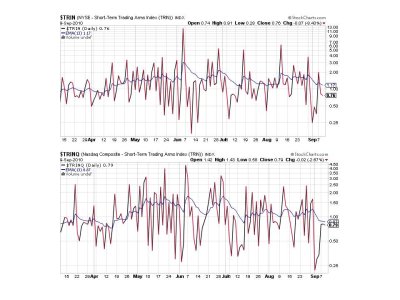

TRIN and TRINQ are also on a buy.

BPCOMPQ does continue to bias upward and also remains on a buy.

So we have all signals flashing buys, but NYMO has yet to post a new 28 day trading high so the system remains on an intermediate term sell.

Still 100% G here. See you tomorrow.

Continuing claims were pegged at 4.48 million, a little above the anticipated 4.45 million.

And of course the market took its cues from those numbers and drove the indexes higher. But interestingly, those numbers have been revised lower quite often after the initial reports are given, but the market doesn't seem to care about that.

So the job picture is still bad, but it's better than expected, assuming you put any stock in those numbers at all.

Part of the reason for the selling pressure earlier in the trading day was news from Deutsche Bank that it may issue stock to raise capital. Sounds like a familiar story, but for the moment the big money isn't reacting to that kind of news the way it did a few months ago.

But while we did get a rally today, volume picked up right at the close amid selling pressure and indexes closed well off their highs of the day.

Here's the charts:

Still flashing buys here, but NYMO has still not hit its 28 day trading high.

Two more buys here.

TRIN and TRINQ are also on a buy.

BPCOMPQ does continue to bias upward and also remains on a buy.

So we have all signals flashing buys, but NYMO has yet to post a new 28 day trading high so the system remains on an intermediate term sell.

Still 100% G here. See you tomorrow.