When it rains it pours and if I was a bear I'd be quite dejected by now.

Today's buying frenzy was touched off by an unemployment rate that fell to 8.3% in January from 8.5% the previous month. That was an unexpected reading for most economists. In addition, nonfarm payrolls spiked by 243,000, which was well above estimates calling for 155,000. Private payrolls also rose, in this case by 257,000. That too was well above estimates as economists were looking for a number closer to 168,000.

The ISM Service Index was also up from 52.6 in December to a reading of 56.8 for January. It was yet another data pont that exceeded economists estimates.

Factory orders for December were up 1.1%, but in this case that was below estimates looking for a 1.5% increase.

Here's today's charts:

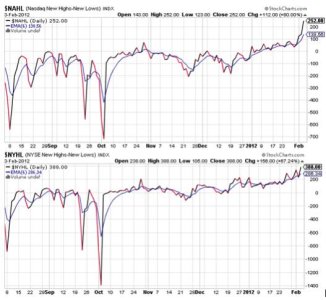

Beginning another up leg? Both signals remain on buys.

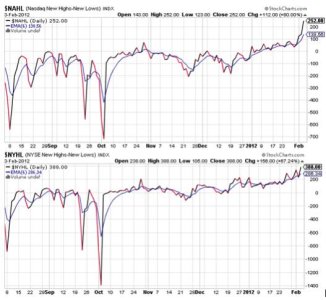

NAHL and NYHL are also moving higher and are in buy conditions.

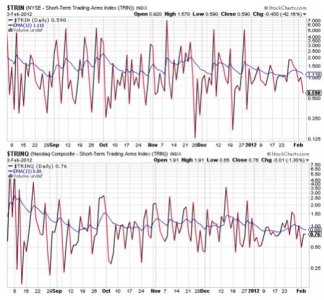

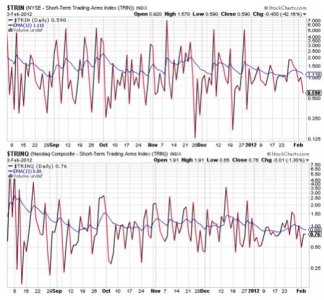

TRIN and TRINQ are now both on buys. And collectively they are not suggesting an overbought market.

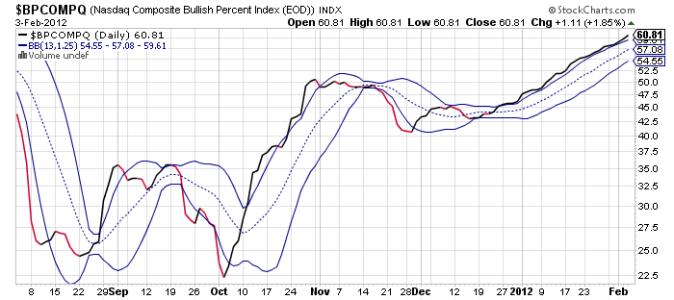

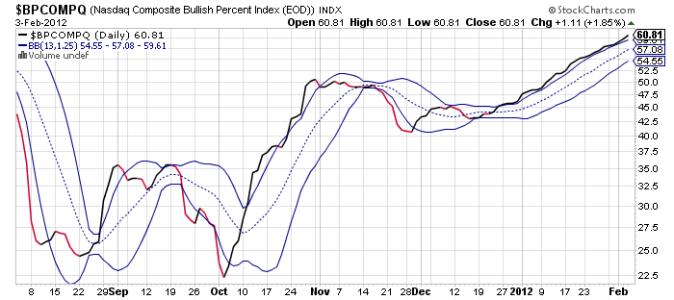

BPCOMPQ's trajectory remains the same. Up and on a buy.

So the Seven Sentinels are all sporting buy signals, which keeps the system in an intermediate term buy condition.

As overbought as this market may seem, these charts suggest we're heading higher still. I know it won't last forever, but when the train has this much momentum you don't want to step in front of it. Nuff said.

Stop by Sunday evening when I'll have the tracker charts posted for next week. See you then.

Today's buying frenzy was touched off by an unemployment rate that fell to 8.3% in January from 8.5% the previous month. That was an unexpected reading for most economists. In addition, nonfarm payrolls spiked by 243,000, which was well above estimates calling for 155,000. Private payrolls also rose, in this case by 257,000. That too was well above estimates as economists were looking for a number closer to 168,000.

The ISM Service Index was also up from 52.6 in December to a reading of 56.8 for January. It was yet another data pont that exceeded economists estimates.

Factory orders for December were up 1.1%, but in this case that was below estimates looking for a 1.5% increase.

Here's today's charts:

Beginning another up leg? Both signals remain on buys.

NAHL and NYHL are also moving higher and are in buy conditions.

TRIN and TRINQ are now both on buys. And collectively they are not suggesting an overbought market.

BPCOMPQ's trajectory remains the same. Up and on a buy.

So the Seven Sentinels are all sporting buy signals, which keeps the system in an intermediate term buy condition.

As overbought as this market may seem, these charts suggest we're heading higher still. I know it won't last forever, but when the train has this much momentum you don't want to step in front of it. Nuff said.

Stop by Sunday evening when I'll have the tracker charts posted for next week. See you then.