Bears be warned, when the money flow is high, and it is, it's best to either go with the flow or at the least stay off the train tracks.

Here's this week's charts:

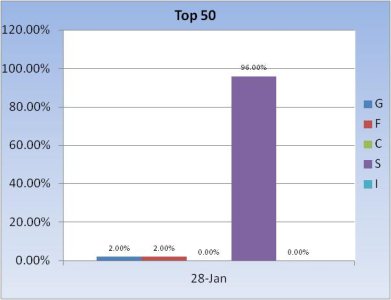

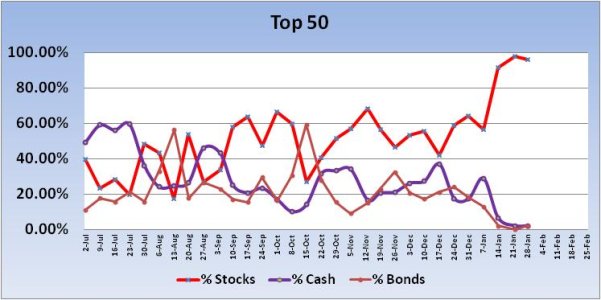

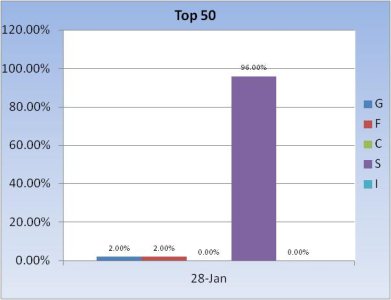

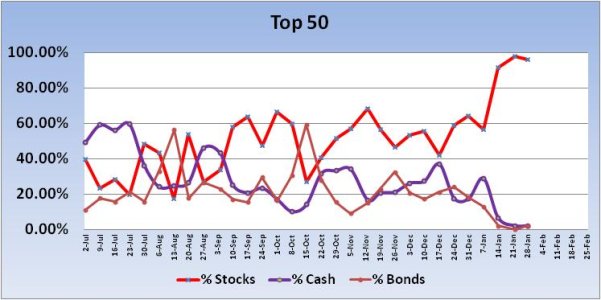

The Top 50 have been in the money for most of this month. Stock allocation levels have been over 91% for three weeks now.

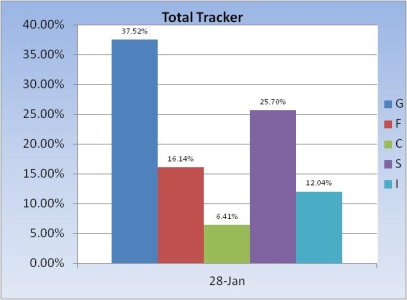

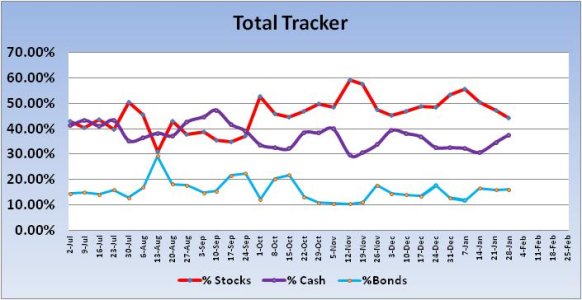

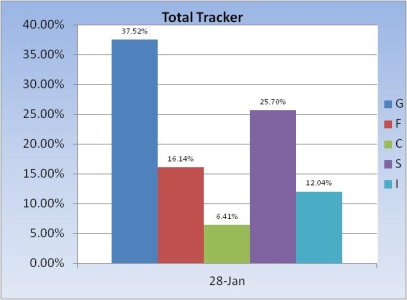

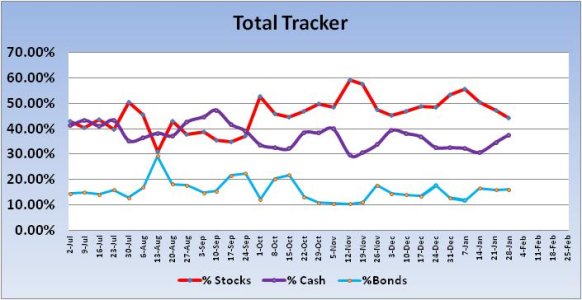

While the Top 50 have been increasing stock allocation all month (most are simply holding their positions), the Total Tracker shows a decrease in stock allocations for the third week in row. Last week, those allocations were at a conservative 47.1%. This week they dipped another 2.96% to a total stock allocation of just 44.14%. It's obvious that collectively we aren't the ones driving this market .

.

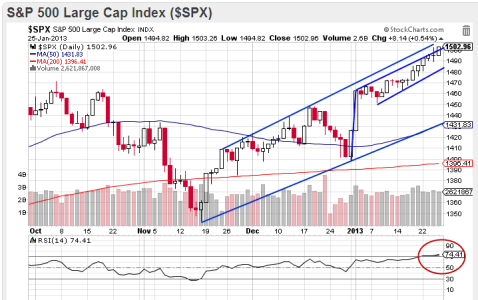

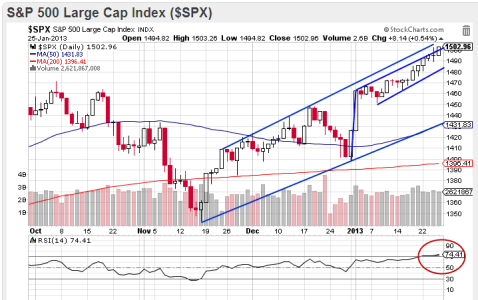

Looking at the chart of the S&P 500, we can see that not much has changed. The intermediate term remains firmly up. I do note that the Relative Strength Index (RSI) is above 70, which is an overbought condition. The S fund has an RSI over 80. It's an indication of momentum and it has yet to subside by this measure. This suggests the upside has weeks to go, but not necessarily straight up. Sooner or later we should see a pullback and I highly suspect it will get bought as many are sitting in cash and getting uneasy at missing this run.

Our sentiment survey remains on a sell, but the overall sentiment is not "over-the-top" bullish with a 53% bull to 37% bear survey for this week. As I said, we can get a pullback at any time given the overbought conditions in the indexes and overall bullish sentiment, but it's definitely too soon to get overly bearish (longer term) with the kind of underlying strength this market is showing.

Here's this week's charts:

The Top 50 have been in the money for most of this month. Stock allocation levels have been over 91% for three weeks now.

While the Top 50 have been increasing stock allocation all month (most are simply holding their positions), the Total Tracker shows a decrease in stock allocations for the third week in row. Last week, those allocations were at a conservative 47.1%. This week they dipped another 2.96% to a total stock allocation of just 44.14%. It's obvious that collectively we aren't the ones driving this market

Looking at the chart of the S&P 500, we can see that not much has changed. The intermediate term remains firmly up. I do note that the Relative Strength Index (RSI) is above 70, which is an overbought condition. The S fund has an RSI over 80. It's an indication of momentum and it has yet to subside by this measure. This suggests the upside has weeks to go, but not necessarily straight up. Sooner or later we should see a pullback and I highly suspect it will get bought as many are sitting in cash and getting uneasy at missing this run.

Our sentiment survey remains on a sell, but the overall sentiment is not "over-the-top" bullish with a 53% bull to 37% bear survey for this week. As I said, we can get a pullback at any time given the overbought conditions in the indexes and overall bullish sentiment, but it's definitely too soon to get overly bearish (longer term) with the kind of underlying strength this market is showing.