It may not mean a whole lot, but volume was once again very anemic for the day. But it did pick up pace towards the close and it was to the downside. I won't read too much into this as it wasn't particularly remarkable, but it is possible that some follow-through selling interest may be coming. Tomorrow is the last trading day of the quarter and we are not seeing a lot of window dressing being applied. It would seem yesterday's buying spree was a response to last weeks selling pressure along with some M&A activity, but the fact that we did not follow through in the closing days of the quarter may be telling us something.

If more weakness is to follow I still don't see it lasting too long or going too deep. But I'd love to see another 3-5% decline before the next SS buy signal and then have time to get in front of it. But I'm not so sure we'll get that much selling and the bullish reversals have been quick and steep making it tough to react in time to take advantage of lower prices.

But I'm really only musing about the short term future of the market. In the end it's a simple matter of following the signal and hoping for the best. My decision making is quite easy in this regard.

The Seven Sentinels remained on a sell today as noted in the charts.

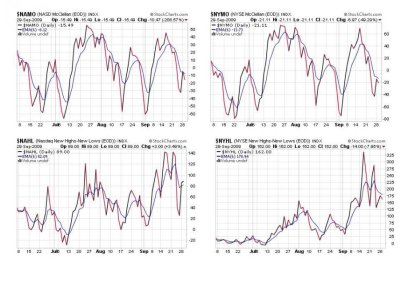

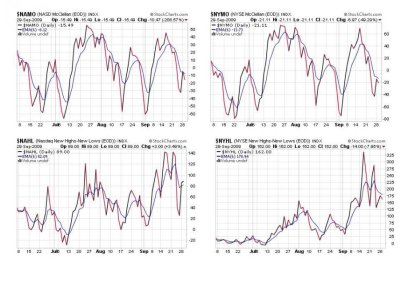

NAMO, NYMO, and NYHL are all still flashing sell signals, while NAHL in now on a buy. The three sell signals here could easily flip to buys with moderate buying pressure at this point.

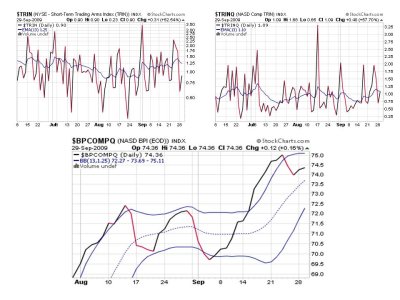

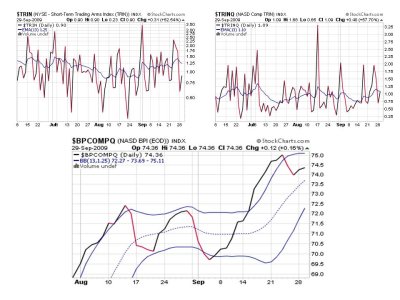

TRIN and TRINQ both remain on a buy today, while BPCOMPQ remains on sell.

So we still have 3 buy signals and 4 sell signals leaving the system on a sell.

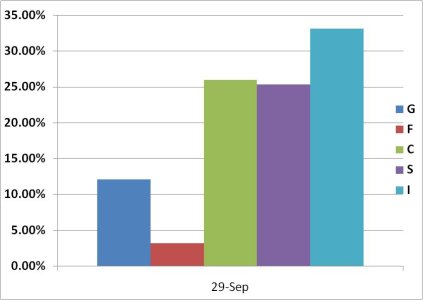

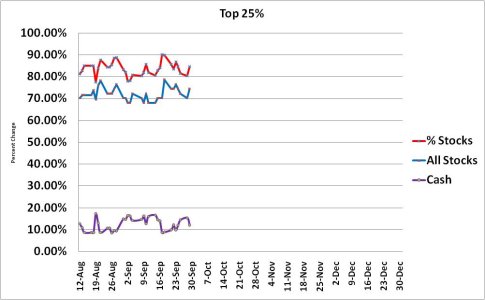

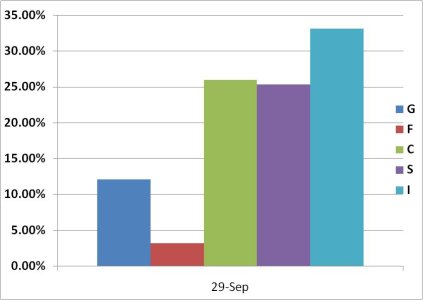

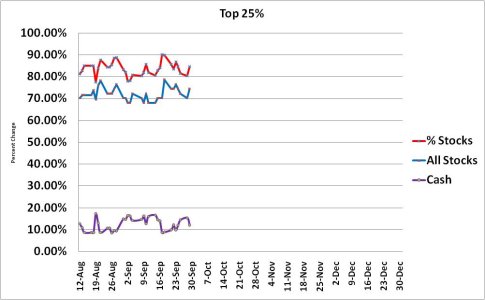

In this chart we can see our top 25% performers continue to hold tight to their bullish allocation, with the I fund moving a little bit higher.

Overall, cash levels dipped, while equity holdings rose.

So I continue to wait for another buy signal, but I'm expecting more weakness prior to that next bullish leg up. But in this market that may not happen. In any event, I'm ready for whatever the market decides to do.

If more weakness is to follow I still don't see it lasting too long or going too deep. But I'd love to see another 3-5% decline before the next SS buy signal and then have time to get in front of it. But I'm not so sure we'll get that much selling and the bullish reversals have been quick and steep making it tough to react in time to take advantage of lower prices.

But I'm really only musing about the short term future of the market. In the end it's a simple matter of following the signal and hoping for the best. My decision making is quite easy in this regard.

The Seven Sentinels remained on a sell today as noted in the charts.

NAMO, NYMO, and NYHL are all still flashing sell signals, while NAHL in now on a buy. The three sell signals here could easily flip to buys with moderate buying pressure at this point.

TRIN and TRINQ both remain on a buy today, while BPCOMPQ remains on sell.

So we still have 3 buy signals and 4 sell signals leaving the system on a sell.

In this chart we can see our top 25% performers continue to hold tight to their bullish allocation, with the I fund moving a little bit higher.

Overall, cash levels dipped, while equity holdings rose.

So I continue to wait for another buy signal, but I'm expecting more weakness prior to that next bullish leg up. But in this market that may not happen. In any event, I'm ready for whatever the market decides to do.