The trading day started out a bit mixed, but stocks remained moderately in the green all the way up to about 1:30 est, and then some selling pressure kicked in that saw the major averages fall to moderate losses before rallying in the final hour to end up near the neutral line.

Greece's political, social, and fiscal woes continue to be focal points for market participants.

Here at home, the initial jobless claims number was released early in the morning, and it came in at 414,000, which was under the 421,000 claims analysts were expecting. So this was a minor positive.

In the housing sector, May housing starts came in at an annualized rate of 560,000, while building permits hit 612,000. Both were higher than expected.

But there was bad news too. The Philadelphia Fed Survey dove to -7.7 in June, after being up 3.9 in May. Economists were looking for something close to 7.0.

So what to make of today's action? For one, the 200-day moving average was tested on the S&P 500 as shown in this chart:

The yellow arrow shows where the candlestick touched the 200 dma and bounced well above it. That's a big plus at this point, but not a guarantee we're out of the woods.

Here's how the Seven Sentinels ended the day:

NAMO remained on a sell, while NYMO flipped to a buy. Neither signal moved much though, but momentum appears to be modestly higher for the moment. Perhaps the market can build on that over the coming days.

NAHL and NYHL remain on sells on flat action.

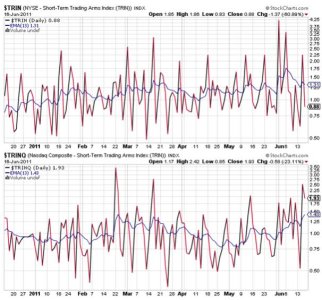

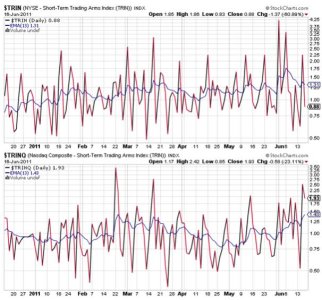

TRIN dropped back to a buy to a buy condition, while TRINQ worked off its oversold condition a bit, but remained on a sell. It still suggests an oversold condition.

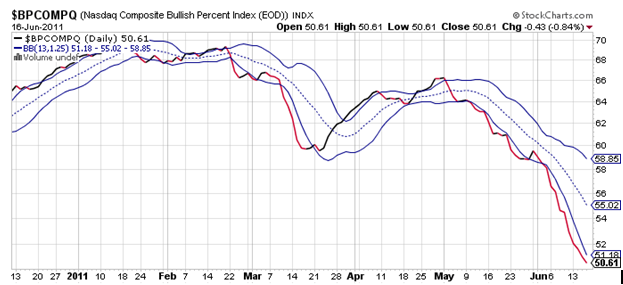

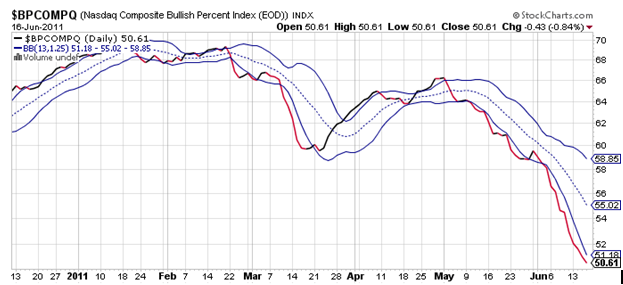

BPCOMPQ just keeps dropping. That lower bollinger band has flared to the point where it's almost touching that signal now, but until that signal turns up, I can't get too excited.

So the Seven Sentinels remain in a sell condition, but the action has been volatile. It appears to be bottoming action and given this is OPEX the volatility may just be par for the course. The market is running out of time to rally in front of that FOMC announcement next week, which is starting to make me think the market may simply chop around now until the Fed makes its rate announcement next week. I doubt the market is overly concerned whether the Fed will begin raising rates, but I'm sure it's interested in what happens post QE2. Whether the Fed will tip their hand remains to be seen, but it'll probably be the main attraction next week.

Greece's political, social, and fiscal woes continue to be focal points for market participants.

Here at home, the initial jobless claims number was released early in the morning, and it came in at 414,000, which was under the 421,000 claims analysts were expecting. So this was a minor positive.

In the housing sector, May housing starts came in at an annualized rate of 560,000, while building permits hit 612,000. Both were higher than expected.

But there was bad news too. The Philadelphia Fed Survey dove to -7.7 in June, after being up 3.9 in May. Economists were looking for something close to 7.0.

So what to make of today's action? For one, the 200-day moving average was tested on the S&P 500 as shown in this chart:

The yellow arrow shows where the candlestick touched the 200 dma and bounced well above it. That's a big plus at this point, but not a guarantee we're out of the woods.

Here's how the Seven Sentinels ended the day:

NAMO remained on a sell, while NYMO flipped to a buy. Neither signal moved much though, but momentum appears to be modestly higher for the moment. Perhaps the market can build on that over the coming days.

NAHL and NYHL remain on sells on flat action.

TRIN dropped back to a buy to a buy condition, while TRINQ worked off its oversold condition a bit, but remained on a sell. It still suggests an oversold condition.

BPCOMPQ just keeps dropping. That lower bollinger band has flared to the point where it's almost touching that signal now, but until that signal turns up, I can't get too excited.

So the Seven Sentinels remain in a sell condition, but the action has been volatile. It appears to be bottoming action and given this is OPEX the volatility may just be par for the course. The market is running out of time to rally in front of that FOMC announcement next week, which is starting to make me think the market may simply chop around now until the Fed makes its rate announcement next week. I doubt the market is overly concerned whether the Fed will begin raising rates, but I'm sure it's interested in what happens post QE2. Whether the Fed will tip their hand remains to be seen, but it'll probably be the main attraction next week.